Synergie SE (EPA:SDG), might not be a large cap stock, but it led the ENXTPA gainers with a relatively large price hike in the past couple of weeks. Less-covered, small caps sees more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s examine Synergie’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

View our latest analysis for Synergie

What is Synergie worth?

The stock seems fairly valued at the moment according to my valuation model. It’s trading around 11% below my intrinsic value, which means if you buy Synergie today, you’d be paying a fair price for it. And if you believe the company’s true value is €34.12, then there’s not much of an upside to gain from mispricing. Is there another opportunity to buy low in the future? Since Synergie’s share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of Synergie look like?

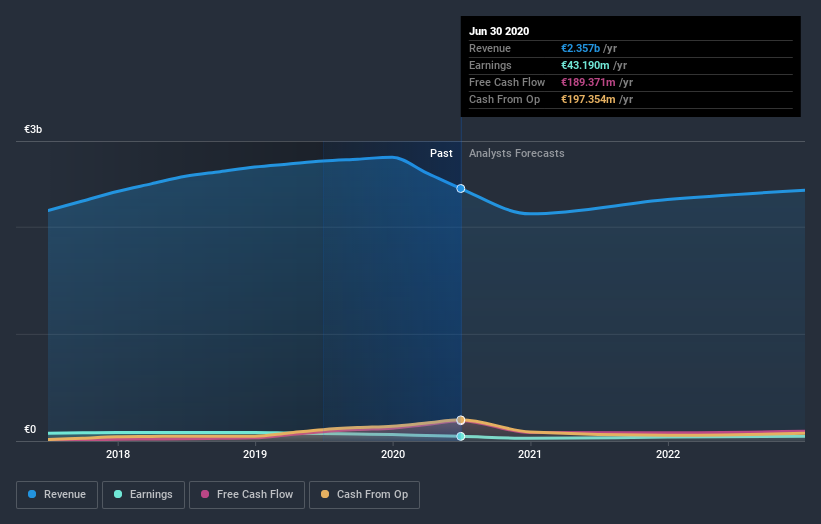

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a negative profit growth of -8.1% expected over the next couple of years, near-term growth certainly doesn’t appear to be a driver for a buy decision for Synergie. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? SDG seems fairly priced right now, but given the uncertainty from negative returns in the future, this could be the right time to de-risk your portfolio. Is your current exposure to the stock optimal for your total portfolio? And is the opportunity cost of holding a negative-outlook stock too high? Before you make a decision on the stock, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping tabs on SDG for a while, now may not be the most optimal time to buy, given it is trading around its fair value. The price seems to be trading at fair value, which means there’s less benefit from mispricing. In addition to this, the negative growth outlook increases the risk of holding the stock. However, there are also other important factors we haven’t considered today, which can help gel your views on SDG should the price fluctuate below its true value.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. At Simply Wall St, we found 2 warning signs for Synergie and we think they deserve your attention.

If you are no longer interested in Synergie, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade Synergie, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Synergie, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:SDG

Synergie

Provides human resources management and development services for companies and institutions in France, Belgium, Other Northern and Eastern Europe, Italy, Spain, Portugal, Canada, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives