- France

- /

- Oil and Gas

- /

- ENXTPA:GTT

Top Dividend Stocks On Euronext Paris To Consider

Reviewed by Simply Wall St

As France's CAC 40 Index recently experienced a slight decline amid mixed earnings reports and economic data, investors are increasingly focused on reliable income-generating opportunities. In this context, dividend stocks can offer a stable source of returns, especially in uncertain market conditions.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.16% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.87% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| Frey (ENXTPA:FREY) | 6.67% | ★★★★★★ |

| Teleperformance (ENXTPA:TEP) | 3.63% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.21% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.01% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 5.97% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.41% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.77% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

Gaztransport & Technigaz (ENXTPA:GTT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gaztransport & Technigaz SA, with a market cap of €4.98 billion, is a technology and engineering company that provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gas and LNG in South Korea, China, Russia, and internationally.

Operations: Gaztransport & Technigaz SA generates revenue from providing cryogenic membrane containment systems for the maritime transport and storage of liquefied gas and LNG across South Korea, China, Russia, and globally.

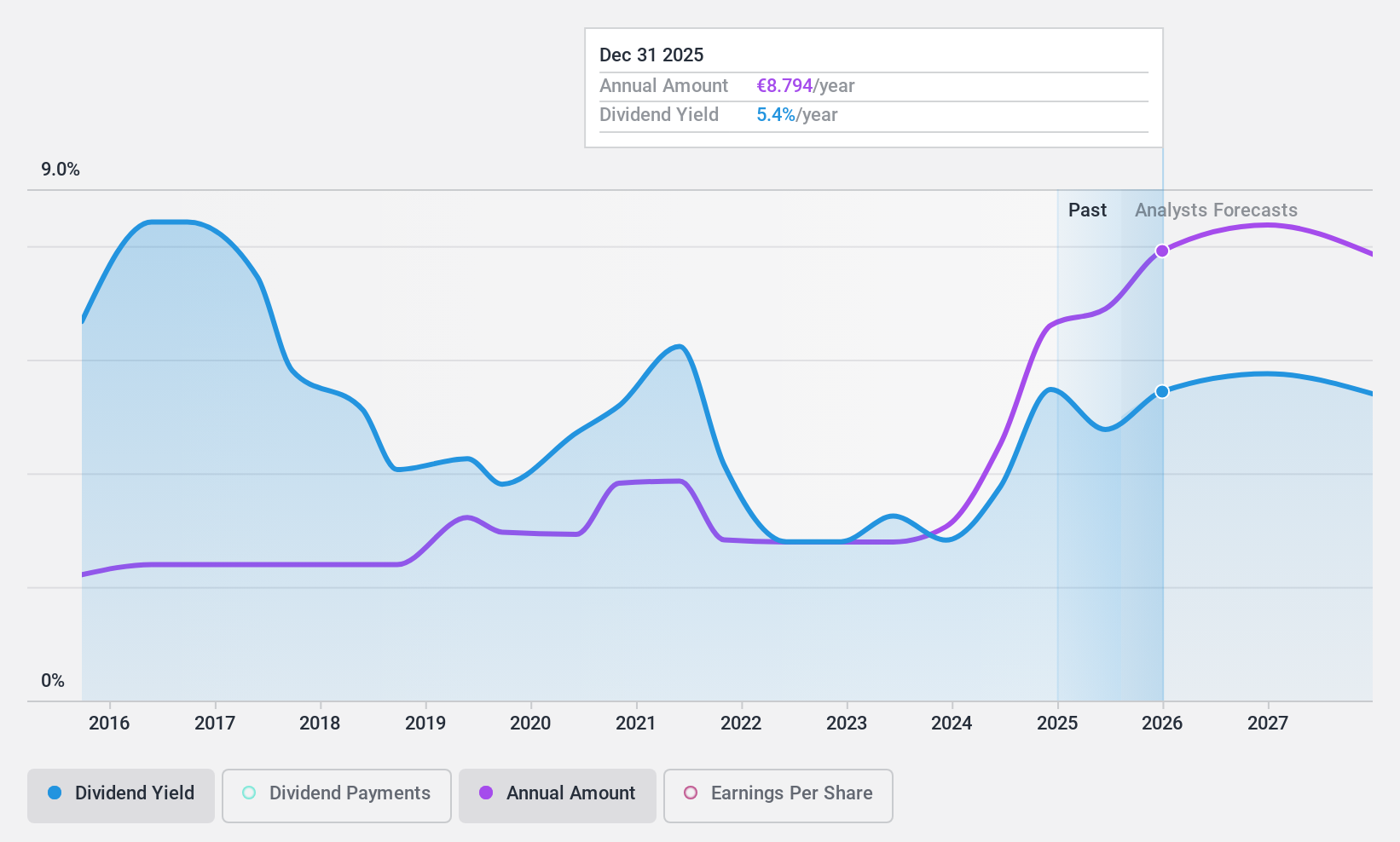

Dividend Yield: 5.5%

Gaztransport & Technigaz (GTT) has recently increased its interim dividend to €3.67 per share, payable in December 2024. Despite strong earnings growth, with net income rising to €170.31 million for H1 2024, the company's dividend payments have been volatile and are not well covered by free cash flows, evidenced by a high cash payout ratio of 139.7%. GTT's dividend yield stands at 5.46%, placing it among the top French market payers but raising sustainability concerns due to unreliable past payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Gaztransport & Technigaz.

- The analysis detailed in our Gaztransport & Technigaz valuation report hints at an deflated share price compared to its estimated value.

Teleperformance (ENXTPA:TEP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE, with a market cap of €6.33 billion, provides customer consultancy services both in France and internationally through its subsidiaries.

Operations: Teleperformance SE generates revenue from various segments including Specialized Services (€1.36 billion), Core Services & D.I.B.S - LATAM (€1.57 billion), Core Services & D.i.b.s. & Majorel (€343 million), Core Services & D.I.B.S - North America & Asia-Pacific (€2.53 billion), and Core Services & D.I.B.S - Europe, Middle East & Africa (EMEA) (€2.54 billion).

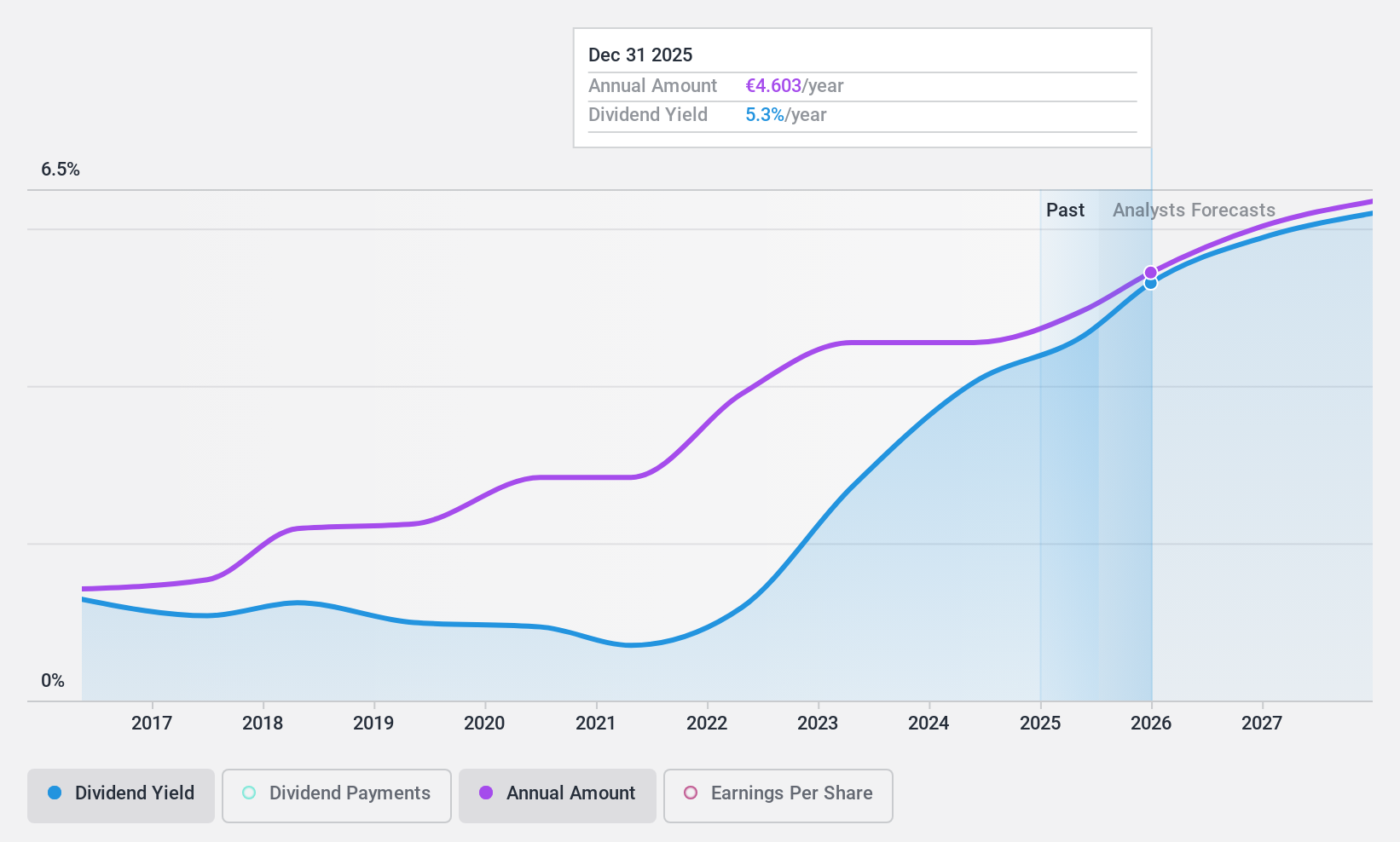

Dividend Yield: 3.6%

Teleperformance SE offers a reliable dividend yield of 3.63%, supported by stable and growing payments over the past decade. The company maintains a low payout ratio of 37.5% and a cash payout ratio of 20.1%, indicating strong coverage by both earnings and cash flows. Despite trading at good value compared to peers, Teleperformance has high debt levels and its share price has been highly volatile recently, which may concern some investors seeking stability in their dividend stocks portfolio.

- Get an in-depth perspective on Teleperformance's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Teleperformance is priced lower than what may be justified by its financials.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company offering interdealer broking, online trading, and private banking services across multiple regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of €612.29 million.

Operations: VIEL & Cie, société anonyme, generates its revenue primarily from professional intermediation (€1.01 billion) and stock exchange online services (€65.12 million).

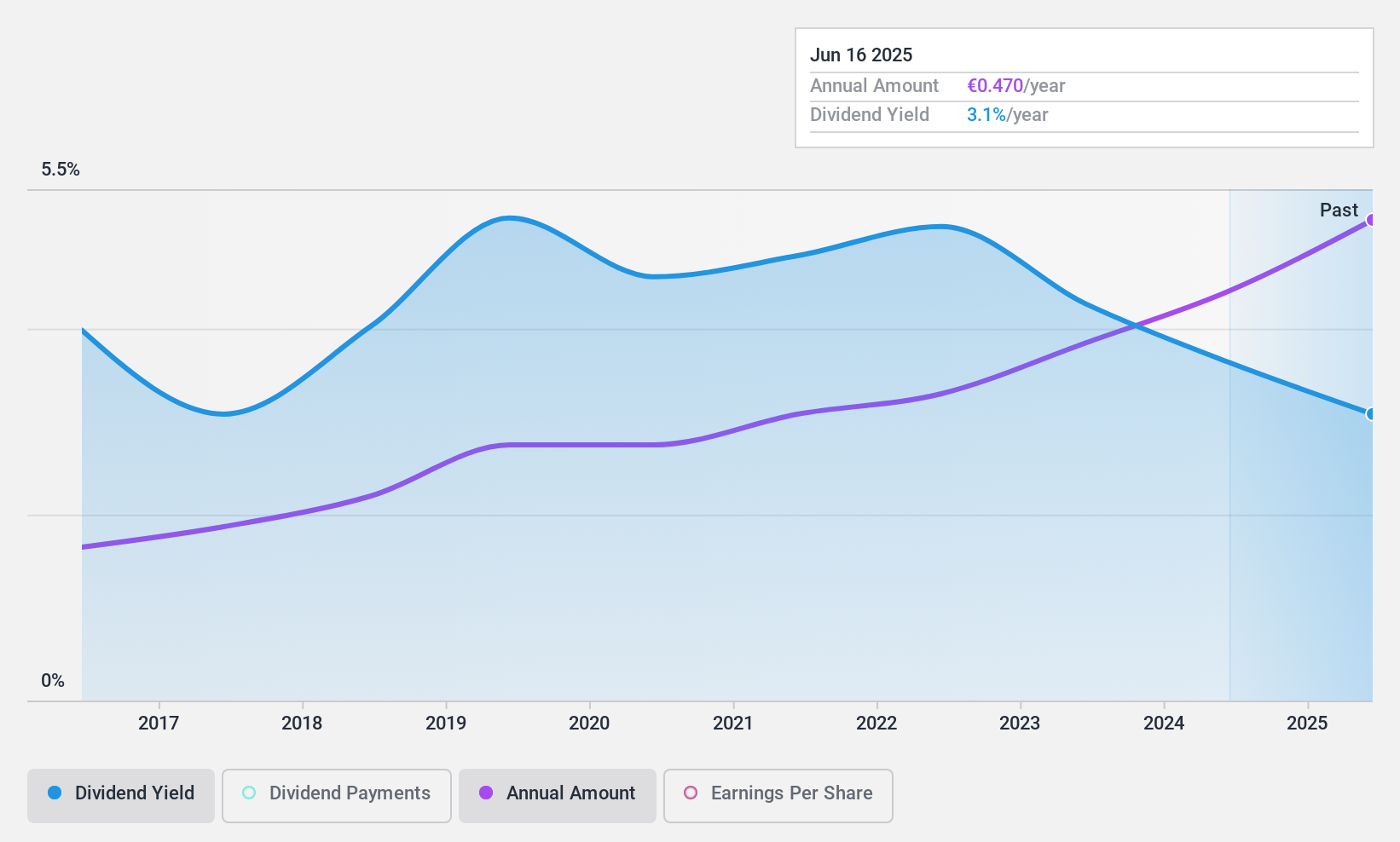

Dividend Yield: 4%

VIEL & Cie société anonyme provides a reliable dividend yield of 4.01%, with stable and growing payments over the past decade. The company maintains a low payout ratio of 25.8% and a cash payout ratio of 20.1%, ensuring dividends are well covered by both earnings and cash flows. Additionally, VIEL's earnings grew by 33.4% last year, further supporting its dividend sustainability. However, its yield is lower than the top 25% of French dividend payers at 5.43%.

- Take a closer look at VIEL & Cie société anonyme's potential here in our dividend report.

- Our expertly prepared valuation report VIEL & Cie société anonyme implies its share price may be lower than expected.

Next Steps

- Get an in-depth perspective on all 36 Top Euronext Paris Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GTT

Gaztransport & Technigaz

A technology and engineering company, provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gas and liquefied natural gas (LNG) in South Korea, China, Russia, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives