Will Analyst Optimism Push Kering (ENXTPA:KER) Toward a New Chapter in Operational Resilience?

Reviewed by Sasha Jovanovic

- In the past week, Kering received positive attention from major investment banks, as Morgan Stanley upgraded its outlook and HSBC maintained a bullish rating following optimistic sales forecasts for the upcoming quarter.

- This increased analyst confidence highlights a potential shift in market sentiment toward Kering, as investors appear more willing to look past current valuations given expectations for improved operational performance.

- We'll explore how recent analyst optimism about Kering's near-term sales and risk/reward profile could influence the company’s investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kering Investment Narrative Recap

To be a shareholder in Kering today, you need to believe in the group's ability to revive consumer demand at its core brands, particularly Gucci, while successfully executing cost and operational improvements to drive margin recovery. The recent upgrades from Morgan Stanley and continued optimism from HSBC may boost near-term sentiment, but they do not materially change the central short-term catalyst: evidence of a sales rebound at key brands. Persistent revenue declines and uncertain macro conditions remain the biggest risks for now.

Among recent events, the September 2025 appointment of Francesca Bellettini as President and CEO of Gucci stands out as closely tied to these catalysts. This leadership change is intended to support Kering's turnaround efforts at its flagship brand as the group works to stabilize sales and restore confidence among investors and analysts.

However, even with renewed analyst optimism, investors should remain alert to the risk of ongoing weak demand in China and key luxury markets, as...

Read the full narrative on Kering (it's free!)

Kering's narrative projects €17.5 billion revenue and €1.4 billion earnings by 2028. This requires 3.5% yearly revenue growth and a €671 million earnings increase from €729 million currently.

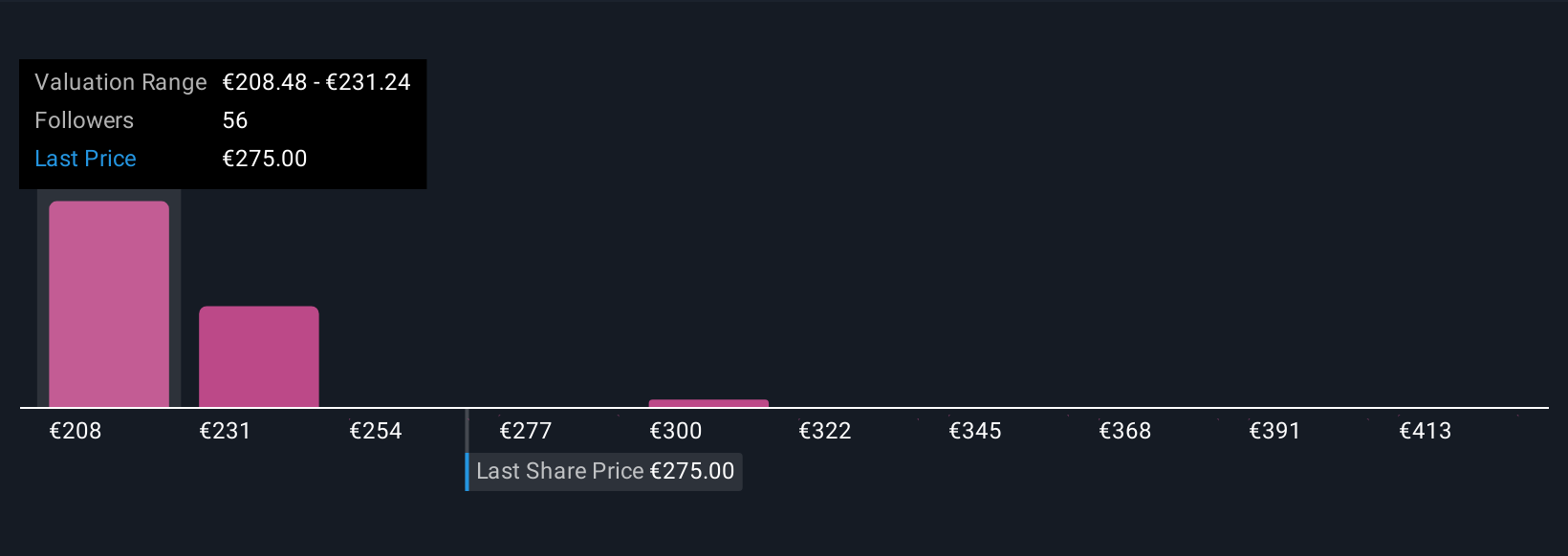

Uncover how Kering's forecasts yield a €225.74 fair value, a 28% downside to its current price.

Exploring Other Perspectives

You can find nine fair value estimates from the Simply Wall St Community, ranging from €225.74 to €436.12 per share. With the risk of persistent brand fatigue and declining demand still in focus, these varying perspectives show how market performance could shift in response to evolving company fundamentals.

Explore 9 other fair value estimates on Kering - why the stock might be worth 28% less than the current price!

Build Your Own Kering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kering research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kering's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives