- France

- /

- Professional Services

- /

- ENXTPA:TEP

Teleperformance (ENXTPA:TEP): Exploring Valuation as Shares Remain Unsteady Without Major News

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 43% Undervalued

The current most popular narrative sees Teleperformance as significantly undervalued, with estimates putting fair value well above today’s trading price.

The accelerating adoption of AI and digitization is expected to increase enterprise demand for outsourced, omnichannel customer experience solutions. Teleperformance has demonstrated strong momentum in EMEA/APAC core services (nearly 6% growth in Q2), suggesting it is well positioned to capture wallet-share as clients seek scalable, tech-enabled engagement. This is likely to support future revenue growth.

Want to know what bold financial assumptions power this valuation? The narrative hints at future profit margins and a growth pace that could surprise skeptics. Think significant upgrades in revenue and bottom-line performance, justified by the company’s transformation plans. The underlying driver behind the analysts’ optimism might reveal the next chapter for Teleperformance’s share price.

Result: Fair Value of €114.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent contract losses or renewed weakness in U.S. demand could cloud the outlook and pose challenges to the bullish case for a rebound.

Find out about the key risks to this Teleperformance narrative.Another View: Discounted Cash Flow Perspective

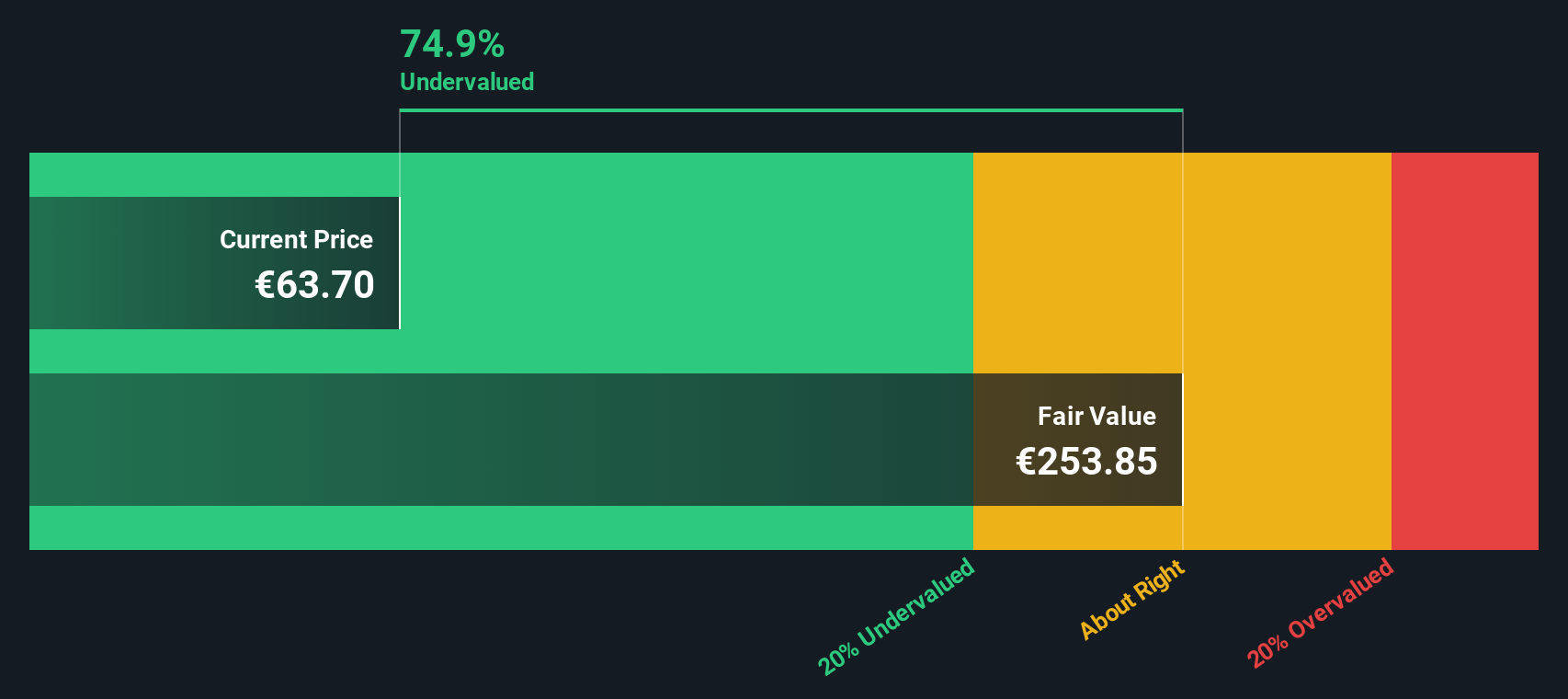

Looking at Teleperformance through our DCF model provides a different perspective. This method also points to the stock being undervalued, but DCF relies on different assumptions about cash flows and risk. Does this approach challenge or confirm your own view on where value really lies?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teleperformance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teleperformance Narrative

If you see the story differently, or want to dig into your own questions, you can craft a custom narrative for Teleperformance in just a few minutes. Do it your way

A great starting point for your Teleperformance research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself the edge this year and unlock fresh opportunities with a few smart moves. Your next winning stock could already be in view. Don’t let others get there first; take the lead today.

- Tap into high-yield stability by browsing outstanding choices for dividend stocks with yields > 3% in markets where steady returns matter most.

- Seize tomorrow’s tech leaders by checking out the innovators behind AI penny stocks as artificial intelligence transforms industries worldwide.

- Jump ahead of the crowd with undervalued gems identified in our expert-curated undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleperformance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TEP

Teleperformance

Operates as a digital business services company in France and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives