- France

- /

- Diversified Financial

- /

- ENXTPA:WLN

Investors Don't See Light At End Of Worldline SA's (EPA:WLN) Tunnel And Push Stock Down 48%

The Worldline SA (EPA:WLN) share price has fared very poorly over the last month, falling by a substantial 48%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

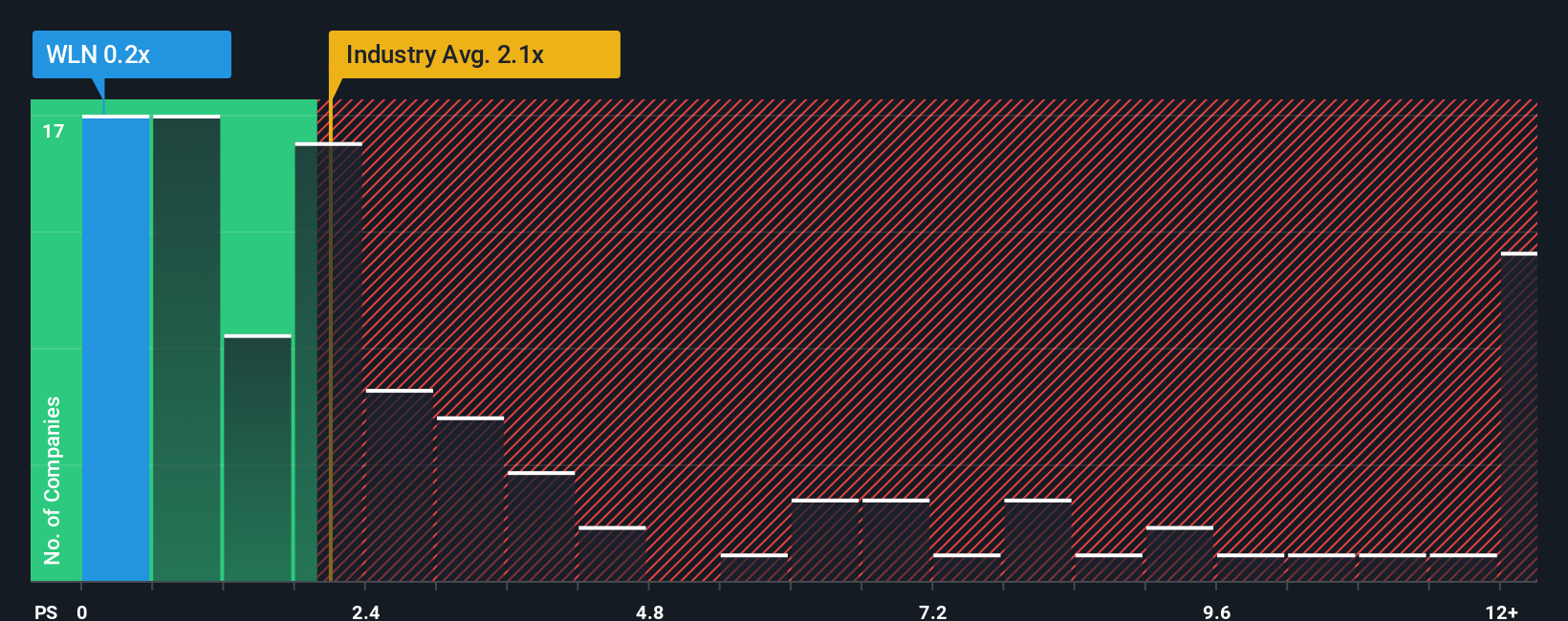

Following the heavy fall in price, Worldline may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Diversified Financial industry in France have P/S ratios greater than 3x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Worldline

What Does Worldline's Recent Performance Look Like?

Recent times have been pleasing for Worldline as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Worldline.Is There Any Revenue Growth Forecasted For Worldline?

In order to justify its P/S ratio, Worldline would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 1.6% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 136% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Worldline's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Worldline's P/S?

Having almost fallen off a cliff, Worldline's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Worldline's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Worldline has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Worldline might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:WLN

Worldline

Provides payments and transactional services for financial institutions, merchants, corporations, and government agencies in Northern Europe, Central and Eastern Europe, Southern Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives