- France

- /

- Capital Markets

- /

- ENXTPA:ANTIN

Antin Infrastructure Partners S.A.'s (EPA:ANTIN) Share Price Matching Investor Opinion

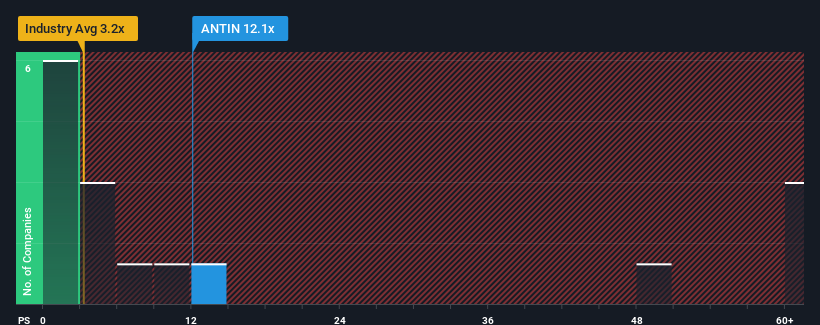

You may think that with a price-to-sales (or "P/S") ratio of 12.1x Antin Infrastructure Partners S.A. (EPA:ANTIN) is a stock to avoid completely, seeing as almost half of all the Capital Markets companies in France have P/S ratios under 5.3x and even P/S lower than 1.3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Antin Infrastructure Partners

What Does Antin Infrastructure Partners' P/S Mean For Shareholders?

Recent times have been pleasing for Antin Infrastructure Partners as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Antin Infrastructure Partners will help you uncover what's on the horizon.How Is Antin Infrastructure Partners' Revenue Growth Trending?

Antin Infrastructure Partners' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 70% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 23% per annum during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 0.2% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Antin Infrastructure Partners is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Antin Infrastructure Partners shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Antin Infrastructure Partners you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ANTIN

Antin Infrastructure Partners SAS

A private equity firm specializing in infrastructure investments.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.