- France

- /

- Food and Staples Retail

- /

- ENXTPA:CO

Casino, Guichard-Perrachon S.A. (EPA:CO) Screens Well But There Might Be A Catch

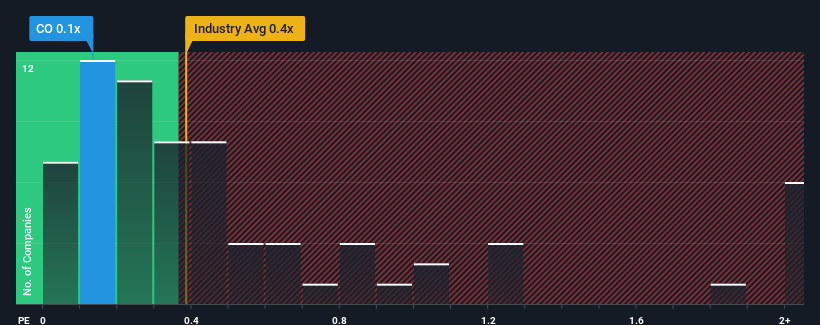

It's not a stretch to say that Casino, Guichard-Perrachon S.A.'s (EPA:CO) price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" for companies in the Consumer Retailing industry in France, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Casino Guichard-Perrachon

How Casino Guichard-Perrachon Has Been Performing

Casino Guichard-Perrachon certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Casino Guichard-Perrachon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Casino Guichard-Perrachon's Revenue Growth Trending?

Casino Guichard-Perrachon's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has fallen 72% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 283% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 7.3%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Casino Guichard-Perrachon's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Casino Guichard-Perrachon's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Casino Guichard-Perrachon currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Casino Guichard-Perrachon (at least 4 which are a bit concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CO

Casino Guichard-Perrachon

Operates as a food retailer in France, Latin America, and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives