- France

- /

- Professional Services

- /

- ENXTPA:ASY

Undiscovered Gems on None for December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have faced notable challenges, reflecting broader investor sentiment. Despite these hurdles, the U.S. economy's robust growth and positive jobs data offer a backdrop of resilience that could favor certain undiscovered stocks with strong fundamentals and growth potential. In this environment, identifying promising small-cap stocks requires careful consideration of companies that demonstrate solid financial health, innovative strategies, and the ability to adapt to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Assystem (ENXTPA:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Assystem S.A. offers engineering and infrastructure project management services globally, with a market capitalization of €601.96 million.

Operations: Assystem S.A. generates its revenue primarily through engineering and infrastructure project management services worldwide, contributing to a market capitalization of €601.96 million.

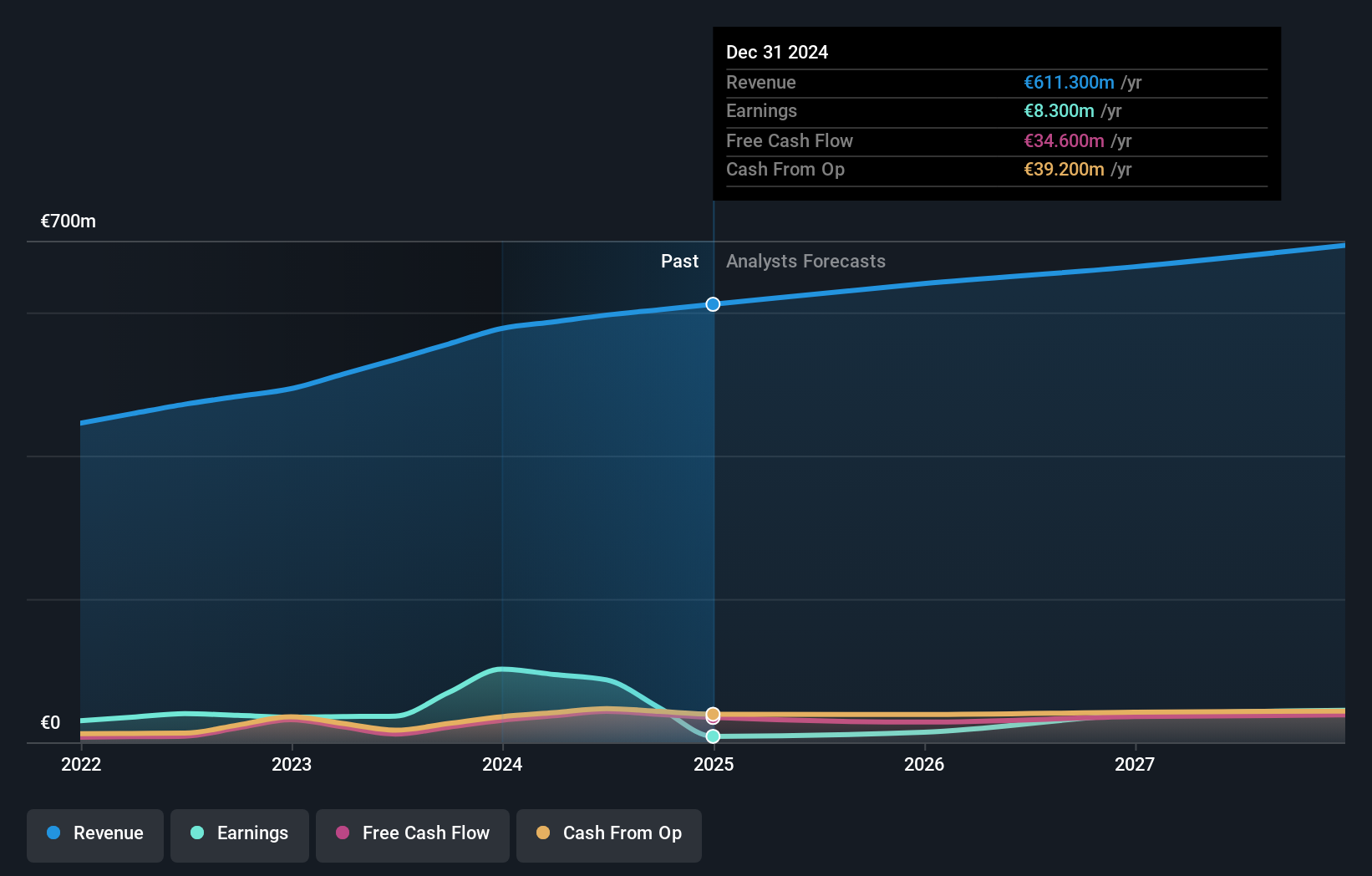

Assystem, a nimble player in the professional services sector, has seen its earnings grow by 137.7% over the past year, outpacing industry averages. Despite this impressive growth, the company faces challenges with a forecasted average earnings decline of 32.2% annually over the next three years due to budget constraints affecting nuclear projects in France and the UK. Its debt-to-equity ratio improved from 22.8% to 20.4% over five years, indicating prudent financial management. Recently announced share repurchase plans aim to enhance liquidity and support employee incentive schemes amid volatile market conditions and revised revenue targets for 2024 at €610 million down from €620 million previously projected.

- Click here and access our complete health analysis report to understand the dynamics of Assystem.

Assess Assystem's past performance with our detailed historical performance reports.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme focuses on supplying electricity and natural gas to individuals, businesses, and local authorities in France, with a market capitalization of approximately €813.73 million.

Operations: Électricite de Strasbourg generates revenue primarily from electricity distribution (€302.94 million) and the production and distribution of electricity and gas (€1.24 billion). The company's operations are centered in France, targeting individuals, businesses, and local authorities.

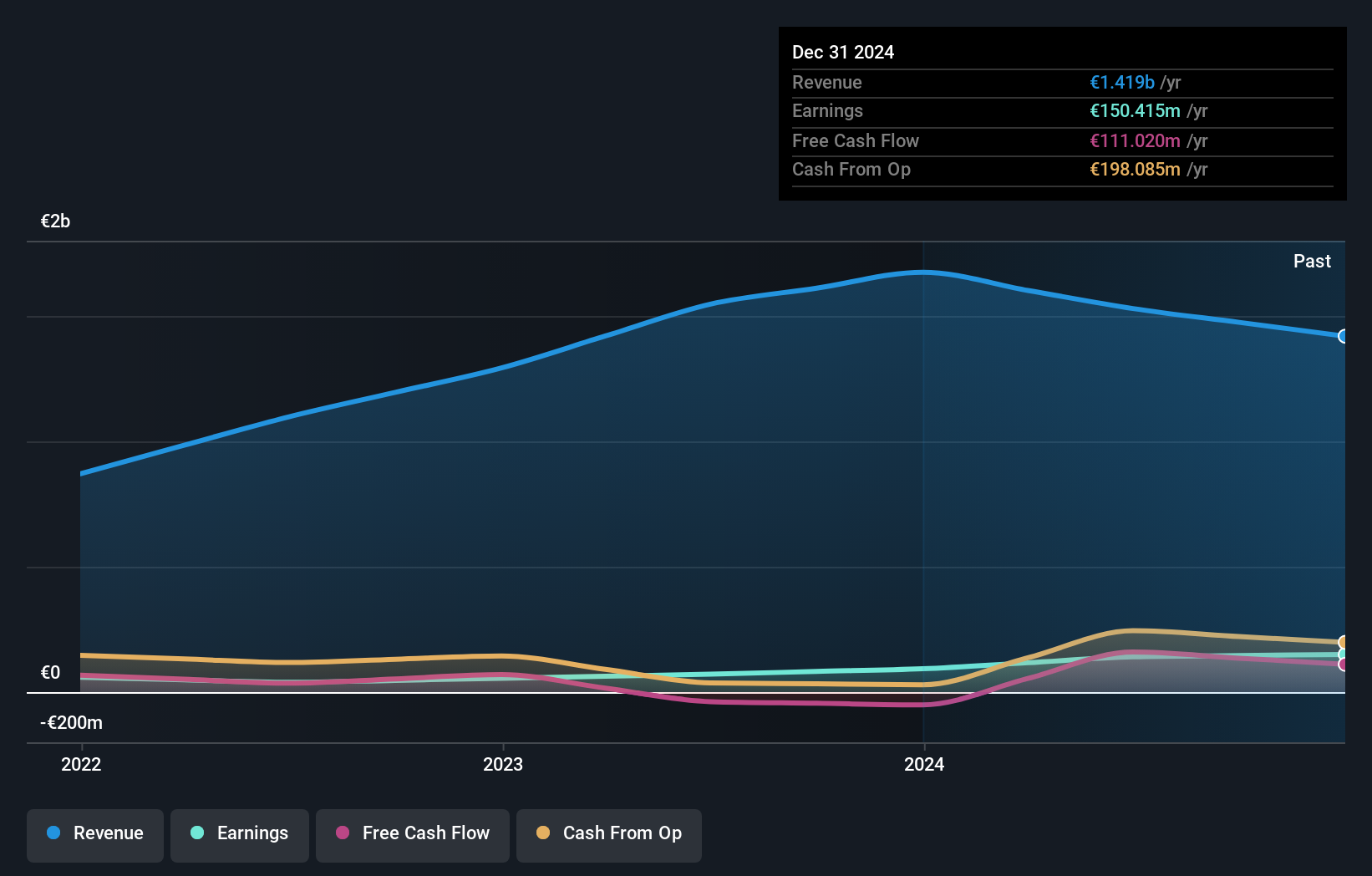

Électricite de Strasbourg, a relatively small player in the energy sector, has demonstrated impressive earnings growth of 97% over the past year, significantly outpacing the Electric Utilities industry's negative 11%. The company appears to have high-quality earnings and is trading at a notable discount of 93% below its estimated fair value. Over five years, its debt-to-equity ratio improved from 3.1 to 2.9, suggesting prudent financial management. With more cash than total debt and positive free cash flow, Électricite de Strasbourg seems well-positioned financially while maintaining interest coverage comfortably above obligations.

Monex Group (TSE:8698)

Simply Wall St Value Rating: ★★★★★☆

Overview: Monex Group, Inc. is an online financial institution offering retail online brokerage services in Japan, the United States, China, and Australia with a market capitalization of ¥250.02 billion.

Operations: Monex Group generates revenue primarily from its operations in the United States, contributing ¥50.17 billion, followed by Japan at ¥10.81 billion and the Crypto-Asset Business at ¥11.83 billion. The Investment Segment shows a negative contribution of ¥34 million, while segment adjustments add ¥1.37 billion to the total revenue mix.

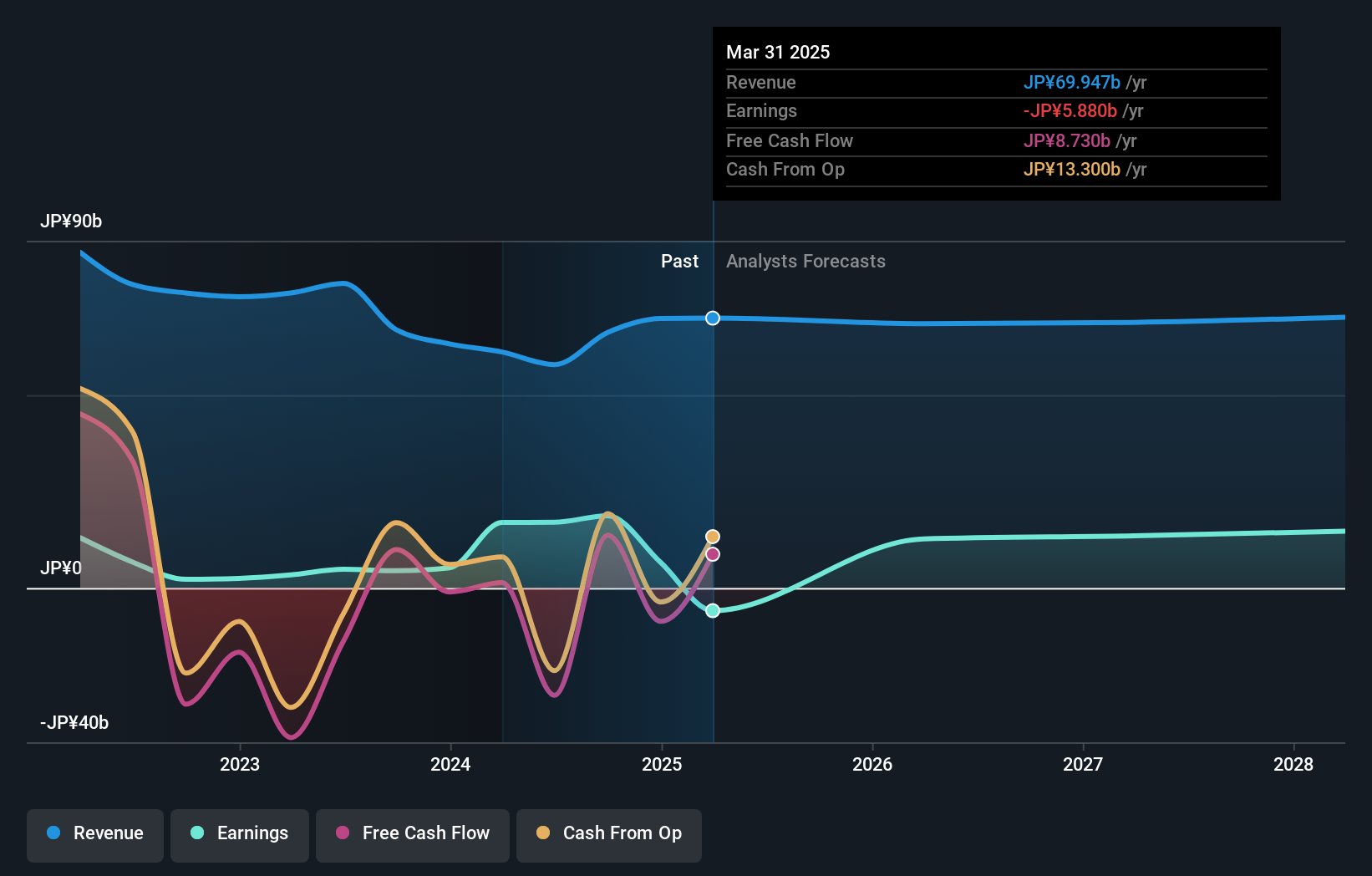

Monex Group, a dynamic player in the financial sector, has seen its earnings skyrocket by 319.6% over the past year, significantly outpacing the Capital Markets industry's 27.6%. This growth coincides with a strategic reduction in debt levels, as evidenced by its debt-to-equity ratio dropping from 361.6% to 58.7% over five years. The company recently launched Monex Web3 ID, an innovative digital ID on blockchain aimed at enhancing asset management capabilities for individuals unfamiliar with web3 technology. Additionally, Monex's Price-To-Earnings ratio of 13x suggests it offers good value compared to the broader JP market average of 13x.

- Dive into the specifics of Monex Group here with our thorough health report.

Examine Monex Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Access the full spectrum of 4627 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ASY

Assystem

Provides engineering and infrastructure project management services in France, the United Kingdom, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)