S.T. Dupont (EPA:DPT investor five-year losses grow to 55% as the stock sheds €6.6m this past week

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example the S.T. Dupont S.A. (EPA:DPT) share price dropped 56% over five years. That is extremely sub-optimal, to say the least. And it's not just long term holders hurting, because the stock is down 55% in the last year. Shareholders have had an even rougher run lately, with the share price down 32% in the last 90 days.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for S.T. Dupont

S.T. Dupont isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years S.T. Dupont saw its revenue shrink by 4.1% per year. That's not what investors generally want to see. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

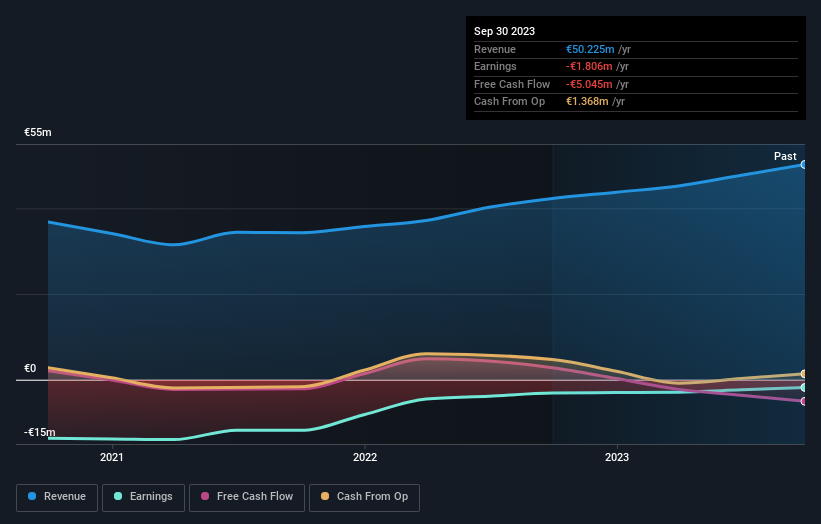

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 13% in the last year, S.T. Dupont shareholders lost 54%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand S.T. Dupont better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for S.T. Dupont you should be aware of, and 3 of them are a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:DPT

S.T. Dupont

Designs, manufactures, and sells luxury products in France and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026