- France

- /

- Capital Markets

- /

- ENXTPA:TKO

What Do New Partnerships Mean for Tikehau Capital’s Value in 2025?

Reviewed by Bailey Pemberton

- Ever wondered whether Tikehau Capital is a hidden gem or if the current price really stacks up against its true value? You're not alone. Investors are looking for clarity in today's market.

- The stock has been on quite a ride lately, with a mild 0.7% gain over the last week, but it is down almost 29% year-to-date and about 26% over the past year, hinting at shifting investor sentiment or risk appetite.

- Recent headlines have focused on Tikehau Capital's new strategic partnerships and the expansion of its alternative asset offerings, moves that have stirred interest and volatility. Large-scale fund launches and leadership shake-ups have also kept the company in the spotlight, providing fresh context for recent price swings.

- On the question of value, Tikehau Capital currently scores 4 out of 6 on our valuation checks. This is a solid score, but there is nuance to uncover. Let's break down what drives those numbers, then touch on an even smarter approach to valuation at the end of this article.

Find out why Tikehau Capital's -25.7% return over the last year is lagging behind its peers.

Approach 1: Tikehau Capital Excess Returns Analysis

The Excess Returns model focuses on how efficiently a company generates profits compared to its cost of equity. In simple terms, it evaluates the company's ability to earn above what investors require as compensation for their risk. This approach is particularly useful for financial institutions like Tikehau Capital, where book value, return on equity, and projected earnings drive the analysis.

For Tikehau Capital, the current Book Value stands at €17.93 per share, and its Stable EPS, based on the median return on equity over the past five years, is €1.13 per share. The Cost of Equity is estimated at €2.04 per share, resulting in an Excess Return of €-0.90 per share. This means that Tikehau Capital is not currently generating returns above its cost of equity. The company’s average return on equity is 5.41%, with the Stable Book Value projected to reach €20.94 per share according to analyst forecasts.

The intrinsic value estimated by the Excess Returns model suggests Tikehau Capital’s stock is trading at a 64.5% premium compared to its underlying performance. According to this model, Tikehau Capital appears notably overvalued at its current price.

Result: OVERVALUED

Our Excess Returns analysis suggests Tikehau Capital may be overvalued by 64.5%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tikehau Capital Price vs Earnings

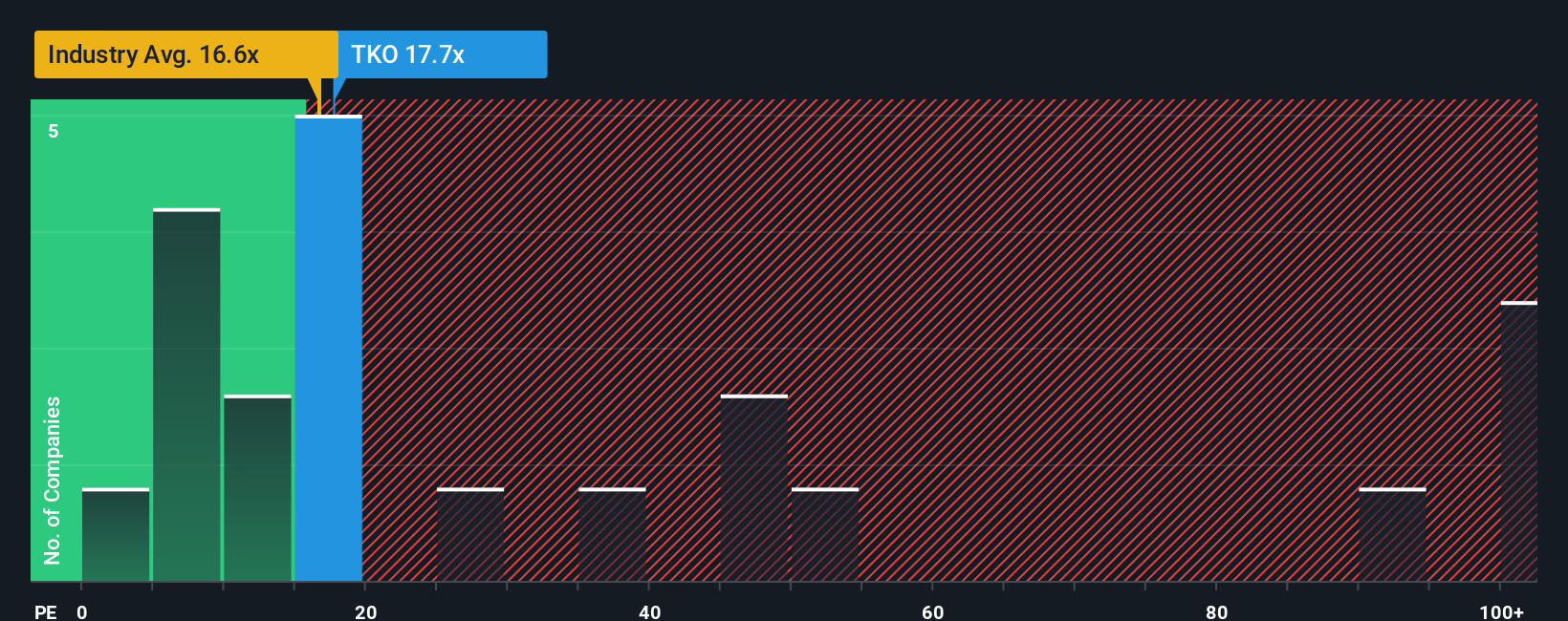

For profitable companies like Tikehau Capital, the Price-to-Earnings (PE) ratio is a commonly used and meaningful way to gauge value. The PE ratio helps investors judge how much they are paying for each euro of a company’s earnings. Generally, companies with strong growth potential or lower risk can justify higher PE ratios. In contrast, those with lower growth prospects or greater uncertainty tend to have lower PE ratios considered fair.

Tikehau Capital is currently trading at a PE ratio of 13.9x. This is below the Capital Markets industry average of 17.9x, and far below the average PE of its listed peers, which stands at 51.1x. By just comparing these benchmarks, Tikehau’s stock might appear cheap. However, such direct comparisons do not consider the underlying differences between companies in terms of their growth rates, risks, or profitability.

To provide a truer sense of what’s fair, Simply Wall St calculates a “Fair Ratio” for each stock. This proprietary metric goes beyond surface-level comparisons and factors in growth outlook, historical profit margins, risk profile, industry context, and market cap. For Tikehau Capital, the Fair PE Ratio is estimated at 24.4x. This means that, after accounting for the company’s unique characteristics, the stock should reasonably trade closer to a PE of 24.4x rather than its current 13.9x. Since Tikehau Capital’s actual PE ratio is well below the Fair Ratio, this suggests the market is undervaluing its earnings power relative to expectations and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tikehau Capital Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an innovation that lets investors connect their personal story about a company to its financial future and fair value. Narratives make it easy for you to describe your perspective on Tikehau Capital, including your assumed fair value and your own estimates for future revenue, earnings, and profit margins, all in plain language.

With Narratives, you can link Tikehau Capital’s evolving story to real financial forecasts and see how that translates into a fair price. This can help you decide when to buy or sell by comparing your Fair Value to the current market price. Narratives update dynamically as new information, such as news or earnings, comes in, ensuring your view stays current. This powerful yet accessible tool is available right now within the Simply Wall St Community page, making it straightforward for millions of investors to share, compare, and refine their perspectives.

For example, based on recent analyst Narratives, one investor sees Tikehau Capital as worth €28.0 due to its strong position in alternative assets and AUM growth, while another sees fair value at just €19.0 due to concerns about liquidity and margin risks.

Do you think there's more to the story for Tikehau Capital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with 46.1 billion euro of assets under management (as of 30 June 2024).

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.