- France

- /

- Capital Markets

- /

- ENXTPA:ENX

Euronext (ENXTPA:ENX): Evaluating Valuation and Opportunity After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Euronext (ENXTPA:ENX) shares have drifted slightly lower over the past week, down nearly 2%, following a more substantial 11% dip over the past month. Investors seem to be weighing recent share price trends in comparison with the company’s broader long-term performance.

See our latest analysis for Euronext.

Although Euronext’s 1-year total shareholder return has been modest, recent price action suggests investors are recalibrating expectations in light of broader market sentiment and potential shifts in risk perception. Momentum has faded a bit compared to earlier in the year, but the latest share price of €124.3 highlights that the market is watching for new catalysts or confirmation of growth potential.

If you’re curious about where else opportunity could be emerging, now is a good time to widen your perspective and check out fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst price targets, investors are left to consider if the current weakness signals a buying opportunity or if the market has already priced in Euronext's future prospects.

Most Popular Narrative: 17.5% Undervalued

With Euronext’s fair value estimated at €150.59 and the last close at €124.30, the narrative identifies a considerable gap in upside potential. This context highlights that fundamental drivers are central to why the consensus still leans bullish, even as recent momentum slows.

The company is capturing the momentum of digital transformation across Europe by expanding proprietary data, advanced analytics, and post-trade services, as evidenced by continued double-digit growth in Corporate/Investor Solutions and Advanced Data Solutions. These higher-margin, recurring businesses improve Euronext's net margin mix and revenue resilience as capital markets increasingly embrace fintech solutions.

Curious what’s powering this bullish target? The narrative’s backbone is bold growth in digital and data-driven businesses plus ambitious profit margin improvement. What financial leap is expected? Discover the underlying projections that spark this striking valuation call.

Result: Fair Value of €150.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue growth may falter if market volatility normalizes or if the integration of recent acquisitions introduces unexpected costs and operational hurdles.

Find out about the key risks to this Euronext narrative.

Another View: The Multiples Perspective

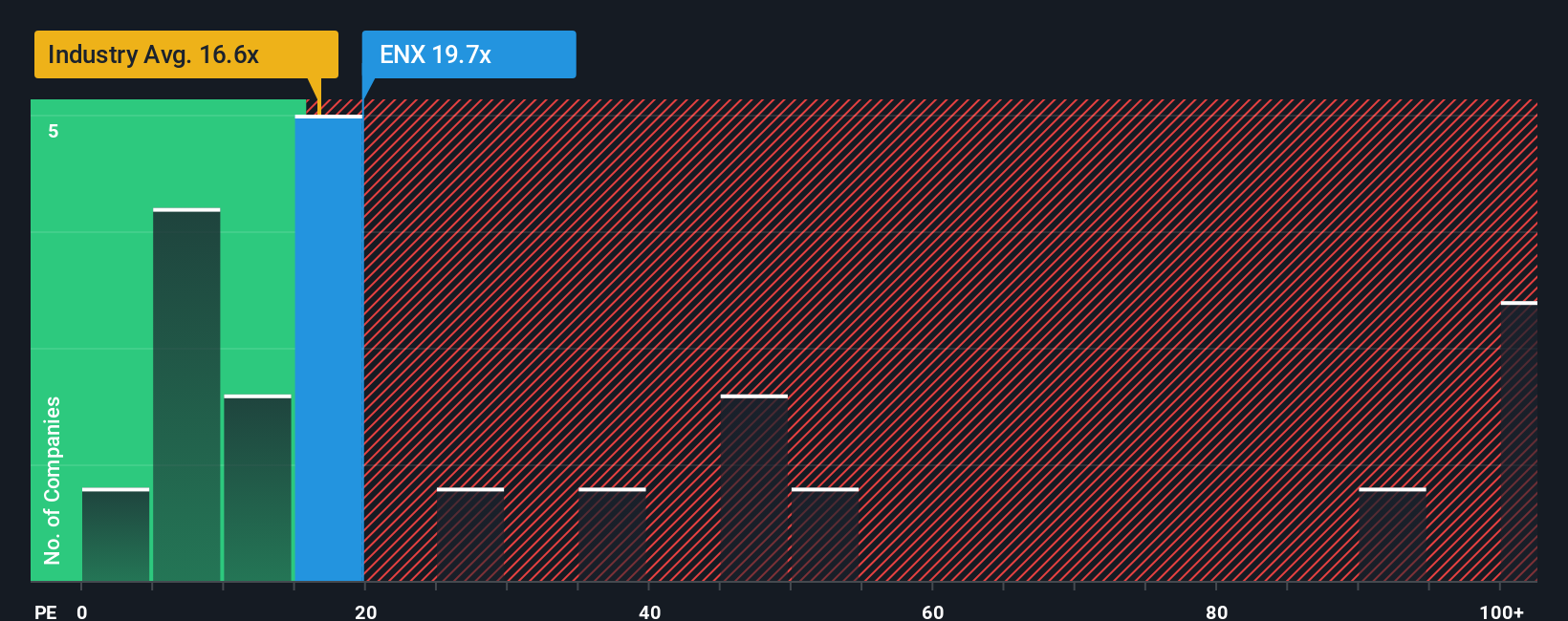

Taking a closer look through traditional valuation ratios, Euronext is priced at 19x earnings, which is notably higher than both the European Capital Markets industry average of 16.2x and its peer average of 13.3x. While the fair ratio analysis suggests a potential shift upward to 21.4x, the current premium hints at valuation risk. Could the market be factoring in more upside than fundamentals support, or is this a sign of resilience worth further scrutiny?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Euronext Narrative

If you see things differently or have your own take on the numbers, you can explore Euronext’s data and build your own view in just a few minutes. Do it your way.

A great starting point for your Euronext research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your watchlist to just one company. Many compelling trends are reshaping markets right now. Take action on these unique opportunities before they get snapped up by everyone else:

- Tap into innovation by reviewing these 25 AI penny stocks, which features companies driving smarter automation and cutting-edge intelligence across industries.

- Boost your potential returns with these 886 undervalued stocks based on cash flows that the market may have overlooked, giving you a chance to spot value ahead of the crowd.

- Start building reliable income streams by selecting from these 19 dividend stocks with yields > 3%, focused on steady yields above 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronext might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENX

Euronext

Operates securities and derivatives exchanges in the Netherlands, France, Italy, Belgium, Portugal, Ireland, the United States, Norway, Denmark, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives