- France

- /

- Hospitality

- /

- ENXTPA:AC

Does Accor’s Recent Expansion Signal a Buying Opportunity After 5% Share Price Jump?

Reviewed by Bailey Pemberton

- Wondering if Accor stock is a hidden gem or fully priced in? Let’s take a look at what is making investors curious about its value.

- Accor's share price has recently gained 5.3% in the past week and is up 12.5% over the last year, hinting at renewed optimism or shifting risk sentiment.

- Recent news around Accor has focused on the company’s expansion into new markets and strategic partnerships, suggesting a more ambitious growth strategy. These moves have caught the market’s attention and may be fueling the latest price action.

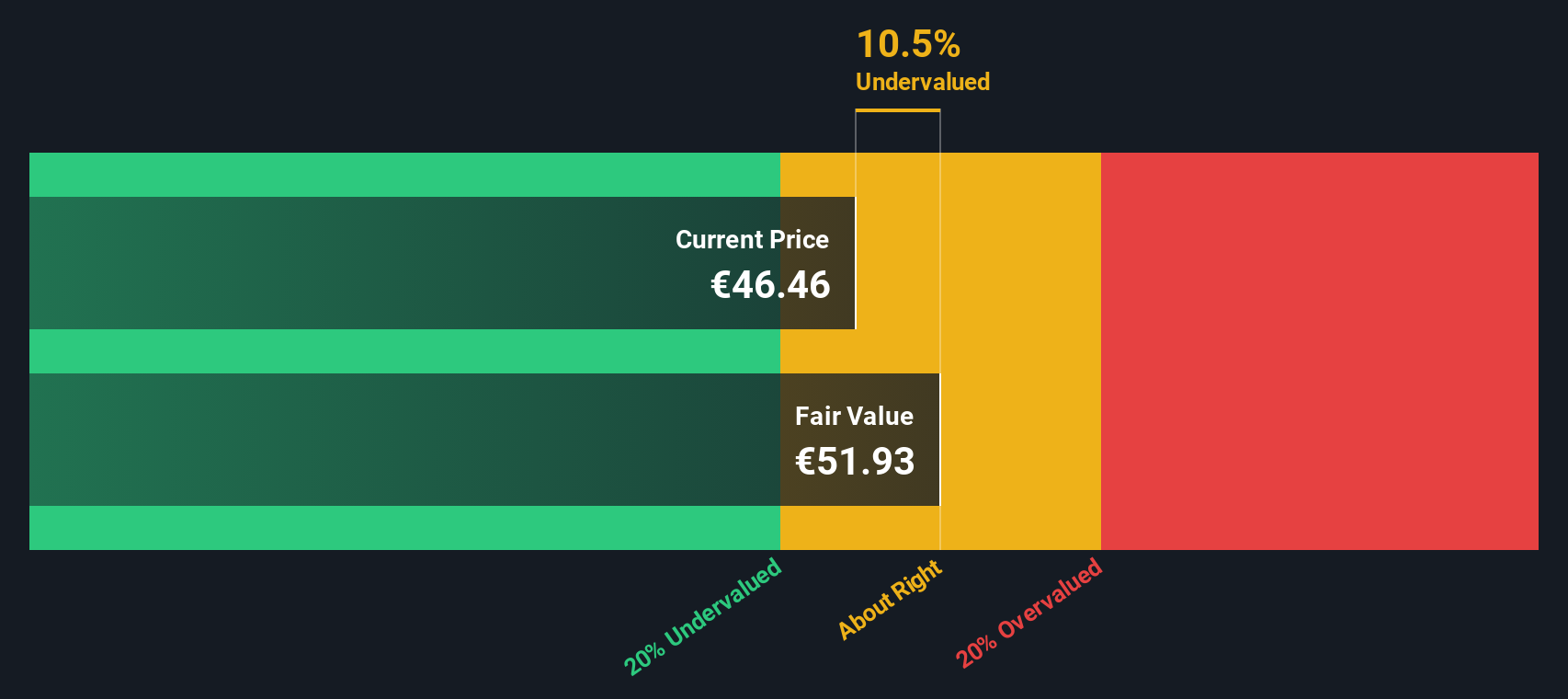

- On our valuation checks, Accor scores 3 out of 6, meaning it is undervalued by half of our core indicators. We will break down what that means using several valuation approaches, but stay tuned to see an alternative way to make sense of the numbers later on.

Approach 1: Accor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach helps investors understand what the company is worth based on its ability to generate cash in the years ahead.

For Accor, the DCF model starts with its current Free Cash Flow of €569 million and incorporates analyst estimates up to five years out. These figures suggest healthy momentum, with Free Cash Flow expected to rise to €814 million by 2029. Beyond the analyst estimates, further FCF projections up to 2035 are extrapolated, showing a steady trend of growth within the company’s core operations.

Using these projections and discounting them back to the present, the model produces a fair value of €52.88 per share. Compared to Accor's current share price, the DCF valuation suggests the stock is trading at a 10.4% discount. This indicates Accor shares may be undervalued based on anticipated cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Accor is undervalued by 10.4%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Accor Price vs Earnings (PE)

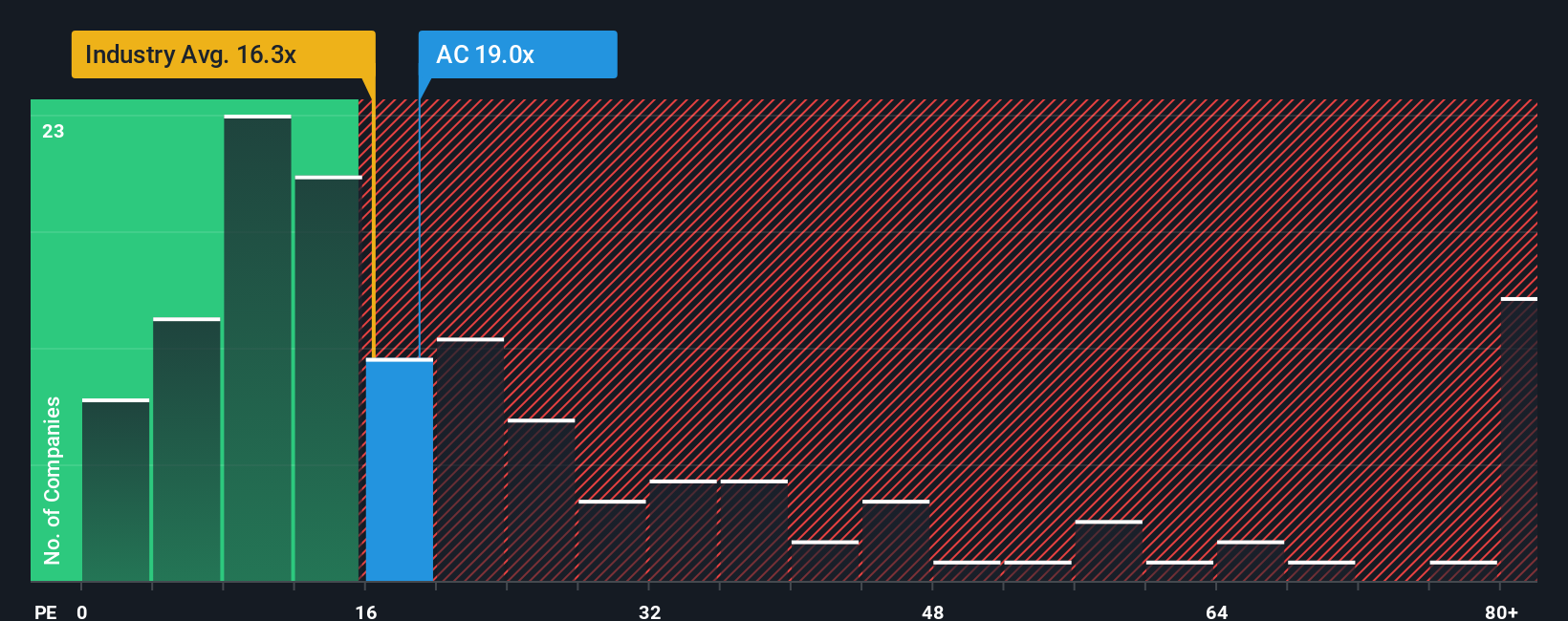

For profitable companies like Accor, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It tells investors how much they are paying for each euro of earnings, offering a quick gauge of whether a stock looks expensive or cheap relative to its earnings power.

Growth expectations and risk profile are key drivers behind what makes a "normal" or "fair" PE ratio. Higher expected growth or lower risk typically justifies a higher PE, while slower growth or increased risk should lead to a lower multiple.

Accor's current PE stands at 19.0x, which is slightly below the Hospitality industry average of 20.7x and significantly below the average of its closest peers at 37.4x. On the surface, this makes Accor appear relatively attractively priced compared to both its sector and competitors. However, simply comparing to averages can miss the full story.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio sets out a PE for Accor that takes into account a deeper set of factors: its projected earnings growth, the quality of its profits, its size, industry conditions, and overall risk. This proprietary benchmark suggests Accor’s fair PE should be around 21.8x, offering a more nuanced and company-specific view than traditional industry or peer averages.

Comparing Accor’s actual PE (19.0x) to its Fair Ratio (21.8x) reveals the stock is trading below what would be expected given its fundamentals and prospects. This suggests Accor is potentially undervalued on a PE basis, despite its recent gains.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Accor Narrative

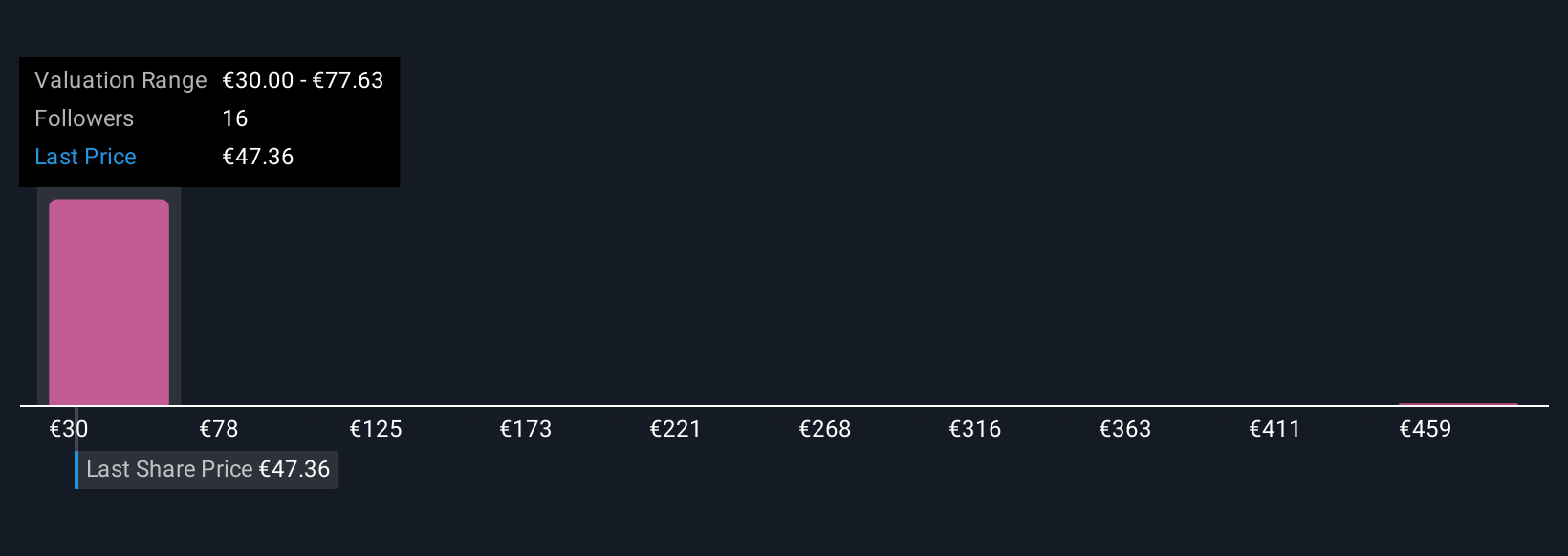

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, your informed perspective on how Accor’s business will perform, including your assumptions for fair value, revenue, earnings, and margins.

Unlike traditional models that reduce everything to just numbers, Narratives connect the story you believe about Accor's strengths, challenges, and growth drivers to a concrete financial forecast, turning your outlook into an actionable fair value.

Narratives are designed to be easy to use and accessible for all investors, and you can explore and create them on Simply Wall St’s Community page, where millions of investors share their perspectives and forecasts.

They empower you to decide when to buy or sell by comparing your Narrative’s fair value to the current market price, making every investment decision feel more informed and personal.

What’s more, Narratives are automatically updated as new information emerges, including fresh news or earnings results, so your outlook can stay in sync with market reality.

For example, with Accor, some investors may expect ambitious growth from its expanding lifestyle brands and set a high fair value at €65.0, while others might see more risk in the European market and take a cautious stance with a lower fair value of €44.0, letting their Narrative guide their investment choices.

Do you think there's more to the story for Accor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AC

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.