- France

- /

- Hospitality

- /

- ENXTPA:VAC

Strong week for Pierre et Vacances (EPA:VAC) shareholders doesn't alleviate pain of five-year loss

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example, after five long years the Pierre et Vacances SA (EPA:VAC) share price is a whole 91% lower. That's not a lot of fun for true believers. But it's up 7.7% in the last week. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last five years has been tough for Pierre et Vacances shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Pierre et Vacances

Pierre et Vacances isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Pierre et Vacances grew its revenue at 5.6% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 14% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. A company like this generally needs to produce profits before it can find favour with new investors.

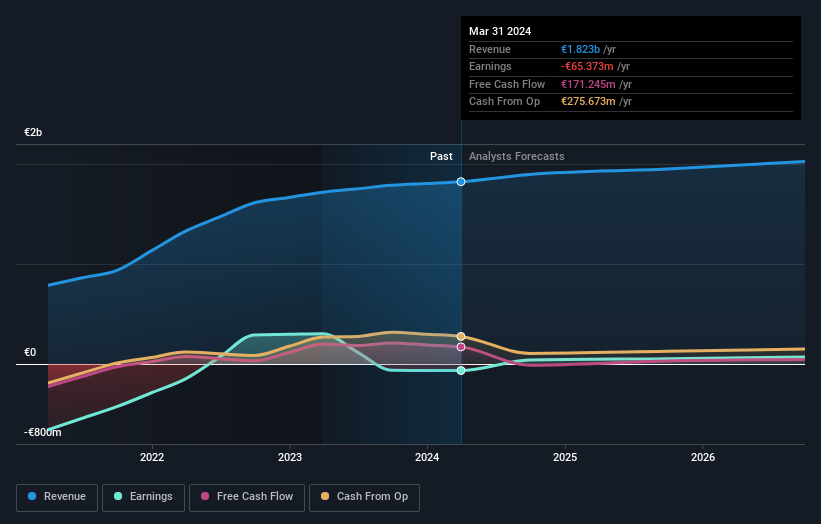

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Pierre et Vacances' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Pierre et Vacances' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Pierre et Vacances' TSR, which was a 65% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that Pierre et Vacances has rewarded shareholders with a total shareholder return of 11% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Pierre et Vacances is showing 1 warning sign in our investment analysis , you should know about...

But note: Pierre et Vacances may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VAC

Pierre et Vacances

Through its subsidiaries, engages in the holiday accommodation and holiday property investment business in Europe and internationally.

Moderate growth potential low.