- France

- /

- Oil and Gas

- /

- ENXTPA:GTT

Gaztransport & Technigaz's (EPA:GTT) Dividend Is Being Reduced To €1.75

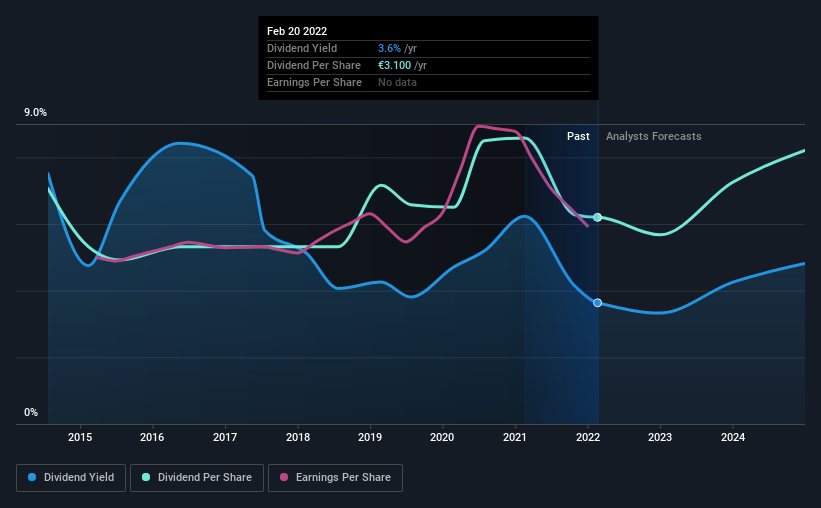

Gaztransport & Technigaz SA (EPA:GTT) has announced it will be reducing its dividend payable on the 8th of June to €1.75. This payment takes the dividend yield to 3.6%, which only provides a modest boost to overall returns.

View our latest analysis for Gaztransport & Technigaz

Gaztransport & Technigaz Is Paying Out More Than It Is Earning

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, Gaztransport & Technigaz's dividend made up quite a large proportion of earnings but only 58% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS is forecast to fall by 6.5%. If the dividend continues along recent trends, we estimate the payout ratio could reach 97%, which could put the dividend in jeopardy if the company's earnings don't improve.

Gaztransport & Technigaz's Dividend Has Lacked Consistency

Looking back, Gaztransport & Technigaz's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2014, the first annual payment was €3.53, compared to the most recent full-year payment of €3.10. This works out to be a decline of approximately 1.6% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings have grown at around 2.4% a year for the past five years, which isn't massive but still better than seeing them shrink. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Gaztransport & Technigaz that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GTT

Gaztransport & Technigaz

A technology and engineering company, provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gas and liquefied natural gas (LNG) in South Korea, China, Russia, and internationally.

Solid track record with excellent balance sheet.