- France

- /

- Capital Markets

- /

- ENXTPA:ENX

Why We Think Euronext N.V.'s (EPA:ENX) CEO Compensation Is Not Excessive At All

Under the guidance of CEO Stéphane Boujnah, Euronext N.V. (EPA:ENX) has performed reasonably well recently. As shareholders go into the upcoming AGM on 11 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Euronext

How Does Total Compensation For Stéphane Boujnah Compare With Other Companies In The Industry?

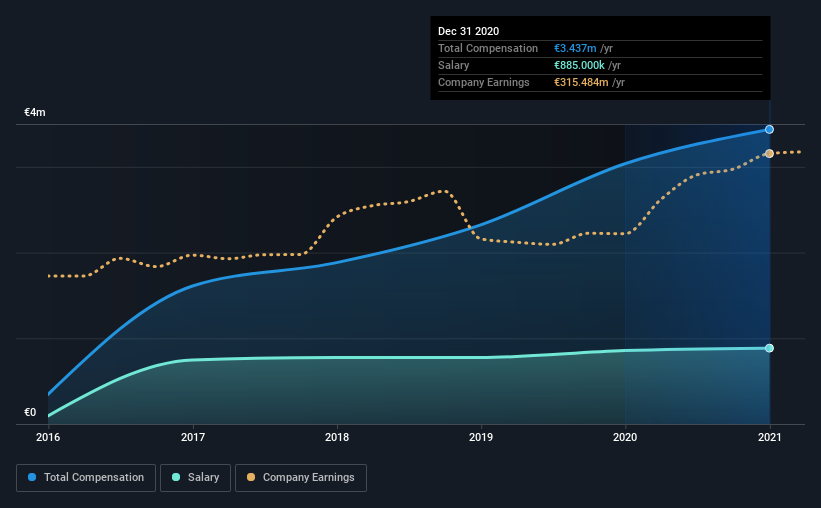

At the time of writing, our data shows that Euronext N.V. has a market capitalization of €6.4b, and reported total annual CEO compensation of €3.4m for the year to December 2020. Notably, that's an increase of 13% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at €885k.

On comparing similar companies from the same industry with market caps ranging from €3.3b to €10.0b, we found that the median CEO total compensation was €3.2m. From this we gather that Stéphane Boujnah is paid around the median for CEOs in the industry. What's more, Stéphane Boujnah holds €2.0m worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €885k | €857k | 26% |

| Other | €2.6m | €2.2m | 74% |

| Total Compensation | €3.4m | €3.0m | 100% |

Speaking on an industry level, nearly 58% of total compensation represents salary, while the remainder of 42% is other remuneration. It's interesting to note that Euronext allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Euronext N.V.'s Growth

Over the past three years, Euronext N.V. has seen its earnings per share (EPS) grow by 7.6% per year. It achieved revenue growth of 17% over the last year.

We think the revenue growth is good. And the improvement in EPSis modest but respectable. So while performance isn't amazing, we think it really does seem quite respectable. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Euronext N.V. Been A Good Investment?

Most shareholders would probably be pleased with Euronext N.V. for providing a total return of 68% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Euronext that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Euronext or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Euronext might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ENX

Euronext

Operates securities and derivatives exchanges in the Netherlands, France, Italy, Belgium, Portugal, Ireland, the United States, Norway, Denmark, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives