- France

- /

- Professional Services

- /

- ENXTPA:ASY

Update: Assystem (EPA:ASY) Stock Gained 44% In The Last Five Years

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, long term Assystem S.A. (EPA:ASY) shareholders have enjoyed a 44% share price rise over the last half decade, well in excess of the market return of around 27% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 22%, including dividends.

See our latest analysis for Assystem

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Assystem actually saw its EPS drop 2.2% per year. So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

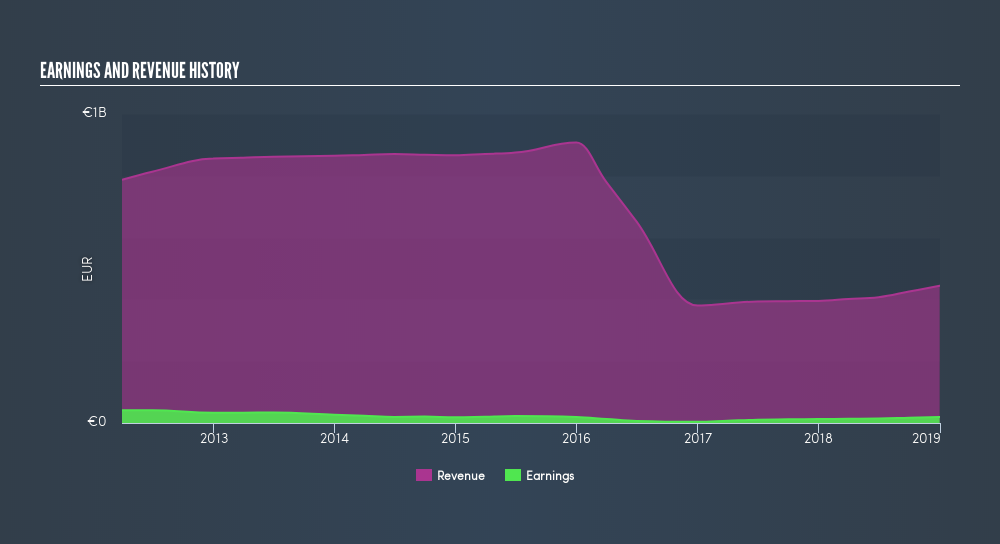

The revenue reduction of 20% per year is not a positive. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Assystem has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Assystem stock, you should check out this freereport showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Assystem, it has a TSR of 70% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Assystem has rewarded shareholders with a total shareholder return of 22% in the last twelve months. That's including the dividend. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Keeping this in mind, a solid next step might be to take a look at Assystem's dividend track record. This freeinteractive graph is a great place to start.

Of course Assystem may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ASY

Assystem

Provides engineering and infrastructure project management services in France, the United Kingdom, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives