- France

- /

- Consumer Durables

- /

- ENXTPA:NACON

The one-year underlying earnings growth at Nacon (EPA:NACON) is promising, but the shareholders are still in the red over that time

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of Nacon S.A. (EPA:NACON) have suffered share price declines over the last year. The share price has slid 55% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 41% in the last three years. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

If the past week is anything to go by, investor sentiment for Nacon isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Nacon

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Nacon share price fell, it actually saw its earnings per share (EPS) improve by 16%. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

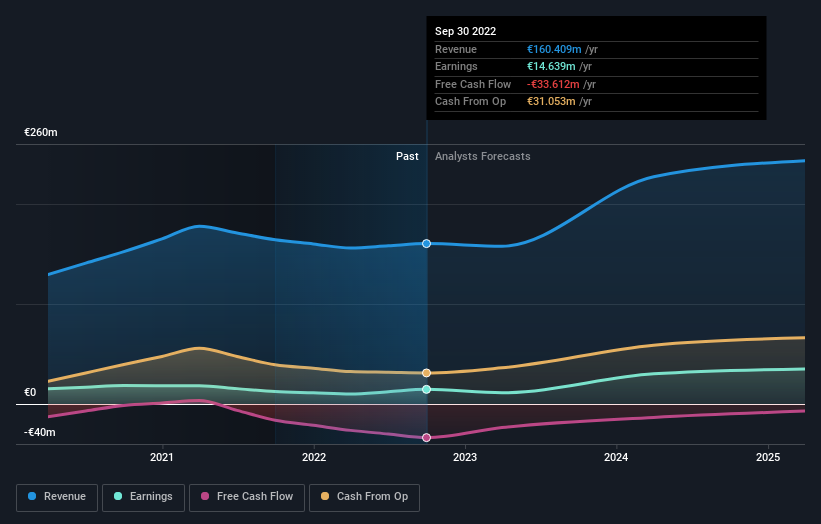

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Nacon has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Nacon stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Over the last year, Nacon shareholders took a loss of 55%. In contrast the market gained about 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 12% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before deciding if you like the current share price, check how Nacon scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nacon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NACON

Nacon

Designs and distributes games and gaming accessories in France and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives