- France

- /

- Trade Distributors

- /

- ENXTPA:JCQ

Exploring Top Dividend Stocks In France For May 2024

Reviewed by Kshitija Bhandaru

As the Eurozone emerges from a recession with a positive economic outlook and moderated inflation expectations, investors are increasingly attentive to opportunities that offer stability and potential income. In this context, dividend stocks in France represent an appealing option for those looking to balance yield with exposure to the recovering European market.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Samse (ENXTPA:SAMS) | 8.89% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.34% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.49% | ★★★★★★ |

| Métropole Télévision (ENXTPA:MMT) | 9.37% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.90% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 3.53% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 5.30% | ★★★★★☆ |

| Jacquet Metals (ENXTPA:JCQ) | 5.17% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.35% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products, with a market capitalization of approximately €2.77 billion.

Operations: Société BIC SA generates revenue primarily through three segments: Blade Excellence - Razors at €544.80 million, Flame for Life - Lighters at €830.60 million, and Human Expression - Stationery at €842.30 million.

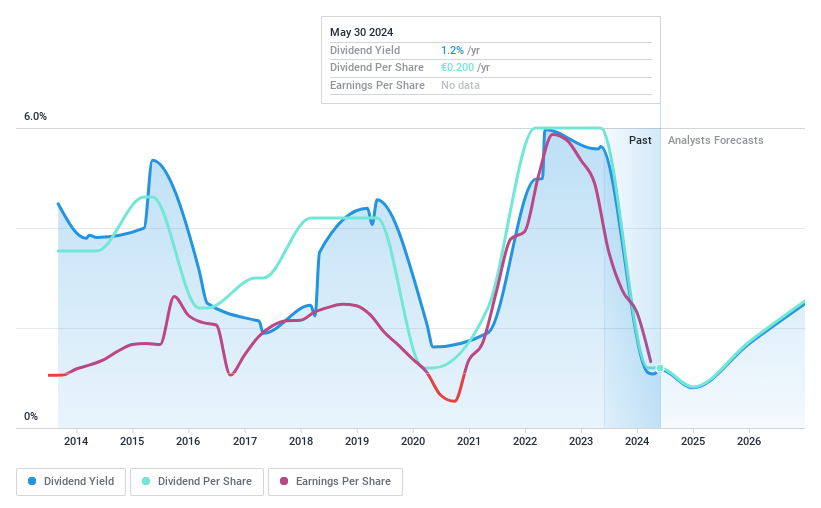

Dividend Yield: 4.3%

Société BIC has demonstrated a mixed performance in terms of dividend reliability, with volatile payments over the past decade despite a 10-year increase. The current yield stands at 4.27%, below the top tier of French dividend stocks. Financially, BIC is trading significantly under its estimated fair value and maintains healthy coverage ratios with earnings and cash flows supporting its dividends at 57.5% and 47.7% respectively. Recent share buybacks totaling €94.25 million underscore a commitment to shareholder returns, alongside robust annual earnings growth projections of about 10%.

- Delve into the full analysis dividend report here for a deeper understanding of Société BIC.

- The analysis detailed in our Société BIC valuation report hints at an deflated share price compared to its estimated value.

Carrefour (ENXTPA:CA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse range of food and non-food retail stores across multiple formats and channels in Europe, Latin America, and parts of the Middle East, Africa, and Asia, with a market cap of approximately €11.36 billion.

Operations: Carrefour SA generates revenue primarily from its operations in France (€39.02 billion), Europe excluding France (€24.27 billion), and Latin America (€22.54 billion).

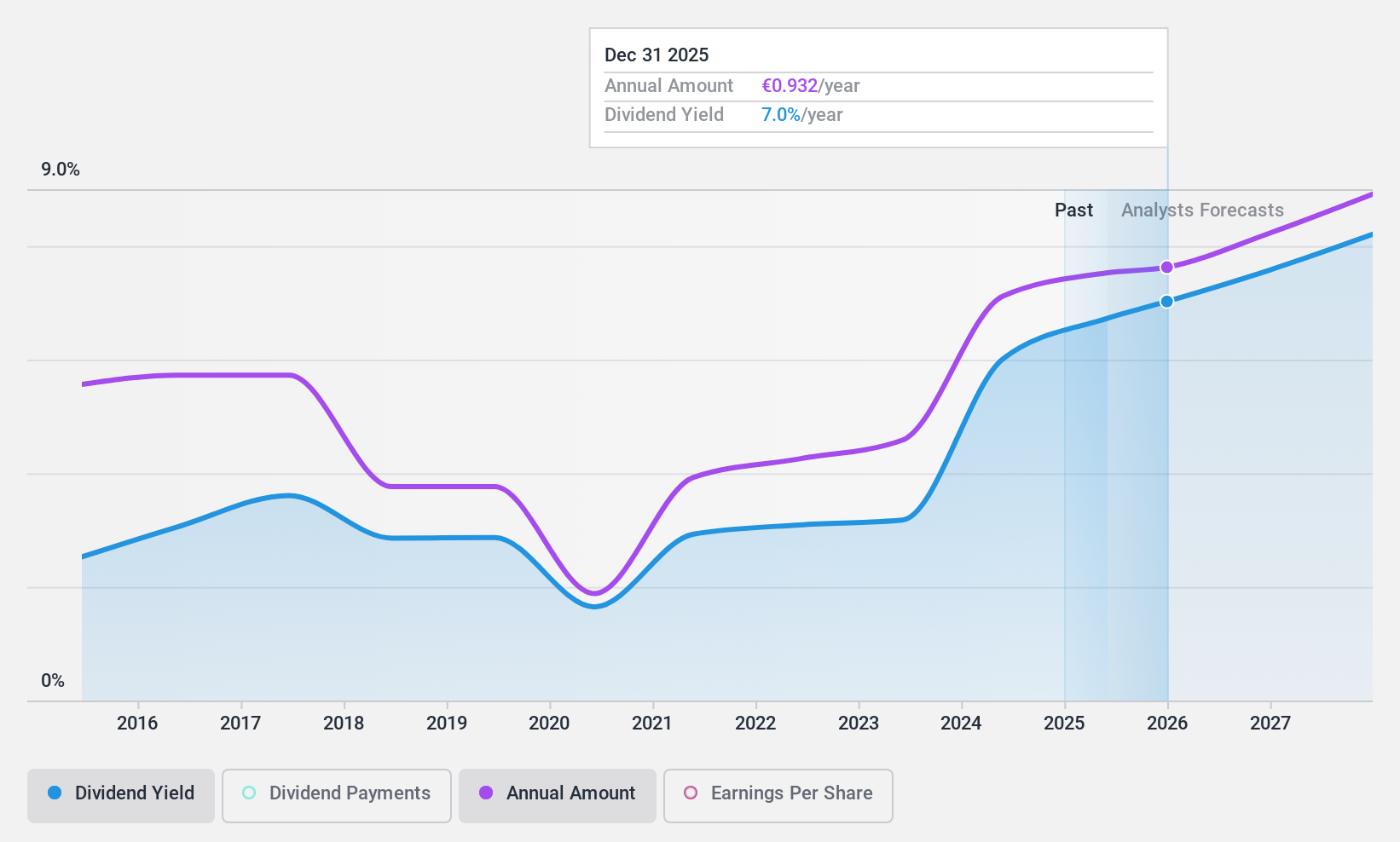

Dividend Yield: 5.3%

Carrefour SA maintains a dividend yield of 5.3%, ranking in the top 25% of French dividend payers, supported by a cash payout ratio of 21.5% and earnings payout ratio of 66.8%. Despite this, dividends have shown volatility and inconsistency over the past decade, reflecting an unstable dividend track record. Recently, Carrefour reported increased year-over-year sales and net income for 2023 and has actively engaged in share buybacks, repurchasing €800 million worth under its latest program.

- Take a closer look at Carrefour's potential here in our dividend report.

- Our valuation report here indicates Carrefour may be undervalued.

Jacquet Metals (ENXTPA:JCQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jacquet Metals SA, with a market cap of approximately €427.44 million, operates in the buying and trading of special metals across Germany, France, North America, Spain, Italy, the Netherlands, and other international markets.

Operations: Jacquet Metals SA generates revenue primarily through three segments: JACQUET, which contributes €521 million, IMS Group - Engineering Steels at €1.11 billion, and STAPPERT - Stainless Steel Long Products with €621 million.

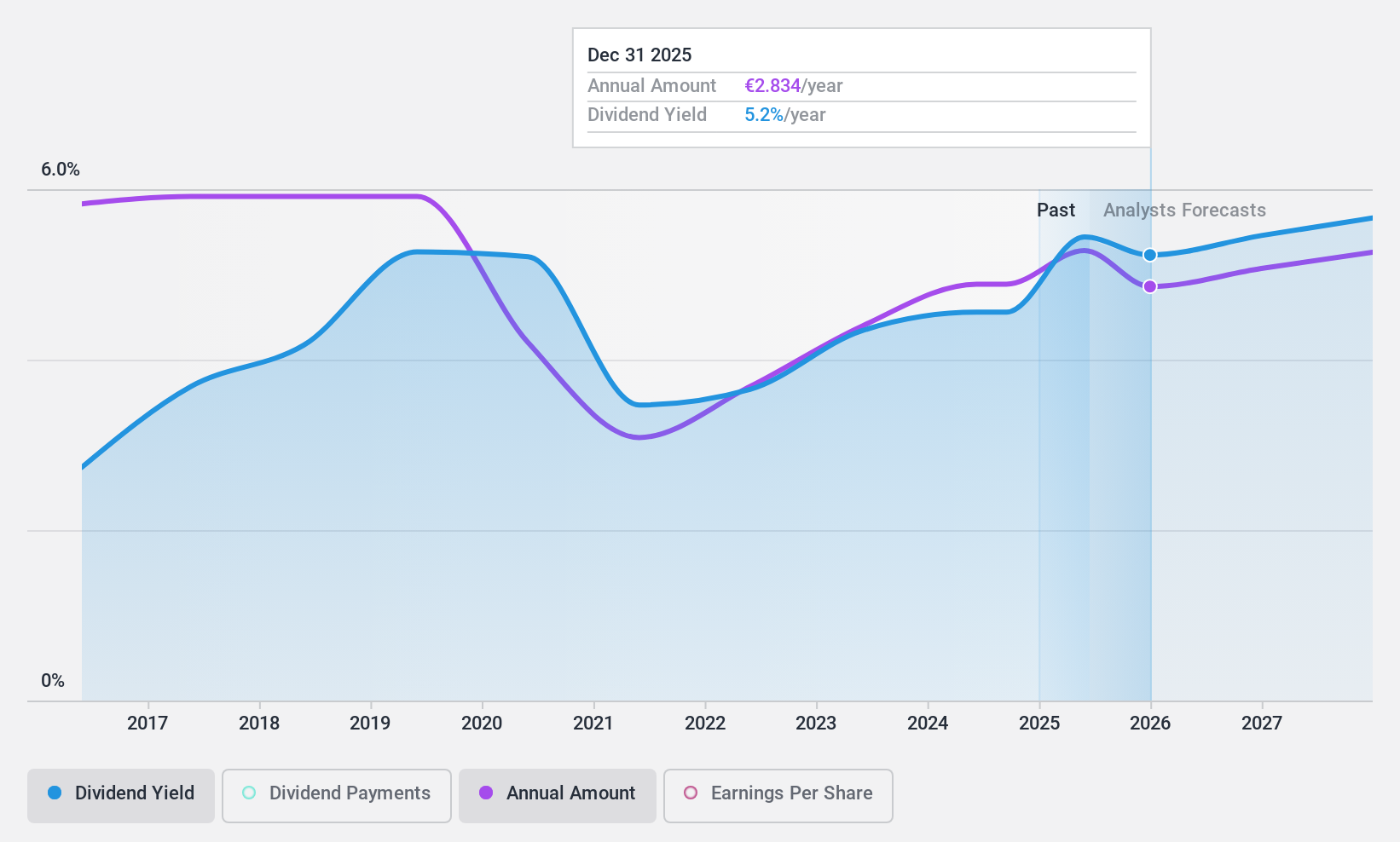

Dividend Yield: 5.2%

Jacquet Metals offers a dividend yield of 5.17%, placing it among the top 25% of French dividend stocks. Its dividends are well-supported by both earnings and cash flows, with payout ratios at 33.1% and 12.7%, respectively, indicating sustainability despite its historically volatile dividend payments. However, the company's profit margins declined to 2.3% from last year's 6.7%, and earnings are expected to decrease by an average of 1.5% annually over the next three years, posing potential challenges ahead.

- Click here to discover the nuances of Jacquet Metals with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Jacquet Metals' share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 30 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:JCQ

Jacquet Metals

Engages in the buying and trading of special metals in Germany, France, North America, Spain, Italy, the Netherlands, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives