- France

- /

- Diversified Financial

- /

- ENXTPA:PEUG

The three-year underlying earnings growth at Peugeot Invest Société anonyme (EPA:PEUG) is promising, but the shareholders are still in the red over that time

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Peugeot Invest Société anonyme (EPA:PEUG) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 11%. And the ride hasn't got any smoother in recent times over the last year, with the price 27% lower in that time. The falls have accelerated recently, with the share price down 28% in the last three months.

With the stock having lost 6.4% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Peugeot Invest Société anonyme

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Peugeot Invest Société anonyme actually managed to grow EPS by 0.6% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It looks to us like the market was probably too optimistic around growth three years ago. But it's possible a look at other metrics will be enlightening.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. On the other hand, the uninspired reduction in revenue, at 17% each year, may have shareholders ditching the stock. This could have some investors worried about the longer term growth potential (or lack thereof).

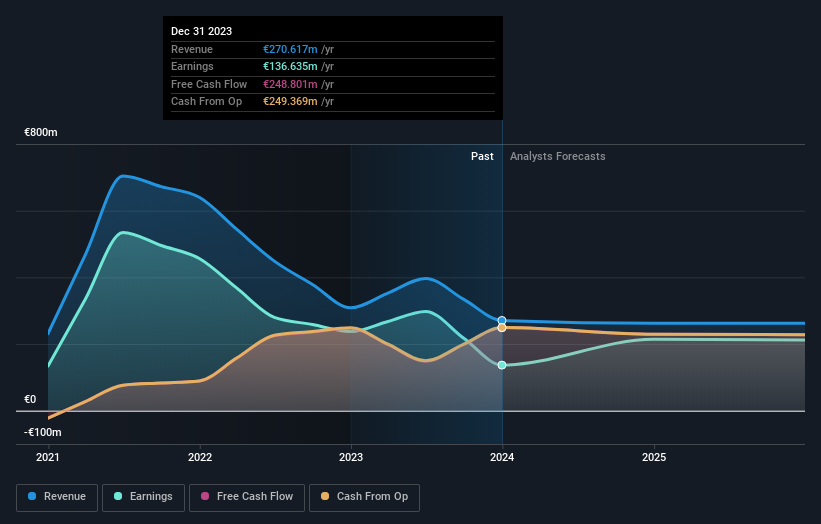

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Peugeot Invest Société anonyme will earn in the future (free profit forecasts).

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Peugeot Invest Société anonyme, it has a TSR of -31% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Peugeot Invest Société anonyme shareholders are down 25% for the year (even including dividends), but the market itself is up 0.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Peugeot Invest Société anonyme that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:PEUG

Undervalued with excellent balance sheet.