- France

- /

- Hospitality

- /

- ENXTPA:VAC

Even With A 30% Surge, Cautious Investors Are Not Rewarding Pierre et Vacances SA's (EPA:VAC) Performance Completely

Pierre et Vacances SA (EPA:VAC) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 78%.

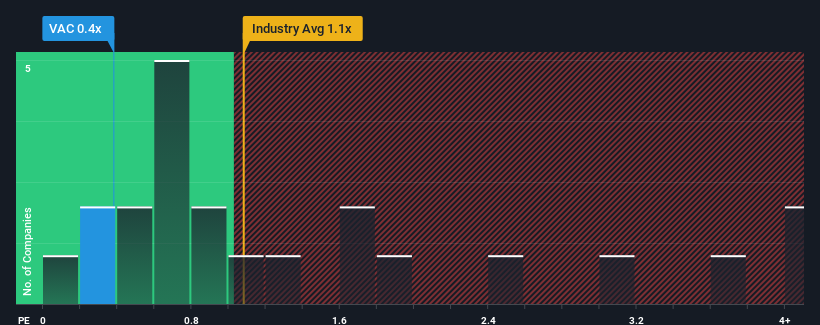

In spite of the firm bounce in price, when close to half the companies operating in France's Hospitality industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Pierre et Vacances as an enticing stock to check out with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Pierre et Vacances

What Does Pierre et Vacances' Recent Performance Look Like?

Recent times have been advantageous for Pierre et Vacances as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pierre et Vacances.How Is Pierre et Vacances' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Pierre et Vacances' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. As a result, it also grew revenue by 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.8%, which is noticeably less attractive.

In light of this, it's peculiar that Pierre et Vacances' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Pierre et Vacances' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Pierre et Vacances currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Pierre et Vacances (of which 2 make us uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VAC

Pierre et Vacances

Engages in the property development and tourism businesses in Europe and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026