- France

- /

- Capital Markets

- /

- ENXTPA:TKO

Is Tikehau Capital (ENXTPA:TKO) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Kshitija Bhandaru

Tikehau Capital (ENXTPA:TKO) has caught the attention of some investors recently, following a period of mixed returns over the past year. The company's performance is a talking point for those watching the European financial sector.

See our latest analysis for Tikehau Capital.

Tikehau Capital’s share price has drifted lower so far this year, despite some upbeat financial results and positive sentiment surrounding the broader European finance space. While both its short-term returns and long-term 5-year total shareholder return have been modest, recent momentum is muted. This suggests investors remain watchful for clearer growth signals or signs of a re-rating in valuation.

If you’re looking to spot the next compelling opportunity, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Tikehau Capital trading at a discount to analyst price targets despite solid earnings growth, is there real value on offer for investors, or is the market already anticipating the company’s future potential?

Most Popular Narrative: 20.7% Undervalued

With Tikehau Capital’s most popular narrative assigning a fair value nearly 21% above the last close of €19.18, optimism stems from structural shifts and strong earnings growth projections that could underpin a re-rating in the company’s valuation.

The acceleration in product innovation and retailization, particularly successful launches of semi-liquid private debt and unit-linked strategies aimed at private investors, positions Tikehau to capture new segments of the global shift toward alternative assets. This expands the revenue base and improves operating leverage.

Want to know the secret behind this bullish stance? It’s not just the asset mix; the real intrigue lies in bold assumptions about future profitability, margin expansion, and the kind of top-line performance that’s usually reserved for sector frontrunners. Are these ambitious projections realistic? The details behind this narrative could surprise you.

Result: Fair Value of €24.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened sensitivity to market sentiment and growing exposure to illiquid private markets could quickly challenge Tikehau Capital’s optimistic growth outlook.

Find out about the key risks to this Tikehau Capital narrative.

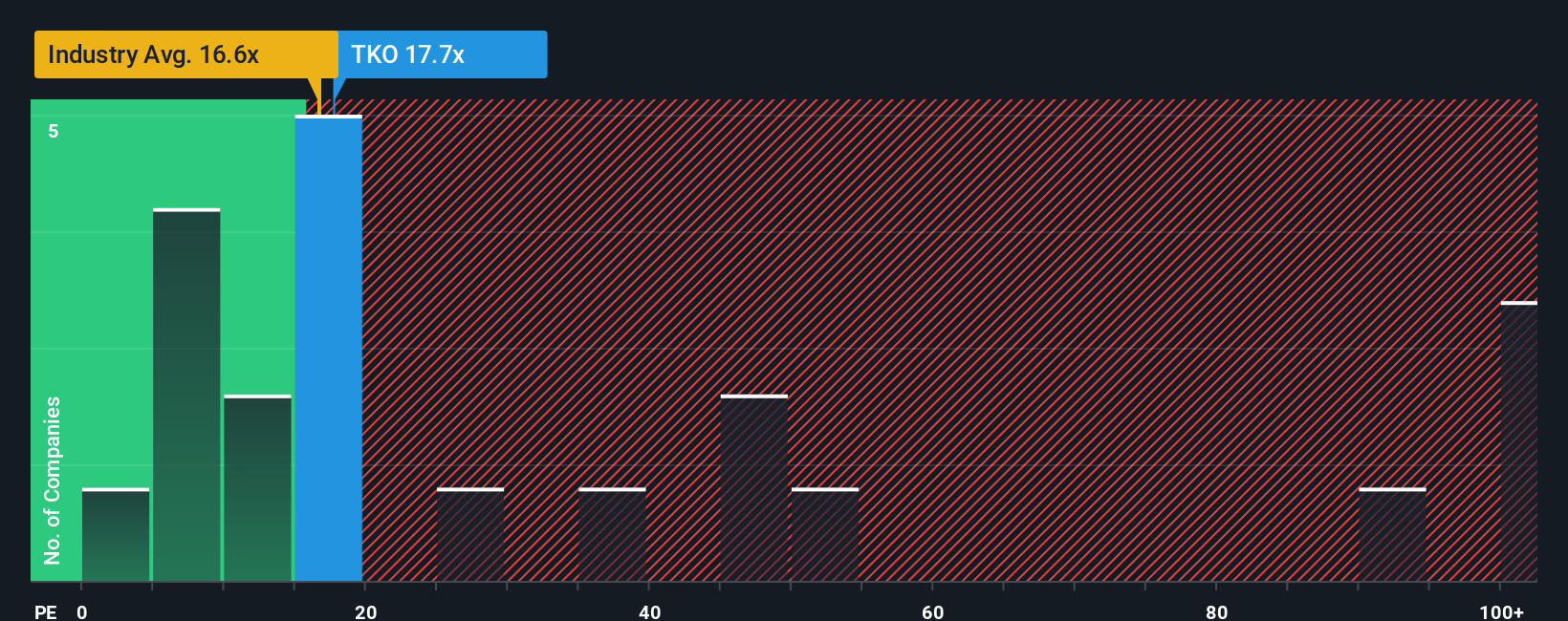

Another View: Market Multiples Tell a Different Story

While the dominant narrative points to Tikehau Capital being undervalued, a closer look at its price-to-earnings ratio against the industry paints a more cautious picture. At 17.9x, the company’s valuation is higher than the European Capital Markets industry average of 15.9x. This suggests shares are not exactly cheap relative to peers. However, if the market were to re-rate the company towards its fair ratio of 25.2x, there could be hidden value. Is the real opportunity waiting for a change in sentiment, or is risk building at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tikehau Capital Narrative

If you have a different perspective or want to dive into the numbers yourself, why not craft your own narrative in just a few minutes? Do it your way

A great starting point for your Tikehau Capital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t limit yourself to just one strategy. Expand your reach and get ahead with other smart moves only a click away on Simply Wall Street.

- Boost your long-term income by reviewing these 19 dividend stocks with yields > 3% with consistently strong yields above 3% and proven payout track records.

- Catch the next wave in tech by seizing these 24 AI penny stocks, which show explosive growth in artificial intelligence across core and emerging industries.

- Capitalize on value by targeting these 901 undervalued stocks based on cash flows trading well below their fair value. These may offer rare entry points with potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with 46.1 billion euro of assets under management (as of 30 June 2024).

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.