- France

- /

- Hospitality

- /

- ENXTPA:FDJU

Carrefour Leads Three Key Dividend Stocks On Euronext Paris

Reviewed by Simply Wall St

Amidst a backdrop of political shifts and economic adjustments, the French market has shown resilience with the CAC 40 Index climbing significantly. This context sets an intriguing stage for investors looking towards dividend stocks as a potentially stable component in their portfolios.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 9.61% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.92% | ★★★★★★ |

| Métropole Télévision (ENXTPA:MMT) | 9.71% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.56% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.33% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.02% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.96% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.44% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.62% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

Carrefour (ENXTPA:CA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a network of food and non-food retail stores across multiple formats and channels in Europe, Latin America, the Middle East, Africa, and Asia, with a market capitalization of approximately €9.56 billion.

Operations: Carrefour SA generates €39.02 billion in revenue from its operations in France, €24.27 billion from Europe (excluding France), and €22.54 billion from Latin America.

Dividend Yield: 6.2%

Carrefour's dividend yield of 6.17% ranks in the top 25% of French dividend payers, supported by a reasonable payout ratio of 66.8% and a cash payout ratio of 21.1%, ensuring dividends are well-covered by both earnings and cash flows. However, the company has experienced volatility in its dividend payments over the past decade and currently trades at a significant discount to estimated fair value (44.2%). Additionally, Carrefour faces challenges with one-off items impacting financial results and a high debt level, alongside modest profit margins which have declined from last year's 1.7% to 1.1%.

- Take a closer look at Carrefour's potential here in our dividend report.

- The valuation report we've compiled suggests that Carrefour's current price could be quite moderate.

La Française des Jeux Société anonyme (ENXTPA:FDJ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: La Française des Jeux Société anonyme operates in the gaming and distribution sector both in France and internationally, with a market capitalization of approximately €6.10 billion.

Operations: La Française des Jeux Société anonyme generates revenue through three primary segments: Lottery, which brings in €1.94 billion, Sport Betting and Online Gaming Open to Competition at €0.52 billion, and Adjacent Activities contributing €0.17 billion.

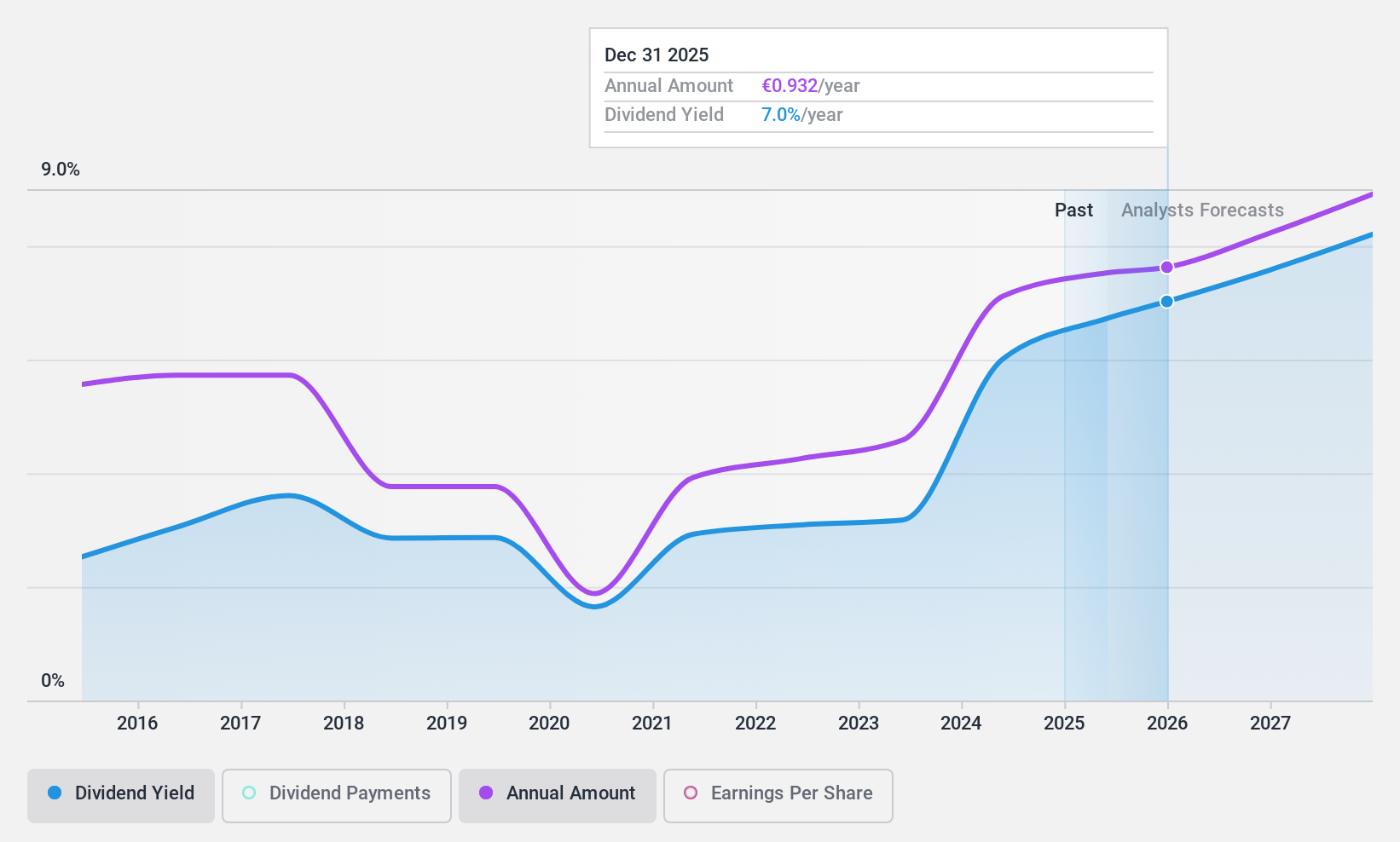

Dividend Yield: 5.4%

La Française des Jeux Société anonyme recently approved a dividend of €1.78 per share, reflecting its stable yet short dividend history under 10 years. Despite this, FDJ's dividends are well-supported by a cash payout ratio of 65.3% and an earnings payout ratio of 79.9%. The company reported a revenue increase to €710 million in Q1 2024, up by 7%, and earnings growth is projected at 4.94% annually. However, the stock trades at a discount of 24.4% below its estimated fair value, signaling potential undervaluation amidst concerns over its relatively new dividend program.

- Click to explore a detailed breakdown of our findings in La Française des Jeux Société anonyme's dividend report.

- Our valuation report unveils the possibility La Française des Jeux Société anonyme's shares may be trading at a discount.

Colas (ENXTPA:RE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA is a global company engaged in the construction and maintenance of transport infrastructure, with a market capitalization of approximately €5.71 billion.

Operations: Colas SA generates its revenue primarily from various geographic road construction segments, with significant contributions from Roads France-Overseas France/IO at €5.97 billion, Roads EMEA at €3.36 billion, Canada Routes at €2.38 billion, and Roads United States at €2.24 billion, alongside Railways and Other Activities which contribute €1.38 billion.

Dividend Yield: 4.2%

Colas SA reported a revenue increase to €16.02 billion in 2023, up from €15.53 billion the previous year, with net income also rising to €316 million. Despite a reasonable cash payout ratio of 58.9%, its dividend payments are considered volatile over the past decade and yield only 4.2%, lower than the top quartile of French dividend stocks at 5.35%. Furthermore, while dividends are supported by earnings and cash flows, Colas carries high debt levels and has experienced significant one-off financial items impacting results.

- Delve into the full analysis dividend report here for a deeper understanding of Colas.

- Our expertly prepared valuation report Colas implies its share price may be too high.

Seize The Opportunity

- Get an in-depth perspective on all 38 Top Euronext Paris Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade FDJ United, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FDJU

FDJ United

Engages in the gaming operation and distribution business in France and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives