- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

Is Amundi Trading Below Fair Value After Its Latest Sustainability Push?

Reviewed by Bailey Pemberton

Thinking about what’s next for Amundi’s stock? You are not alone. Whether you have held on through the years or are weighing a new position, it is hard to ignore a company that has delivered nearly 71% growth over the past three years. Even if the pace has slowed, with a 3.0% rise so far this year and a modest 1.0% bump just this past week, there is a sense that something is stirring beneath the surface.

Some of that recent uplift comes on the back of Amundi’s push into new markets and the buzz around its ambitious sustainability initiatives. This theme has resonated across the sector in response to tightening regulations and shifting investor sentiment. Although the last month’s 0.5% gain is far from headline-grabbing, it hints at renewed interest and possibly changing risk perceptions among investors. Not every news item moves the needle, but together, these updates keep Amundi top-of-mind for market watchers.

All of this begs the question: is Amundi’s current price a good entry point? If we look at the numbers, the company currently earns a valuation score of 3 out of 6. This is a solid middle ground, suggesting it is undervalued in some areas but not across the board. In the next section, I will break down how these valuation indicators stack up and why some investors rely on a more nuanced approach to uncover the real story behind any value score.

Why Amundi is lagging behind its peers

Approach 1: Amundi Excess Returns Analysis

The Excess Returns model estimates a company's value by comparing how much profit it generates above the cost of equity, factoring in how efficiently it uses shareholder capital. In essence, this approach tells us whether Amundi is generating meaningful wealth for its shareholders after covering the cost to finance its business.

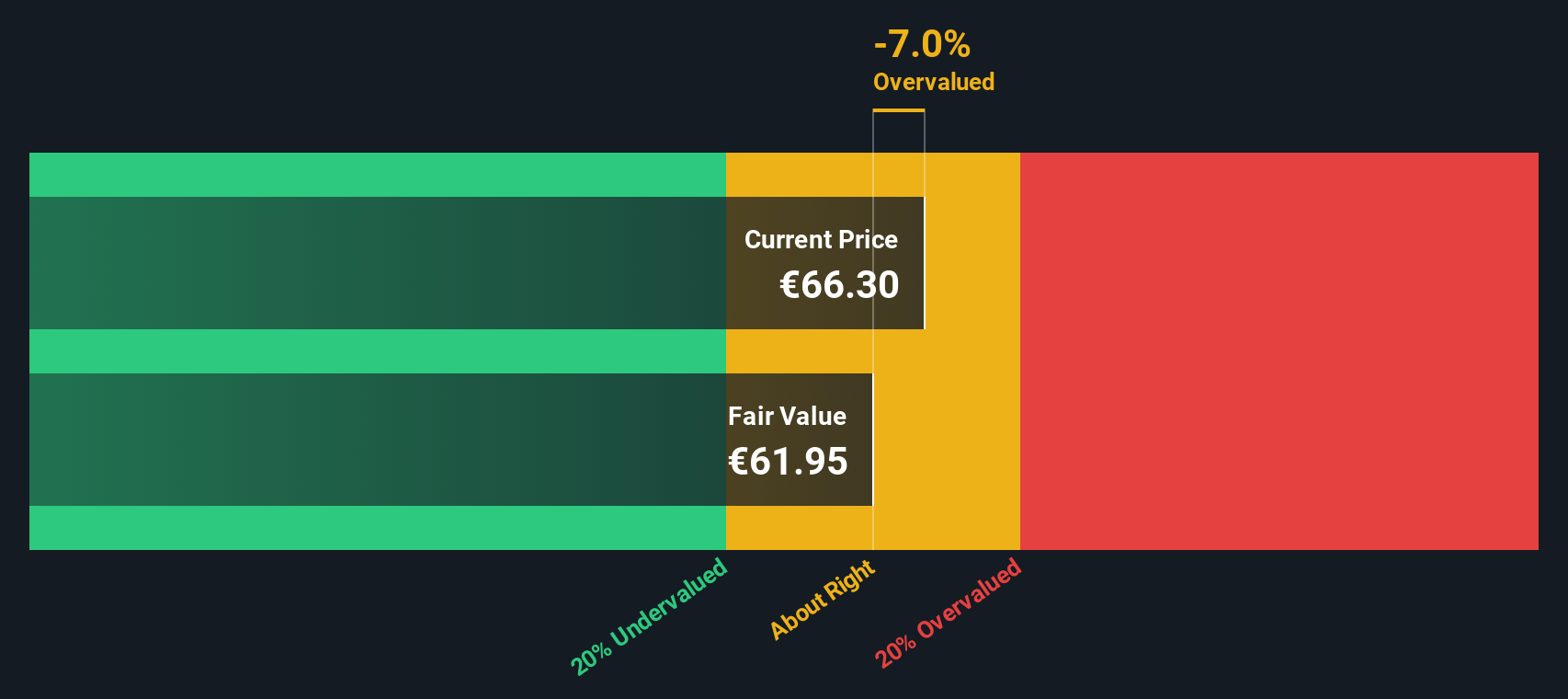

For Amundi, the key figures tell a nuanced story. The latest book value stands at €58.85 per share, while analysts see a stable book value closer to €63.86 per share in the future, based on weighted forecasts from six experts. Expected earnings sit at a stable €7.25 per share, but the cost of equity is slightly higher at €7.40 per share. This means the current excess return is €-0.15 per share, suggesting that the company is just about meeting, if not slightly lagging, the required return demanded by its investors. The projected average return on equity of 11.36% further supports this balanced outlook.

Based on these numbers, the Excess Returns model estimates that Amundi’s intrinsic value is actually 6.3% below its current share price, pointing to mild overvaluation. While not a dramatic mismatch, the findings suggest the stock is trading a little above what its core financial performance justifies.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Amundi's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Amundi Price vs Earnings

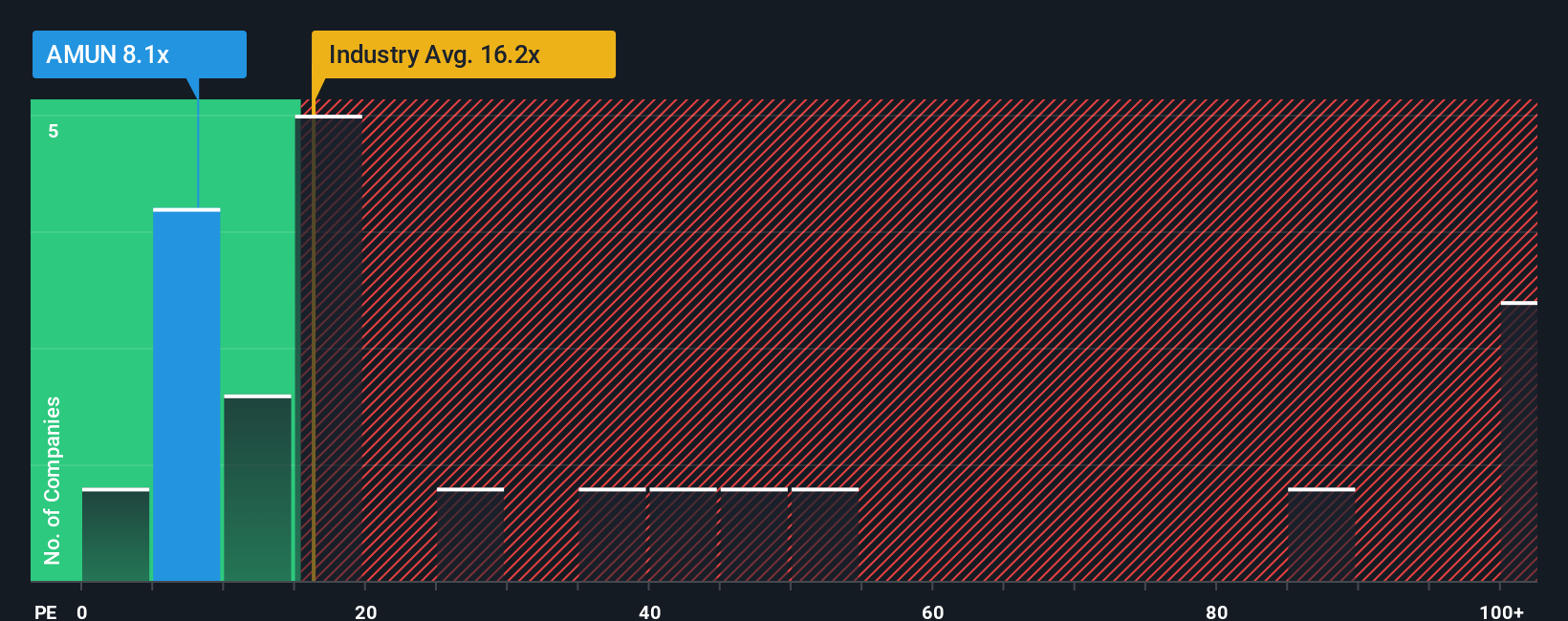

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established, profitable companies like Amundi. This is because it directly relates the price investors are willing to pay for each euro of earnings, making it easy to compare across businesses and industries. In periods of solid profitability, the PE ratio provides a clear window into how the market is valuing those earnings, factoring in both potential growth and perceived risk.

A "normal" or "fair" PE ratio is not the same for every company. Higher growth expectations or lower risk typically drive up the PE, since investors are willing to pay more for future profits. Conversely, companies facing headwinds or greater uncertainty will see lower PE ratios. Looking at Amundi, its current PE stands at 8.1x, well below the Capital Markets industry average of 18.9x and the peer average of 17.6x. This by itself suggests Amundi trades at a notable discount.

However, simple comparisons can miss the bigger picture. This is where Simply Wall St’s Fair Ratio comes in. It synthesizes earnings growth, profit margins, market cap, industry trends, and company-specific risks to produce a tailored benchmark. For Amundi, the Fair Ratio is 20.1x, reflecting its financial characteristics and sector dynamics. This approach offers a more nuanced assessment than simply lining up industry or peer multiples, as it adapts to each company's unique profile.

Comparing Amundi’s actual PE (8.1x) to its Fair Ratio (20.1x) signals meaningful undervaluation at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amundi Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful way to combine your view of Amundi’s future, what you believe will drive its growth, risks, and industry changes, with your own fair value estimate, revenue, earnings, and margin outlooks.

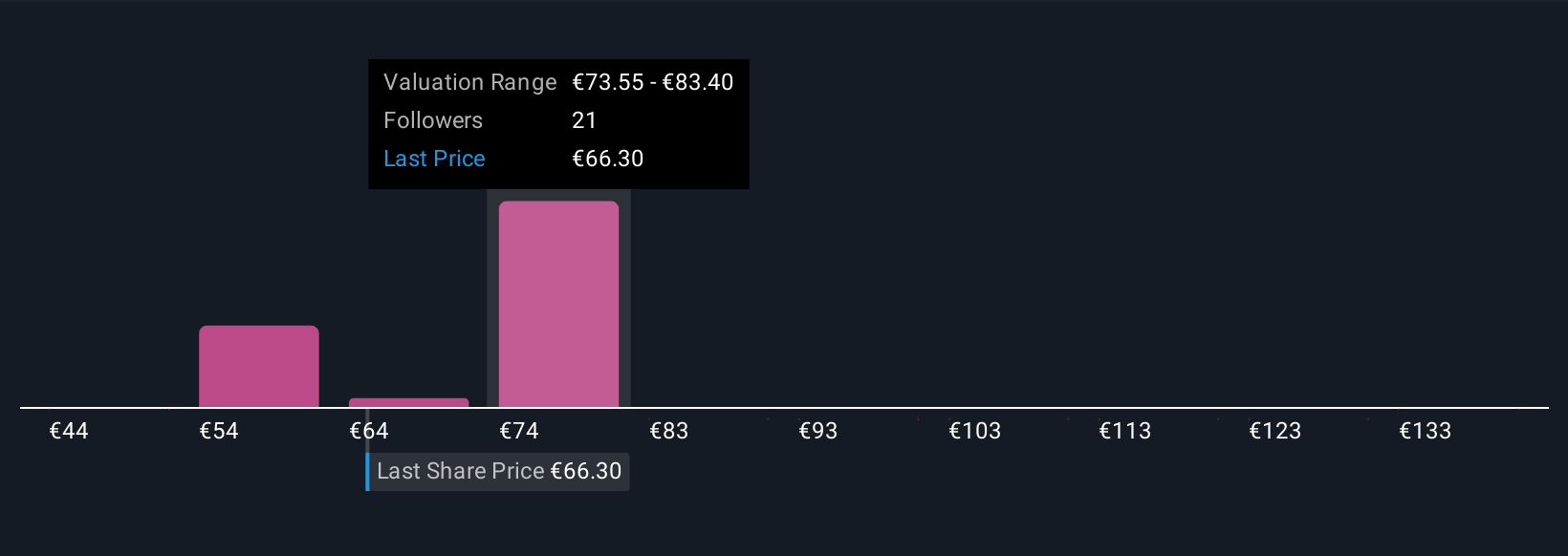

With Narratives, you link your story about the business to a set of financial forecasts, generating a fair value that reflects your perspective, not just backward-looking numbers. Narratives are accessible to everyone on Simply Wall St’s Community page, where millions of investors explore, share, and compare their views.

This approach makes it much easier to see whether Amundi’s current share price lines up with your own beliefs, helping you decide whether to buy, hold, or sell. In addition, Narratives update automatically whenever major news or earnings data emerges, meaning your fair value always stays relevant.

For example, one investor’s Narrative could forecast revenue decline but record-high profit margins and assign a fair value near €68 per share, while another, more optimistic, might expect expanding global partnerships to boost long-term growth, resulting in a fair value closer to €89.90.

Do you think there's more to the story for Amundi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives