As the European Central Bank's recent interest rate cut aims to bolster economic growth amid slowing inflation, France's CAC 40 Index has seen a notable uptick of 1.54%. In this environment, dividend stocks can offer a compelling investment opportunity by providing steady income streams and potential capital appreciation. When evaluating dividend stocks in such market conditions, it's essential to consider companies with strong financial health and consistent dividend payout histories.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.08% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.38% | ★★★★★★ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.72% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.38% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.94% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.65% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.92% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.97% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 5.06% | ★★★★☆☆ |

| Rexel (ENXTPA:RXL) | 4.60% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. produces and sells food packaging products in France and internationally, with a market cap of €553.67 million.

Operations: Groupe Guillin S.A. generates revenue primarily from its Packaging Sector (€837.39 million) and Material Sector (€48.24 million).

Dividend Yield: 3.7%

Groupe Guillin's dividend payments have increased over the past decade, supported by a low payout ratio of 27% and a cash payout ratio of 18.5%, indicating strong coverage by both earnings and cash flows. However, its dividend yield of 3.67% is below the top quartile in France (5.56%). Despite trading at 65.1% below its estimated fair value and showing significant earnings growth (47.9% last year), its dividend track record has been volatile over the past ten years.

- Take a closer look at Groupe Guillin's potential here in our dividend report.

- Upon reviewing our latest valuation report, Groupe Guillin's share price might be too pessimistic.

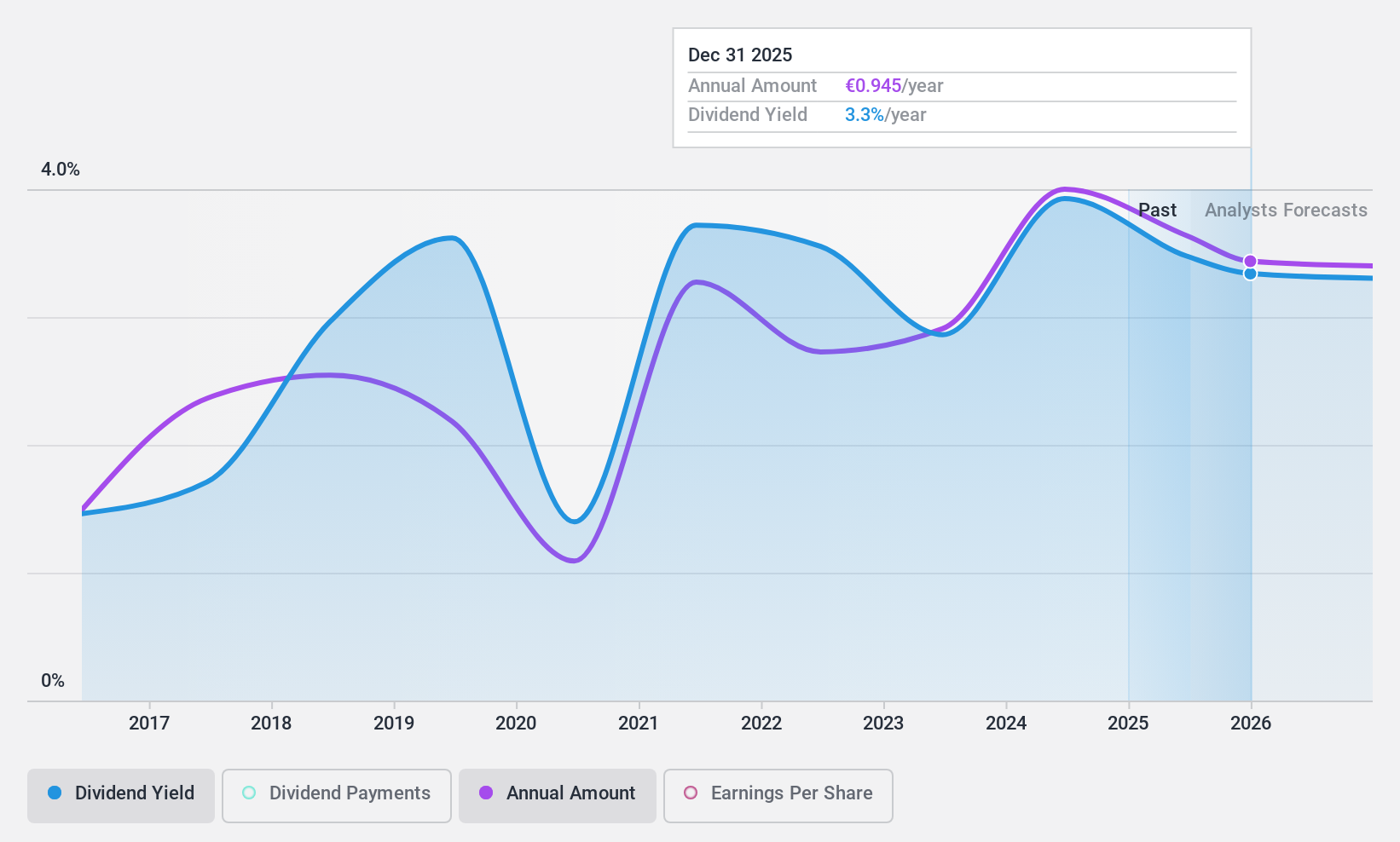

Bénéteau (ENXTPA:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes in France and internationally, with a market cap of €661.25 million.

Operations: Bénéteau S.A.'s revenue primarily comes from its boat segment, which generated €1.47 billion.

Dividend Yield: 8.9%

Bénéteau's dividend yield of 8.94% ranks in the top 25% of French dividend payers, but its sustainability is questionable due to a lack of free cash flows and volatile payments over the past decade. Although earnings grew by 84.1% last year and the payout ratio is low at 37.2%, analysts forecast a significant decline in earnings over the next three years, raising concerns about future dividend reliability.

- Dive into the specifics of Bénéteau here with our thorough dividend report.

- Our valuation report here indicates Bénéteau may be undervalued.

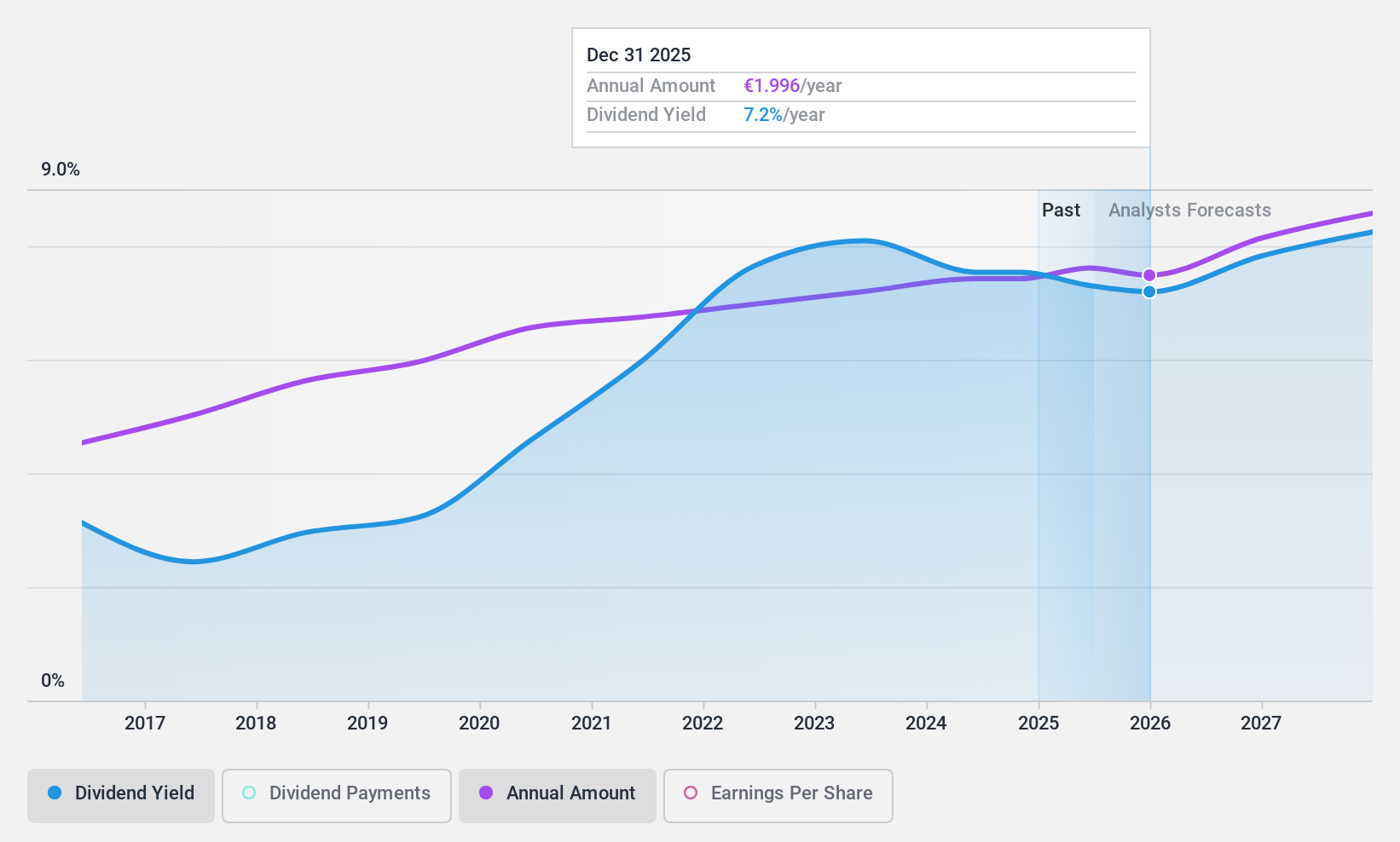

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market cap of €2.46 billion.

Operations: Rubis generates revenue primarily from energy distribution (€6.60 billion) and renewable electricity production (€48.02 million).

Dividend Yield: 8.4%

Rubis offers a high dividend yield of 8.38%, placing it in the top 25% of French dividend payers, with stable and growing payments over the past decade. Its dividends are well-covered by both earnings (65.4% payout ratio) and free cash flows (58.5% cash payout ratio). Despite trading at a good value with a low Price-To-Earnings ratio of 7.9x, recent earnings reports show a decline in net income to €129.5 million from €170.62 million last year, which may raise concerns about future profitability amidst its high debt levels.

- Navigate through the intricacies of Rubis with our comprehensive dividend report here.

- The analysis detailed in our Rubis valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Unlock our comprehensive list of 35 Top Euronext Paris Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bénéteau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BEN

Bénéteau

Designs, manufactures, and sells boats and leisure homes in France and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives