- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

Is Carrefour’s Share Price Rally in 2025 Justified After Its Recent Earnings Recovery?

Reviewed by Bailey Pemberton

If you own Carrefour stock or you’re thinking about jumping in, you might be wondering what’s next for this retail heavyweight. Over the past month, Carrefour’s share price has climbed a sturdy 10.1%, putting a spring in the step of anyone watching for signs of growth. Even over the past week, the stock notched up another 3.3%. Despite these recent gains, the stock is still down 2.3% so far this year and trails by 4.0% over the last twelve months. Looking further back, there is a respectable 21.0% return over five years, quietly underscoring the company’s resilience through market ups and downs.

Some of these moves have been shaped by broader trends rather than any single headline, with investors seeing potential in Carrefour’s ongoing transformation efforts and the sector’s shifting winds. There is also an interesting point from a value scoring system where companies can score up to 6 for being undervalued across different metrics. Carrefour comes in at a solid 3, meaning the company is undervalued by half of the standard valuation checks and signaling possible upside for patient investors.

So, how does Carrefour really stack up under the microscope of valuation? Let's break down the different approaches analysts use to figure out if this stock might be trading at a bargain. It is important to remember that there is more to the story than just numbers. We will explore that at the end of our deep dive.

Approach 1: Carrefour Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those back to today’s value. This process gives investors an idea of what the business might actually be worth at present.

For Carrefour, the latest reported Free Cash Flow is €2.01 Billion. Analysts provide detailed estimates for several years into the future, after which cash flows are extrapolated. In 2026, projected FCF is €1.55 Billion, declining to about €1.38 Billion by 2035 according to Simply Wall St projections.

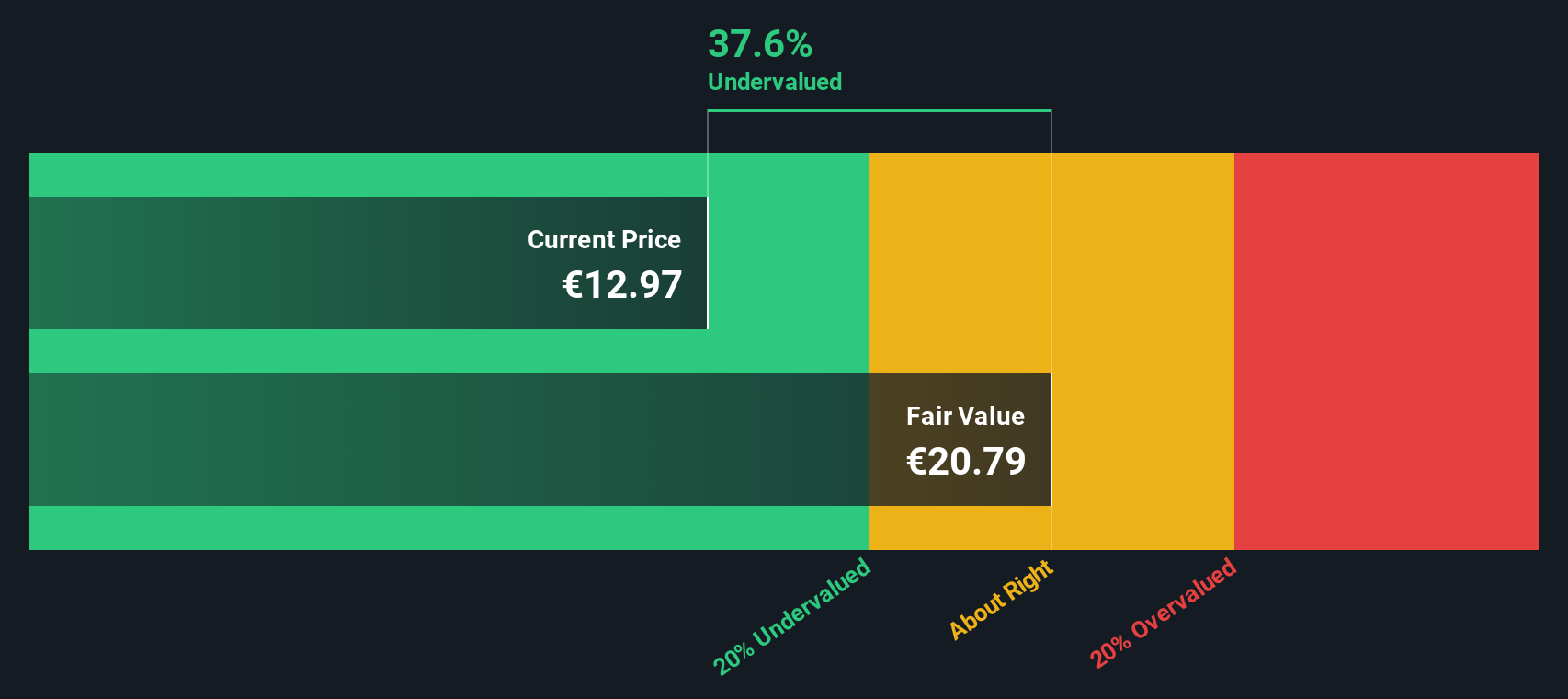

Using the 2 Stage Free Cash Flow to Equity approach and incorporating all those future cash flows, the calculated intrinsic value per share is €21.36. This amount is approximately 37.5% above the current share price, which suggests that the stock is trading at a notable discount to its estimated underlying worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carrefour is undervalued by 37.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Carrefour Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true valuation tool for profitable companies like Carrefour. It shows how much investors are willing to pay for each euro of current earnings, making it especially helpful when a company is consistently generating profits.

Of course, what counts as a “normal” or “fair” PE ratio depends on several moving parts, including how quickly the company's earnings are expected to grow and how risky its future looks. Companies with stronger growth prospects or lower risk profiles tend to command higher PE multiples, while slower-growing or riskier firms typically trade lower multiples.

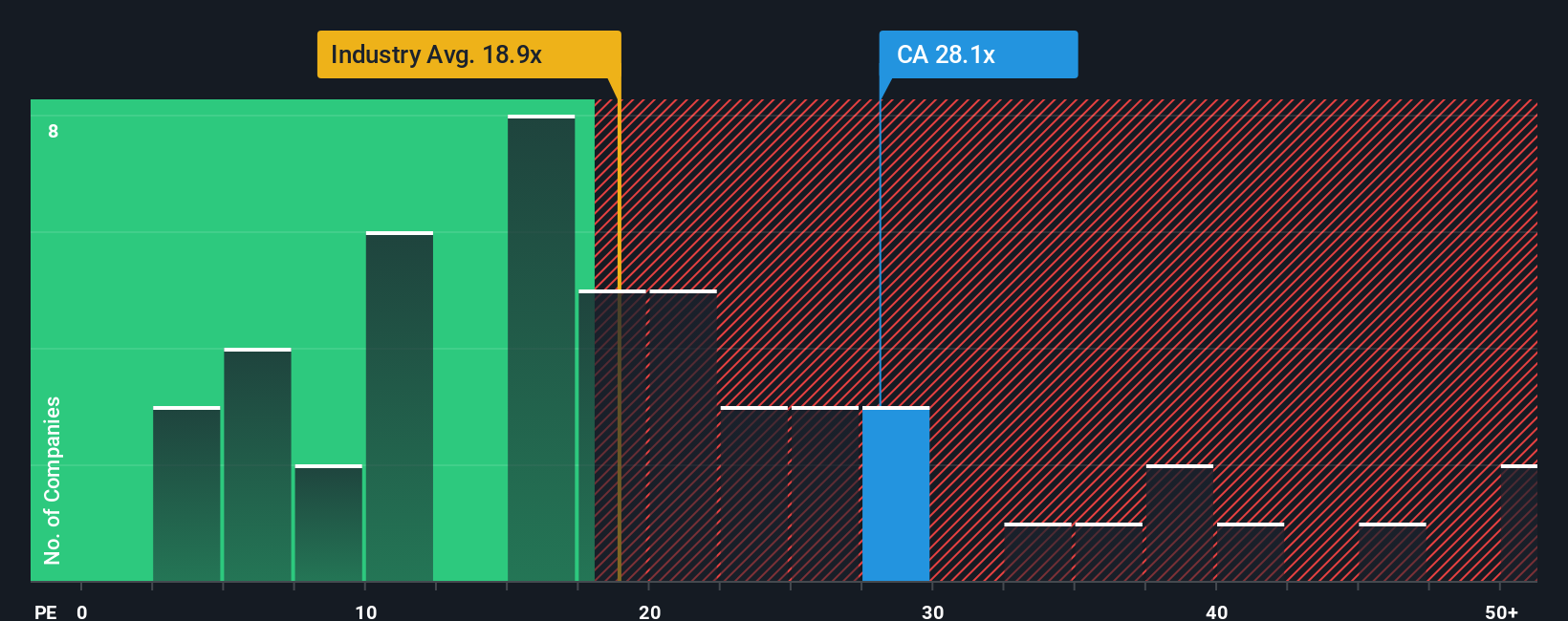

At the moment, Carrefour trades on a PE ratio of 28.9x. That puts it just below the average for its direct peers (29.5x), and notably above the wider Consumer Retailing industry average of 17.2x. On the surface, this could hint at a bit of a premium, likely reflecting Carrefour’s size and stability within its sector.

Enter Simply Wall St’s “Fair Ratio,” a more nuanced benchmark that factors in the company’s unique traits such as earnings growth potential, profit margins, industry norms, market cap, and risks. Unlike a blunt comparison with peers or the industry, the Fair Ratio adjusts the lens to what is truly appropriate for Carrefour's particular circumstances.

By weighing these considerations, Carrefour’s actual PE and its Fair Ratio are remarkably close, which suggests the stock’s valuation is in line with what would be expected based on company and industry fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carrefour Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple and powerful concept: it is your personal story or perspective about a company like Carrefour, connecting the company’s journey and strategy directly to assumptions about its future financials and ultimately its fair value.

Narratives allow investors to make their expectations and reasoning explicit, linking what they believe about Carrefour’s future, such as projected revenue, earnings, and profit margins, to a financial forecast and a calculated fair value per share. This not only makes your thesis actionable but also helps you spot when the current price presents an opportunity to buy or sell.

Best of all, Narratives are accessible and easy to use right on Simply Wall St’s platform in the Community page, where millions of investors share their viewpoints. Narratives are dynamic, updating automatically as new information, like earnings reports or news, rolls in, helping you stay ahead in a changing market.

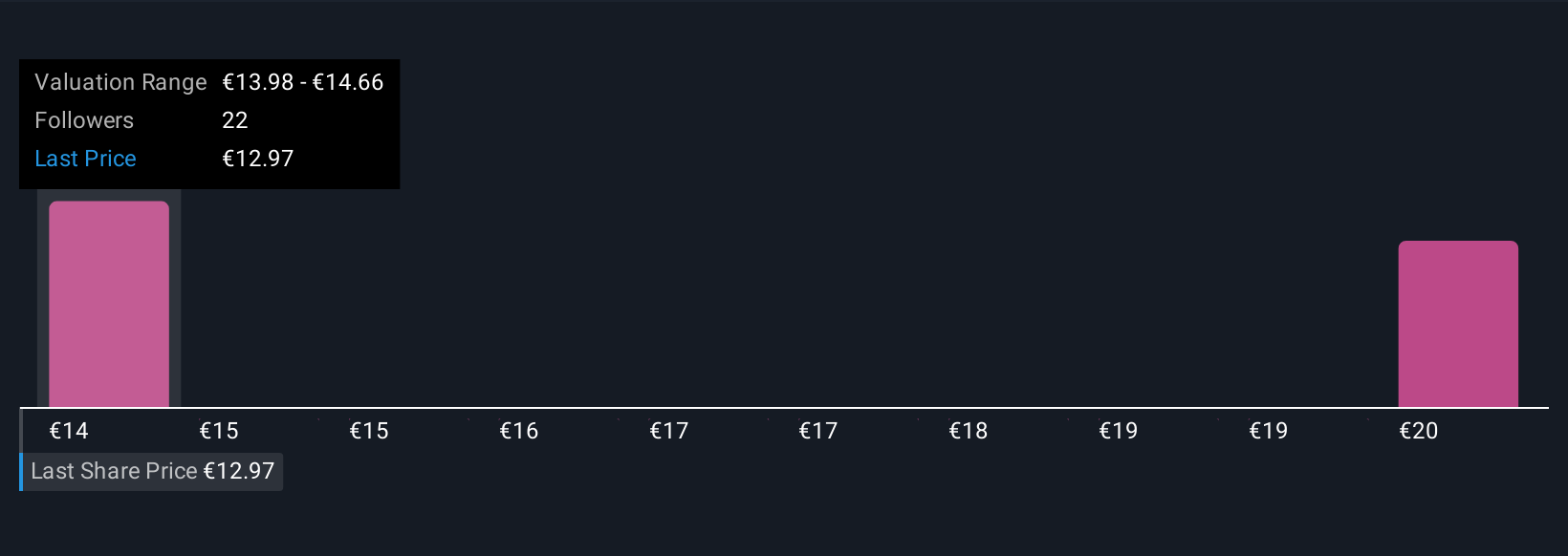

For example, some investors might view Carrefour’s digital strategy and cost cuts as justifying a bullish price target of €17.00. Others, more cautious about competitive risks and currency exposure, might see fair value at only €9.00, showing how different narratives lead to different investment decisions.

Do you think there's more to the story for Carrefour? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CA

Carrefour

Operates as a food retailer in France, Spain, Italy, Belgium, Poland, Romania, Brazil, Argentina, the Middle East, Africa, and Asia.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives