- France

- /

- Hospitality

- /

- ENXTPA:FCMC

European Undiscovered Gems To Explore In December 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed returns, with the pan-European STOXX Europe 600 Index inching higher on optimism around potential interest rate cuts, investors are keenly observing economic indicators such as inflation and GDP revisions that hint at underlying strengths and challenges. In this dynamic environment, identifying stocks that exhibit resilience through robust fundamentals and growth potential becomes crucial for those seeking opportunities amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Ferrari Group (ENXTAM:FERGR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferrari Group PLC is a company that specializes in shipping, integrated logistics, and value-added services for jewelry and precious goods across Europe, Asia, North America, Brazil, and internationally with a market cap of €860.05 million.

Operations: Ferrari Group's primary revenue stream comes from its business services, generating €355.25 million. The company has a market capitalization of €860.05 million.

Ferrari Group, a small player in the logistics industry, has seen its earnings take a hit with a 27.1% negative growth over the past year, contrasting with an industry average of -8.6%. Despite this setback, it's trading at 39.1% below its estimated fair value and maintains high-quality earnings. The company's recent half-year results showed sales rising to €179.58 million from €173.08 million last year, although net income dropped to €12.36 million from €27.45 million previously, reflecting challenges but also potential for recovery given its forecasted annual earnings growth of 19.49%.

- Navigate through the intricacies of Ferrari Group with our comprehensive health report here.

Evaluate Ferrari Group's historical performance by accessing our past performance report.

Société Fermière du Casino Municipal de Cannes (ENXTPA:FCMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Société Fermière du Casino Municipal de Cannes is a French company engaged in operating hotels, casinos, gaming clubs, spas, performance venues, and restaurants with a market capitalization of €299.56 million.

Operations: The company's primary revenue stream is its hotel business, generating €135.93 million, followed by casinos with €15.89 million.

Trading at 16.5% below its estimated fair value, Société Fermière du Casino Municipal de Cannes (FCMC) presents an intriguing opportunity in the hospitality sector. Over the past year, earnings surged by 13.6%, outpacing the industry's modest 0.9% growth. The debt to equity ratio has improved from 10.2% to 7.2% over five years, indicating better financial health. Despite recent share price volatility, FCMC's high-quality earnings and positive free cash flow suggest robust fundamentals. A significant development is Barrière family's acquisition of a 25.9% stake for €77.6 million (€1897 per share), signaling confidence in FCMC's future prospects.

Hotel Majestic Cannes (ENXTPA:MLHMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hotel Majestic Cannes owns and operates a hotel with a market capitalization of €411.13 million.

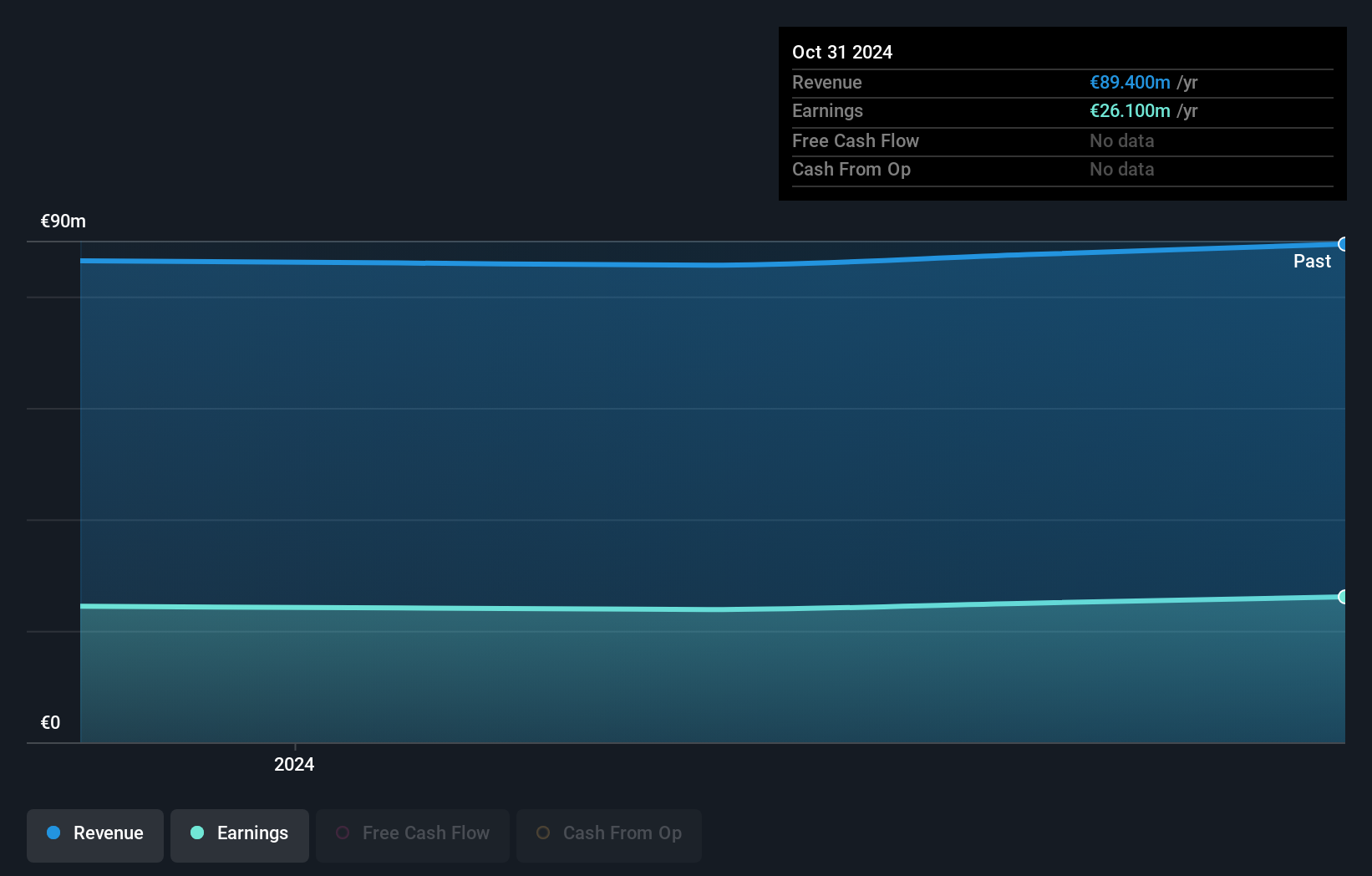

Operations: The primary revenue stream for Hotel Majestic Cannes is its Hotels & Motels segment, generating €89.19 million.

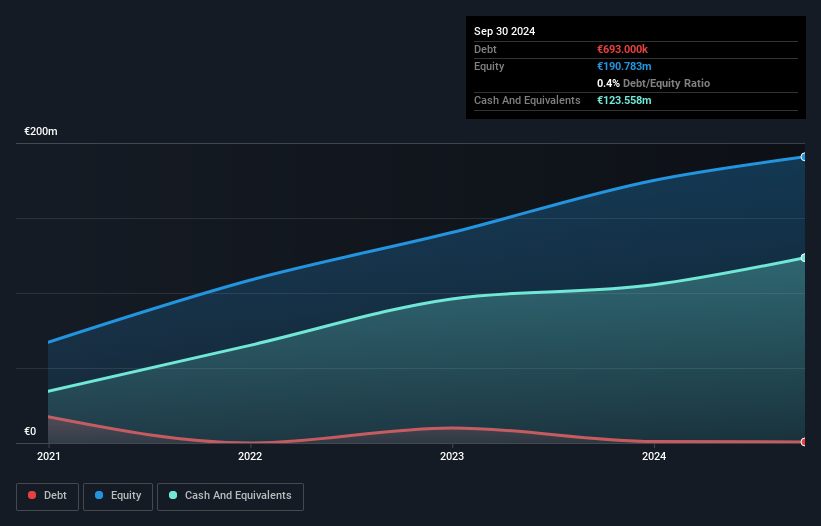

Hotel Majestic Cannes, a small player in the hospitality sector, showcases promising financial metrics. Its earnings growth of 1.9% over the past year outpaced the industry average of 0.9%, indicating strong performance relative to peers. The company's debt is well-managed, with a net debt to equity ratio at a satisfactory 0.3%, and interest payments are comfortably covered by EBIT at an impressive 202 times coverage. These figures suggest robust financial health and high-quality earnings, positioning Hotel Majestic Cannes as an intriguing option for investors exploring niche opportunities in Europe’s hospitality market.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 308 European Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FCMC

Société Fermière du Casino Municipal de Cannes

Operates hotels, casinos, gaming club, spas, performance venues, and restaurants in France.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026