- Sweden

- /

- Consumer Durables

- /

- OM:DUNI

3 European Dividend Stocks To Watch With Up To 5.8% Yield

Reviewed by Simply Wall St

As European markets navigate mixed performances, with the STOXX Europe 600 Index ending slightly lower and varied results across major indices like Germany’s DAX and France’s CAC 40, investors are keenly observing dividend stocks for their potential to offer stable returns amid economic uncertainties. In light of the European Central Bank's cautious stance on interest rates and ongoing discussions about economic resilience, a good dividend stock may be characterized by its ability to provide consistent yields while maintaining financial stability in fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.16% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.88% | ★★★★★★ |

| Evolution (OM:EVO) | 4.82% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.11% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.93% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.47% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Credito Emiliano (BIT:CE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credito Emiliano S.p.A., along with its subsidiaries, operates in commercial banking and wealth management in Italy, with a market cap of €5.19 billion.

Operations: Credito Emiliano S.p.A.'s revenue is primarily derived from its commercial banking segment, contributing €1.23 billion, and private banking activities, which generate €286.60 million.

Dividend Yield: 4.9%

Credito Emiliano's dividend is well-covered by earnings, with a payout ratio of 38.2%, and is forecasted to remain sustainable at 52.5% in three years. Despite past volatility in dividend payments, the current yield of 4.93% places it among the top Italian dividend payers. Recent strategic collaborations with Google Cloud aim to enhance productivity and innovation, potentially supporting long-term financial stability despite an anticipated decline in earnings over the next few years.

- Navigate through the intricacies of Credito Emiliano with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Credito Emiliano's share price might be too optimistic.

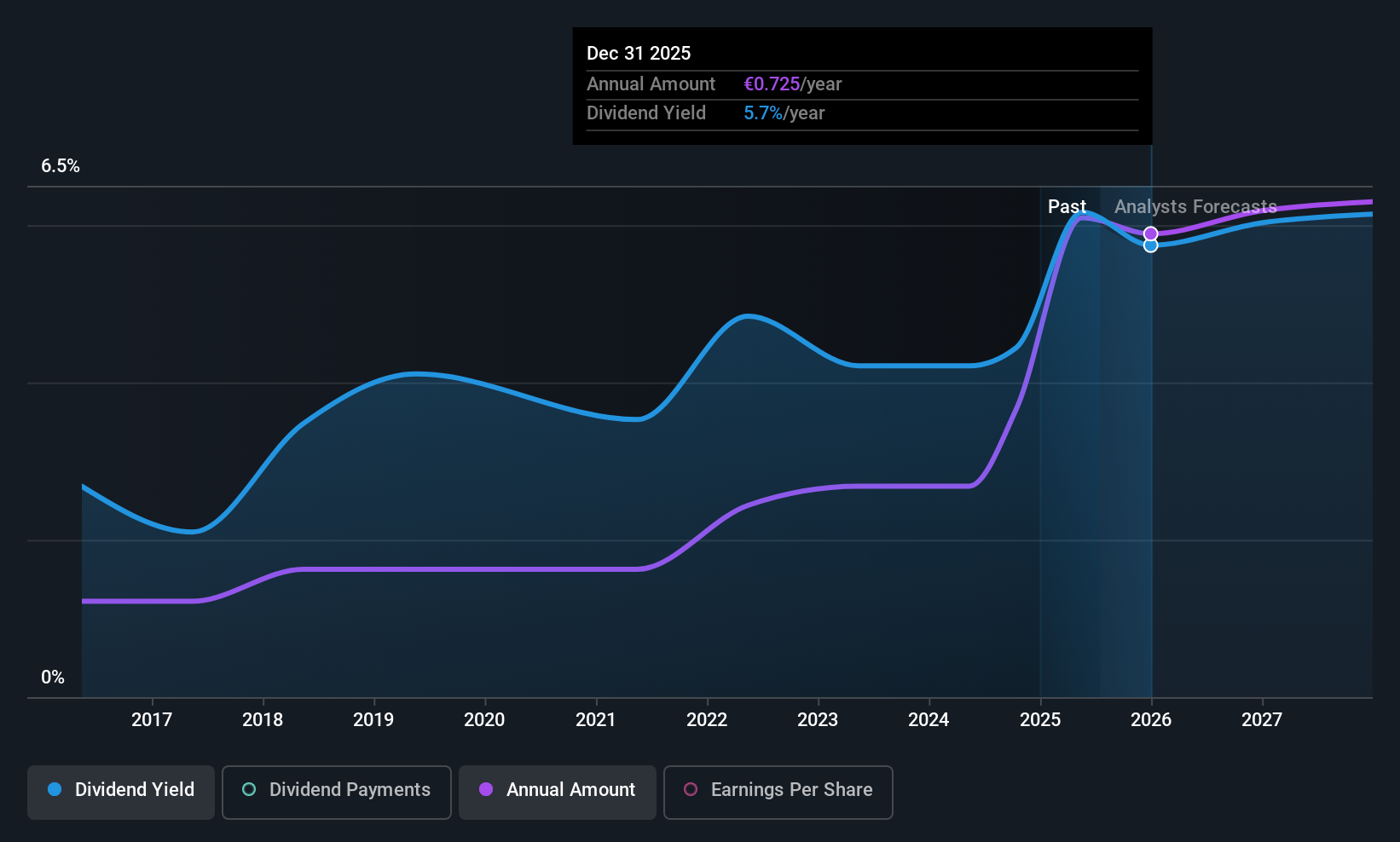

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sodexo S.A. offers food services and facilities management across North America, Europe, and internationally with a market cap of €6.78 billion.

Operations: Sodexo S.A. generates revenue from its operations with €8.59 billion in Europe, €11.18 billion in North America, and €4.30 billion from the rest of the world.

Dividend Yield: 5.8%

Sodexo's dividend of €2.70 per share, approved on December 16, 2025, aligns with its policy of a 50% payout ratio based on underlying net income. Despite past volatility in dividend payments, the current yield is among the top French market payers. The company's dividends are well-covered by earnings and cash flows with payout ratios of 56.7% and 62.4%, respectively. Recent leadership changes aim to drive growth in its key U.S. market, potentially enhancing future stability.

- Click to explore a detailed breakdown of our findings in Sodexo's dividend report.

- Our expertly prepared valuation report Sodexo implies its share price may be lower than expected.

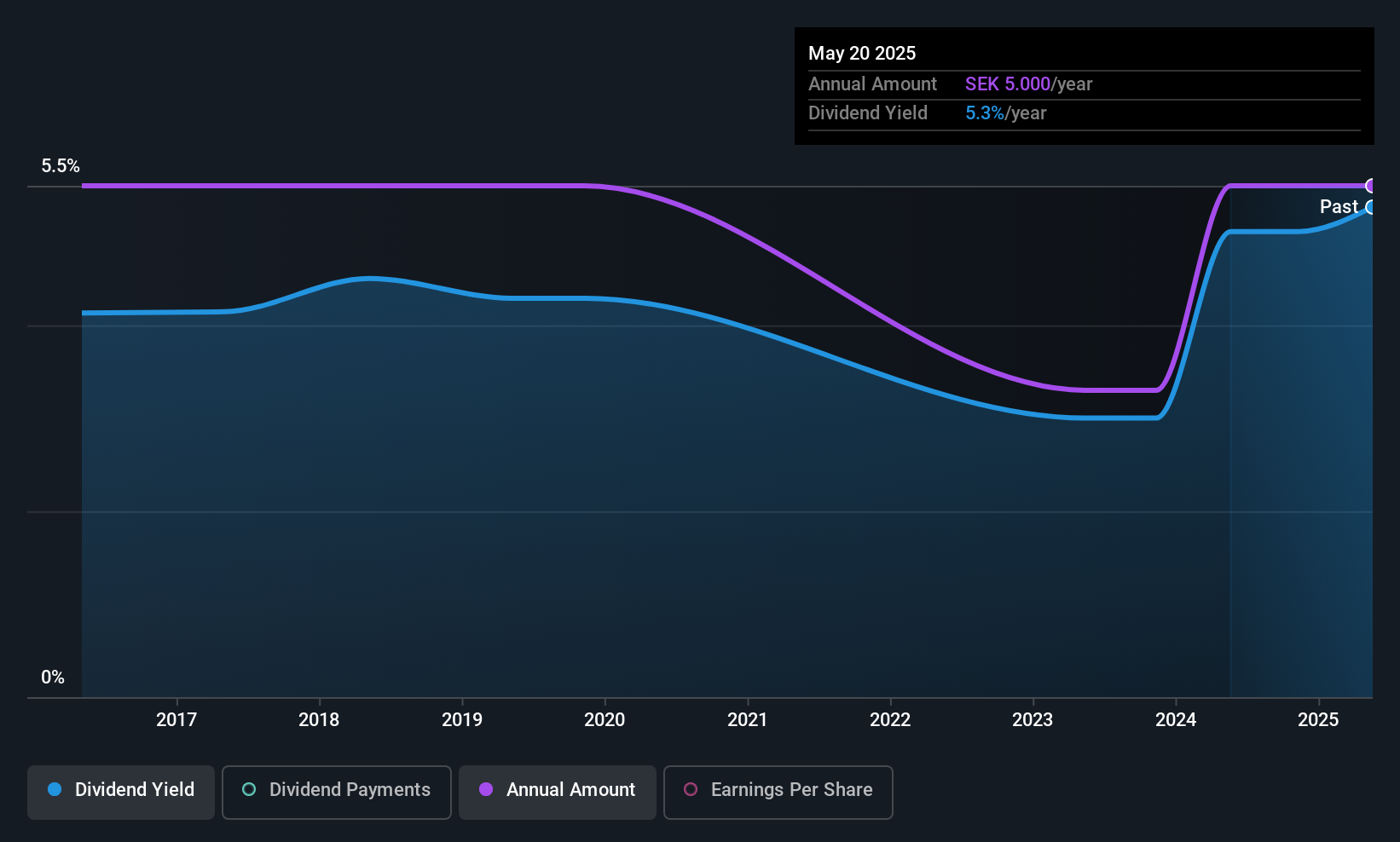

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) develops, manufactures, and sells meal serving, take-away, and packaging products in Sweden, Poland, and internationally with a market cap of SEK4.78 billion.

Operations: Duni AB's revenue is primarily derived from its Dining solutions segment, which contributes SEK4.73 billion, and its Food packaging solutions segment, contributing SEK3.09 billion.

Dividend Yield: 4.9%

Duni's dividend yield of 4.91% places it in the top 25% of Swedish market payers, supported by a payout ratio of 71.9% from earnings and 69.7% from cash flows, indicating coverage by both metrics. However, dividend reliability remains an issue due to historical volatility despite growth over the past decade. Recent product innovations like Octaview and Duniform® solutions aim to enhance sustainability and operational efficiency, potentially supporting long-term profitability amidst fluctuating dividends.

- Take a closer look at Duni's potential here in our dividend report.

- The valuation report we've compiled suggests that Duni's current price could be quite moderate.

Turning Ideas Into Actions

- Access the full spectrum of 207 Top European Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DUNI

Duni

Develops, manufactures, and sells concepts and products for the serving, take-away, and packaging of meals in Sweden, Poland, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)