Unpleasant Surprises Could Be In Store For Hermès International Société en commandite par actions' (EPA:RMS) Shares

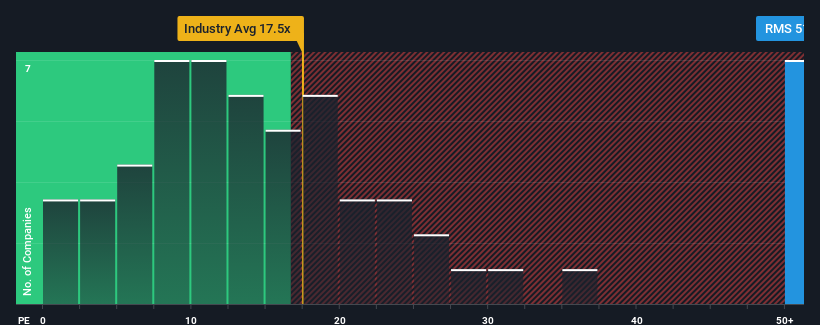

With a price-to-earnings (or "P/E") ratio of 51.3x Hermès International Société en commandite par actions (EPA:RMS) may be sending very bearish signals at the moment, given that almost half of all companies in France have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Hermès International Société en commandite par actions as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hermès International Société en commandite par actions

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hermès International Société en commandite par actions' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. Pleasingly, EPS has also lifted 210% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% per year, which is noticeably more attractive.

With this information, we find it concerning that Hermès International Société en commandite par actions is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Hermès International Société en commandite par actions' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hermès International Société en commandite par actions currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hermès International Société en commandite par actions with six simple checks.

If these risks are making you reconsider your opinion on Hermès International Société en commandite par actions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with proven track record.