- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

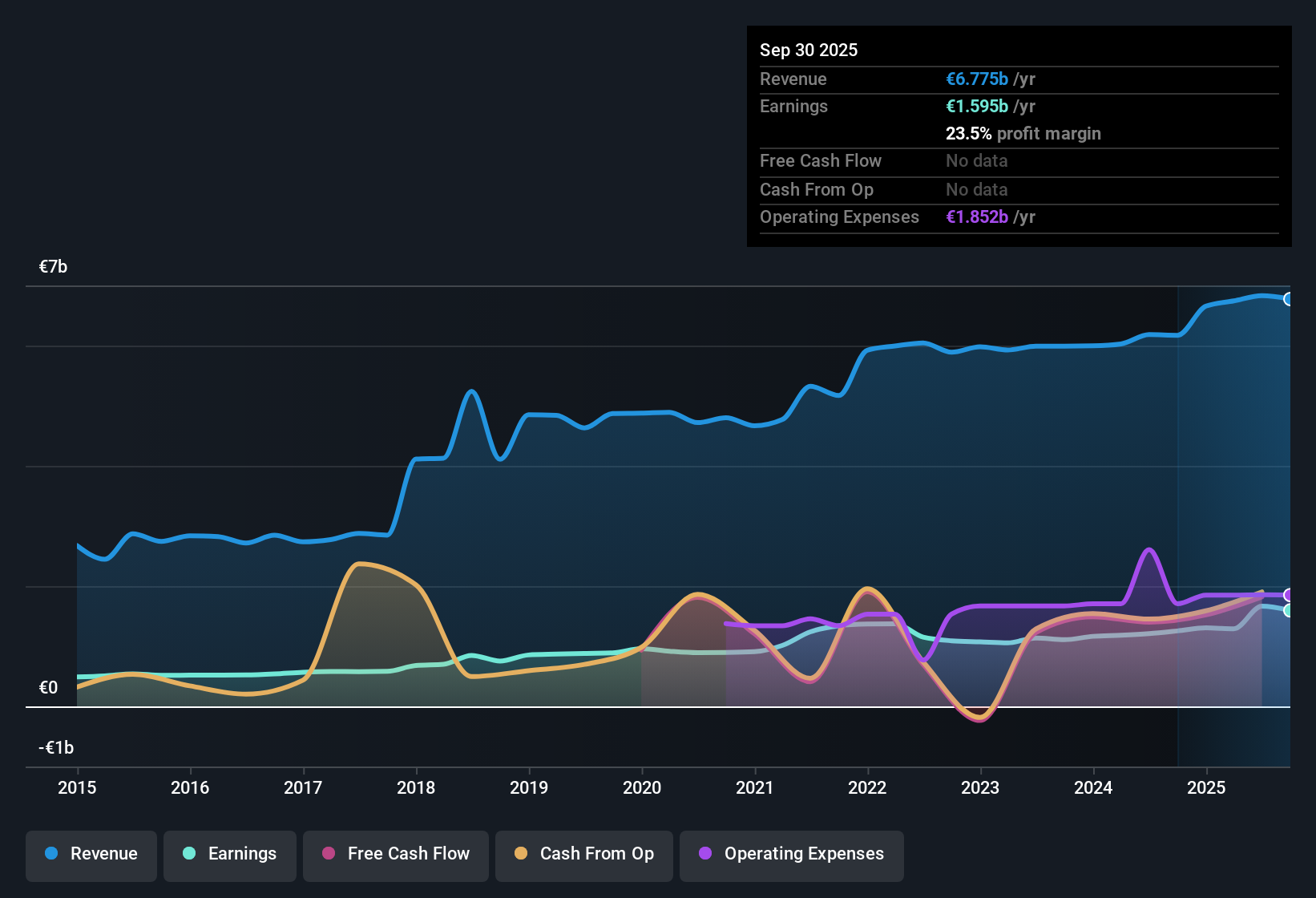

Amundi (ENXTPA:AMUN) Earnings Beat Long-Term Trend, Challenging Bearish Outlooks on Margins and Growth

Reviewed by Simply Wall St

Amundi (ENXTPA:AMUN) posted a standout earnings performance, growing net income by 27.1% over the past year, well above its five-year average of 6.2%. The firm’s net profit margin climbed to 23.5% from 20.3%, showing high-quality profitability, even as forward guidance points to a 15.6% annual revenue decline and a 1.9% annual decrease in earnings over the next three years.

See our full analysis for Amundi.Next up, we will see how these numbers hold up against the major bull and bear narratives that investors have been tracking. Some common opinions may get reinforced, while others are put to the test.

See what the community is saying about Amundi

Profit Margins Widen Despite Revenue Headwinds

- Analysts see profit margins climbing from 24.4% today to 39.1% in three years, even though annual revenue is expected to decrease by 18.4% over that same period.

- According to the analysts' consensus view, while top-line pressure is heavy,

- Expanding margins are expected to act as an offset, with the firm leveraging its European ETF leadership and technology push to maintain profitability against the industry trend.

- This margin resilience stands out as a positive surprise, given substantial cuts to revenue guidance, and heavily supports the consensus that Amundi’s diversified platform may soften the blow of declining revenues.

Valuation Discount, But Not Below Fair Value

- Amundi trades at a price-to-earnings ratio of 8.1x, a sharp discount to its European capital markets peers (16.6x) and the group average (17.4x), but still sits above its DCF fair value of €59.72 with the current share price at €63.55.

- The consensus narrative points out a tension here,

- While many investors see the low P/E as a bargain signal, Amundi’s above-fair-value share price and earnings contraction forecasts create mixed signals for value-driven investors.

- Analysts set their price target at €75.74, about 19% above market, reflecting their belief that Amundi’s profit outlook and peer discount justify a premium over the current level despite looming headwinds.

Tax Changes and Asset Outflows Cloud Forecast

- The French government’s proposed tax could reduce net profits by €60 to €70 million in 2024 and €40 to €50 million in 2025, while Amundi’s exit from a major multi-asset mandate means a €12 billion drop in assets under management. Both are set to sharply impact future earnings.

- Consensus narrative highlights risks on several fronts,

- While Amundi benefits from new partnerships and technology-driven growth, these gains may be overshadowed by regulatory costs and asset attrition.

- Persistent competition in Italy and net outflows from China further reinforce the consensus caution about relying on recent margin strength as a reliable future buffer for bottom-line pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amundi on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results from a fresh angle? Put your insight to work and craft your own take in just a few minutes. Do it your way

A great starting point for your Amundi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Amundi faces shrinking revenue forecasts, asset outflows, and the risk that recent margin growth may not offset these pressures in the future.

Concerned about these headwinds? Focus your search on stable growth stocks screener (2124 results) to find companies with consistently solid revenue and earnings growth that can weather volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives