We Take A Look At Why Hermès International Société en commandite par actions' (EPA:RMS) CEO Compensation Is Well Earned

Key Insights

- Hermès International Société en commandite par actions to hold its Annual General Meeting on 30th of April

- Salary of €2.20m is part of CEO Axel Dumas's total remuneration

- Total compensation is similar to the industry average

- Hermès International Société en commandite par actions' EPS grew by 46% over the past three years while total shareholder return over the past three years was 128%

The performance at Hermès International Société en commandite par actions (EPA:RMS) has been quite strong recently and CEO Axel Dumas has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 30th of April. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for Hermès International Société en commandite par actions

How Does Total Compensation For Axel Dumas Compare With Other Companies In The Industry?

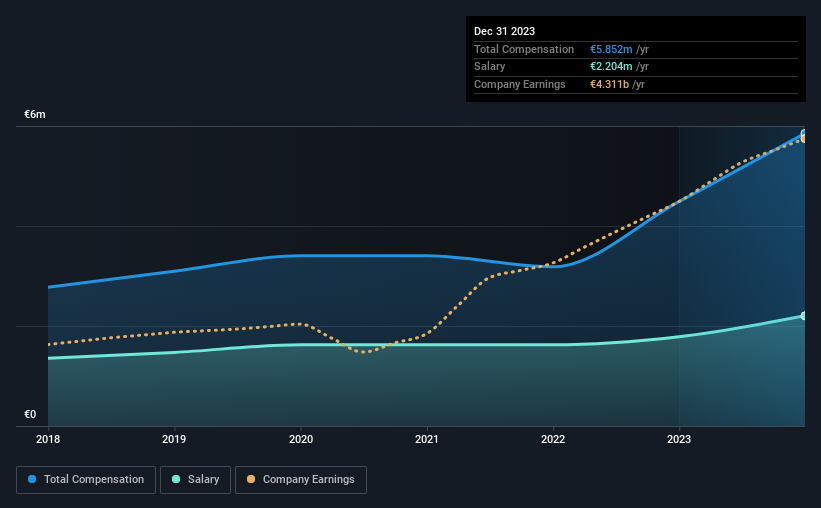

At the time of writing, our data shows that Hermès International Société en commandite par actions has a market capitalization of €247b, and reported total annual CEO compensation of €5.9m for the year to December 2023. We note that's an increase of 30% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €2.2m.

In comparison with other companies in the France Luxury industry with market capitalizations over €7.5b, the reported median total CEO compensation was €7.2m. From this we gather that Axel Dumas is paid around the median for CEOs in the industry. What's more, Axel Dumas holds €27m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €2.2m | €1.8m | 38% |

| Other | €3.6m | €2.7m | 62% |

| Total Compensation | €5.9m | €4.5m | 100% |

Talking in terms of the industry, salary represented approximately 25% of total compensation out of all the companies we analyzed, while other remuneration made up 75% of the pie. It's interesting to note that Hermès International Société en commandite par actions pays out a greater portion of remuneration through salary, compared to the industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Hermès International Société en commandite par actions' Growth Numbers

Over the past three years, Hermès International Société en commandite par actions has seen its earnings per share (EPS) grow by 46% per year. In the last year, its revenue is up 16%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Hermès International Société en commandite par actions Been A Good Investment?

Boasting a total shareholder return of 128% over three years, Hermès International Société en commandite par actions has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

So you may want to check if insiders are buying Hermès International Société en commandite par actions shares with their own money (free access).

Important note: Hermès International Société en commandite par actions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives