This Is Why Kering SA's (EPA:KER) CEO Compensation Looks Appropriate

Key Insights

- Kering will host its Annual General Meeting on 25th of April

- CEO François-Henri Pinault's total compensation includes salary of €1.20m

- The total compensation is 34% less than the average for the industry

- Over the past three years, Kering's EPS grew by 12% and over the past three years, the total loss to shareholders 44%

The performance at Kering SA (EPA:KER) has been rather lacklustre of late and shareholders may be wondering what CEO François-Henri Pinault is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 25th of April. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Kering

Comparing Kering SA's CEO Compensation With The Industry

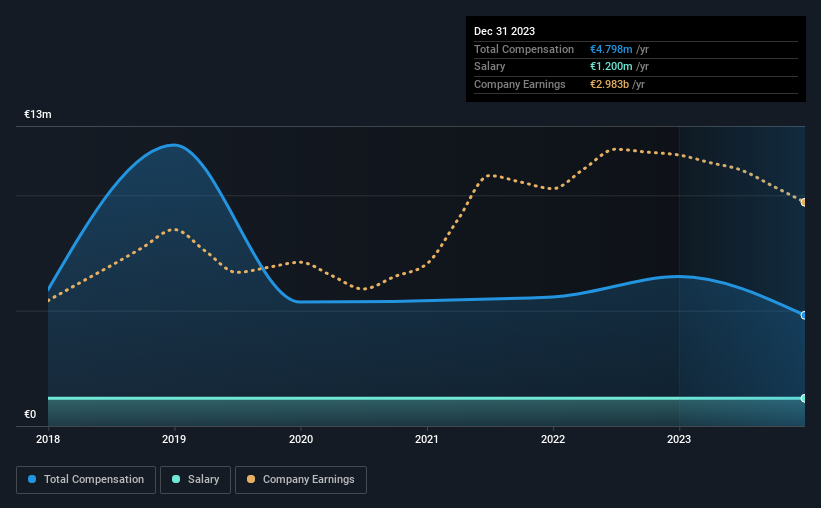

At the time of writing, our data shows that Kering SA has a market capitalization of €42b, and reported total annual CEO compensation of €4.8m for the year to December 2023. Notably, that's a decrease of 26% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €1.2m.

On comparing similar companies in the France Luxury industry with market capitalizations above €7.5b, we found that the median total CEO compensation was €7.2m. That is to say, François-Henri Pinault is paid under the industry median. Moreover, François-Henri Pinault also holds €170k worth of Kering stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.2m | €1.2m | 25% |

| Other | €3.6m | €5.3m | 75% |

| Total Compensation | €4.8m | €6.5m | 100% |

Speaking on an industry level, nearly 25% of total compensation represents salary, while the remainder of 75% is other remuneration. Kering is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Kering SA's Growth Numbers

Kering SA has seen its earnings per share (EPS) increase by 12% a year over the past three years. In the last year, its revenue is down 3.9%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Kering SA Been A Good Investment?

The return of -44% over three years would not have pleased Kering SA shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss is certainly disheartening. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Kering that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives