As European markets experience a modest upswing, with the CAC 40 Index in France gaining 0.48% amid hopes for quicker interest rate cuts by the ECB, investors are increasingly focused on stability and income generation. In this context, dividend stocks stand out as attractive options for those seeking consistent returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.89% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.08% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.15% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.74% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.76% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 6.02% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.82% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.81% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 4.56% | ★★★★☆☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

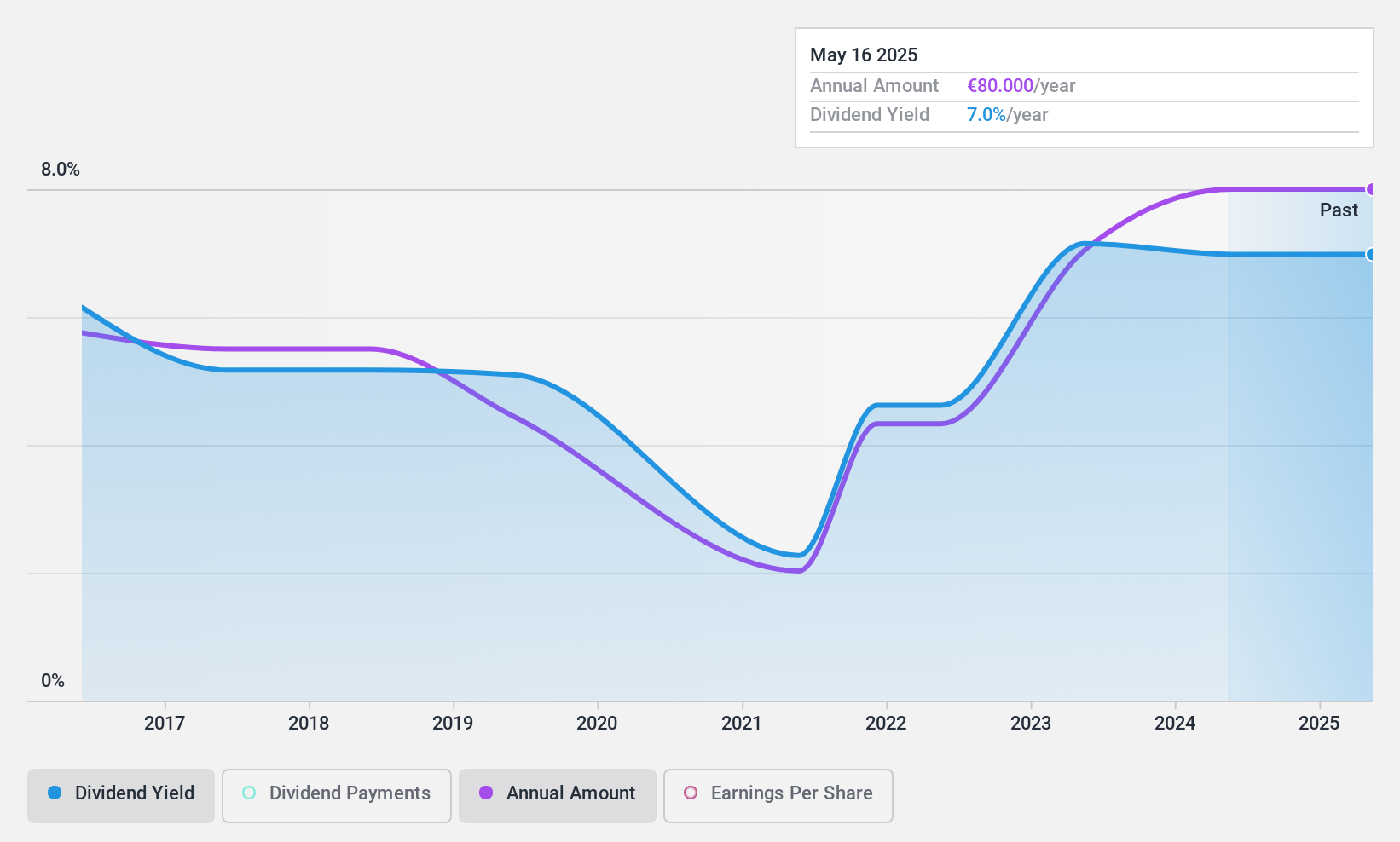

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally, with a market cap of €716.25 million.

Operations: CFM Indosuez Wealth Management SA generates revenue primarily through its Wealth Management segment, which accounted for €196.38 million.

Dividend Yield: 6.4%

CFM Indosuez Wealth Management offers a dividend yield of 6.4%, placing it in the top 25% of French dividend payers, although its historical payments have been volatile and unreliable over the past decade. The company has experienced significant earnings growth of 40.1% in the past year, supporting its reasonable payout ratio of 70.8%. However, insufficient data limits visibility on future dividend sustainability and coverage by earnings or cash flows beyond three years.

- Dive into the specifics of CFM Indosuez Wealth Management here with our thorough dividend report.

- Our expertly prepared valuation report CFM Indosuez Wealth Management implies its share price may be too high.

Colas (ENXTPA:RE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA constructs and maintains transport infrastructure worldwide and has a market cap of €5.71 billion.

Operations: Colas SA generates revenue from various segments including Roads France-Overseas France/IO (€5.97 billion), Roads EMEA (€3.36 billion), Canada Routes (€2.38 billion), Roads United States (€2.24 billion), Railways and Other Activities (€1.38 billion), and Roads Asia-Pacific (€471 million).

Dividend Yield: 4.2%

Colas presents a complex picture for dividend investors. Its current dividend yield of 4.2% is below the top 25% in France, and its payments have been volatile over the past decade, despite some growth. The payout ratio stands at 81.3%, indicating dividends are covered by earnings, while a cash payout ratio of 58.9% suggests coverage by cash flows as well. However, high debt levels and large one-off items affect financial stability and reliability.

- Click to explore a detailed breakdown of our findings in Colas' dividend report.

- The analysis detailed in our Colas valuation report hints at an inflated share price compared to its estimated value.

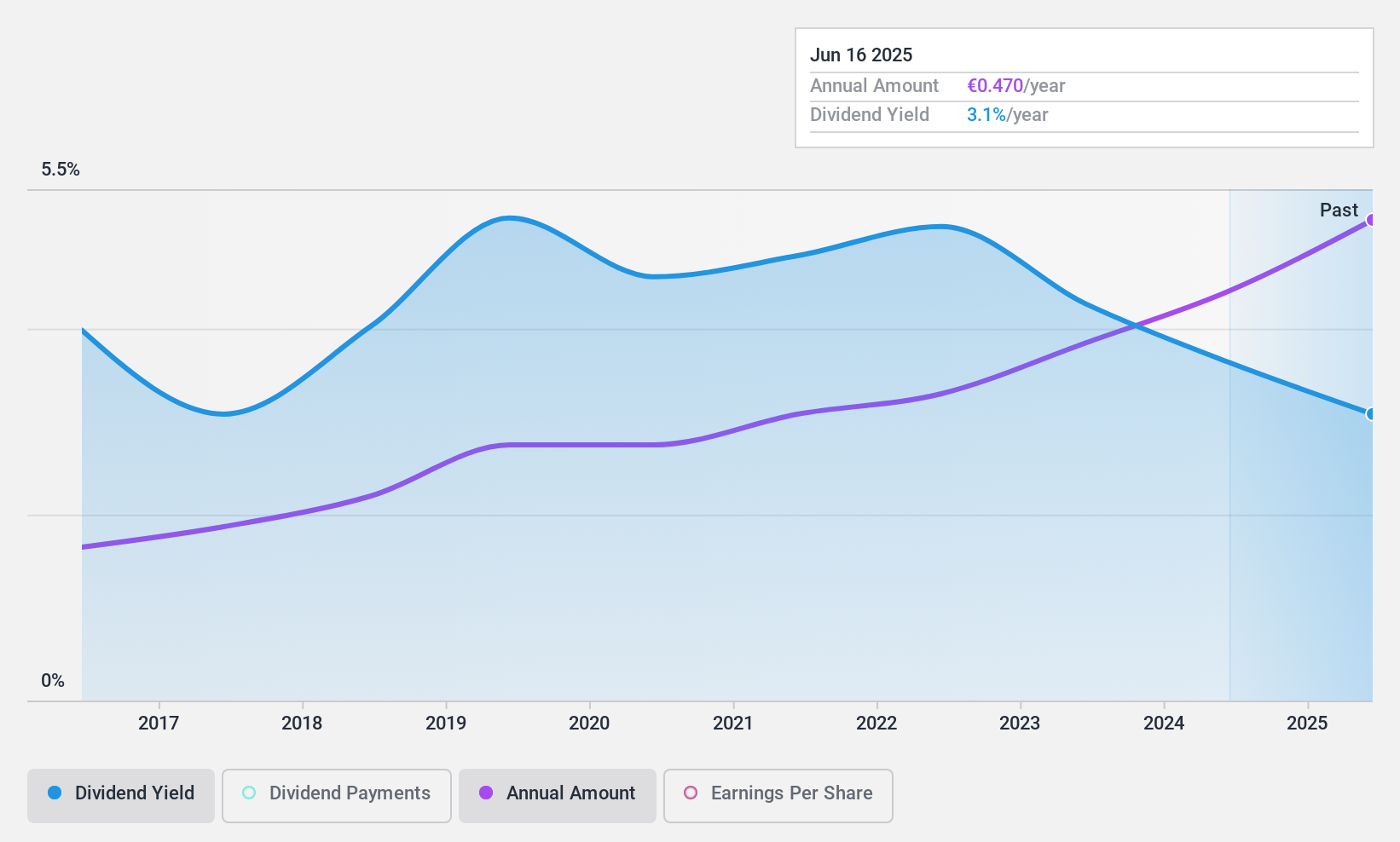

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of €673.85 million.

Operations: VIEL & Cie société anonyme generates revenue from Professional Intermediation (€1.05 billion), Stock Exchange Online (€71.02 million), and Contribution from Holdings (€3.63 million).

Dividend Yield: 3.7%

VIEL & Cie société anonyme offers a stable dividend profile with a yield of 3.74%, though it falls short compared to the top French dividend payers. The company's dividends are well covered by both earnings and cash flows, with low payout ratios of 22.4% and 22.1% respectively, ensuring sustainability. Over the past decade, dividends have been reliable and growing steadily, supported by strong earnings growth of 19.9% annually over five years. Recent financial results show increased revenue (€598.8 million) and net income (€65.4 million).

- Click here and access our complete dividend analysis report to understand the dynamics of VIEL & Cie société anonyme.

- Our valuation report here indicates VIEL & Cie société anonyme may be undervalued.

Taking Advantage

- Access the full spectrum of 33 Top Euronext Paris Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLCFM

CFM Indosuez Wealth Management

Engages in the provision of banking and financial solutions in Monaco and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives