- France

- /

- Hospitality

- /

- ENXTPA:VAC

Pierre et Vacances (ENXTPA:VAC) Swings Back to H1 Loss, Testing Margin-Improvement Narrative

Reviewed by Simply Wall St

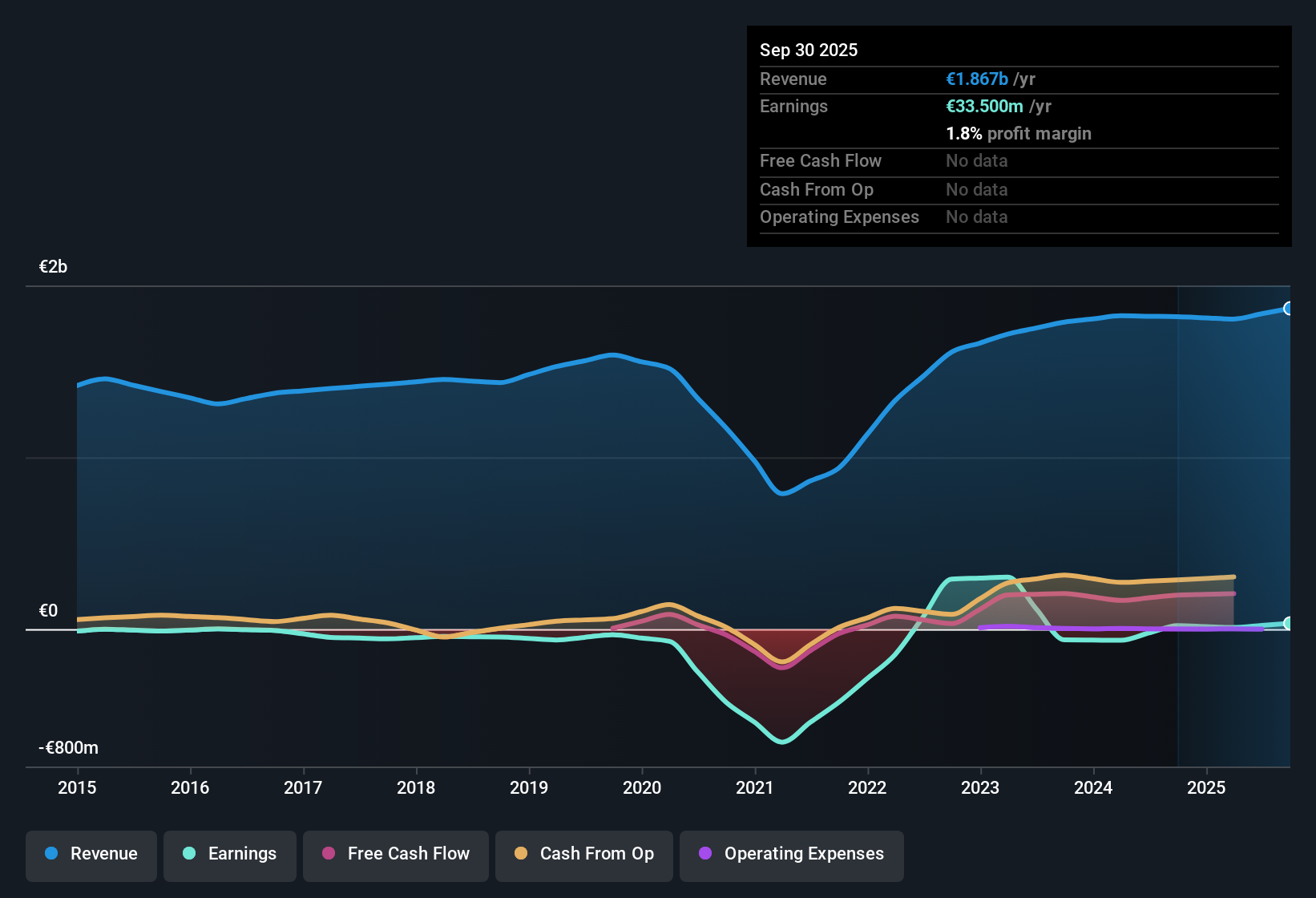

Pierre et Vacances (ENXTPA:VAC) just posted its FY 2025 first half numbers with revenue of €765.1 million and a basic EPS of €-0.25, alongside trailing twelve month revenue of about €1.87 billion and net income of €33.5 million. This puts recent profitability into sharper focus for investors. Over the last three reported half year periods, revenue has moved from €778.6 million in H1 2024 to €1.04 billion in H2 2024 and then €765.1 million in H1 2025. Over the same periods, basic EPS has swung from €-0.23 in H1 2024 to €0.28 in H2 2024 and back to €-0.25 in the latest half. This underscores a business where margins can shift quickly even as the trailing net margin nudges higher.

See our full analysis for Pierre et Vacances.With the latest earnings on the table, the next step is to see how this margin story lines up with the dominant market narratives around Pierre et Vacances, and where the fresh numbers might start to challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Climbs To 1.8 percent On TTM Basis

- Over the last twelve months, Pierre et Vacances generated €1.87 billion of revenue and €33.5 million of net income, giving a 1.8 percent net margin compared with 1.1 percent the year before.

- What stands out for the bullish camp is that this 1.8 percent margin sits on top of a long run of strong profit growth, yet the latest half year dipped back into loss making:

- Earnings grew 67.3 percent over the last year and have compounded at 54.1 percent per year over five years, while H1 2025 alone showed a net loss of €116.8 million after a €126.2 million profit in H2 2024.

- This mix of strong trailing growth but volatile half year profits means the bullish view of steadily improving profitability is only partly backed by the numbers.

Share Price Premium Versus 23x P E Multiple

- The shares trade on a 23x P E ratio at a price of €1.67, above the 16.2x European hospitality average and slightly above the 22.9x peer group.

- Critics highlight that this premium valuation sits uneasily beside more conservative valuation markers and balance sheet red flags:

- The DCF fair value is €0.65, well below €1.67, while shareholders equity is negative and interest payments are not well covered by earnings according to the risk summary.

- This combination challenges any bearish argument that the stock is already pricing in balance sheet risk, because the market is still assigning a higher multiple than the sector despite those weaknesses.

Analyst Upside Of 33 point 6 Percent On 40 point 5 Percent EPS Growth Forecast

- Analysts expect earnings to grow about 40.5 percent per year over the next three years and their price targets imply roughly 33.6 percent upside from the current €1.67 toward €2.23.

- Supporters of a more optimistic view point to these forecasts as a bridge between lumpy recent halves and the stronger trailing record:

- Forecast revenue growth of 5.3 percent per year is broadly in line with the wider French market at 5.4 percent, yet the earnings line is expected to grow much faster, which fits the story of improving efficiency rather than a pure sales surge.

- Set against the latest H1 2025 loss of €116.8 million, these high growth expectations depend heavily on the company sustaining the margin improvements that drove the 1.8 percent trailing net margin.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pierre et Vacances's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Pierre et Vacances combines a thin 1.8 percent trailing net margin, negative equity and volatile half year losses with a valuation premium to peers.

If that blend of fragile profitability and a stretched balance sheet feels uncomfortable, consider moving toward sturdier candidates by scanning solid balance sheet and fundamentals stocks screener (1941 results) right now for stronger financial foundations and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VAC

Pierre et Vacances

Engages in the property development and tourism businesses in Europe and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026