- France

- /

- Professional Services

- /

- ENXTPA:ASY

3 European Stocks Estimated To Be Trading Up To 48.2% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, European markets have shown resilience, with major indices such as Germany’s DAX and the UK’s FTSE 100 posting gains amid a backdrop of steady inflation and surprising retail growth in the UK. As business activity in the Eurozone hits a high not seen since May 2024, investors may find opportunities in stocks that are trading below their intrinsic value, offering potential for long-term appreciation despite current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK29.02 | SEK57.18 | 49.2% |

| Robit Oyj (HLSE:ROBIT) | €1.10 | €2.18 | 49.5% |

| Pandora (CPSE:PNDORA) | DKK879.40 | DKK1752.74 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.90 | SEK23.59 | 49.5% |

| Mo-BRUK (WSE:MBR) | PLN294.00 | PLN585.04 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.02 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.362 | €0.71 | 48.8% |

| Bonesupport Holding (OM:BONEX) | SEK224.80 | SEK443.21 | 49.3% |

| Axfood (OM:AXFO) | SEK260.50 | SEK509.15 | 48.8% |

| Aquafil (BIT:ECNL) | €1.94 | €3.85 | 49.5% |

Let's dive into some prime choices out of the screener.

Talgo (BME:TLGO)

Overview: Talgo, S.A. specializes in the design, manufacture, and maintenance of railway and auxiliary machinery for railway systems worldwide, with a market cap of €325.69 million.

Operations: The company's revenue segments consist of €532.19 million from Rolling Stock and €60.97 million from Auxiliary Machines and Others.

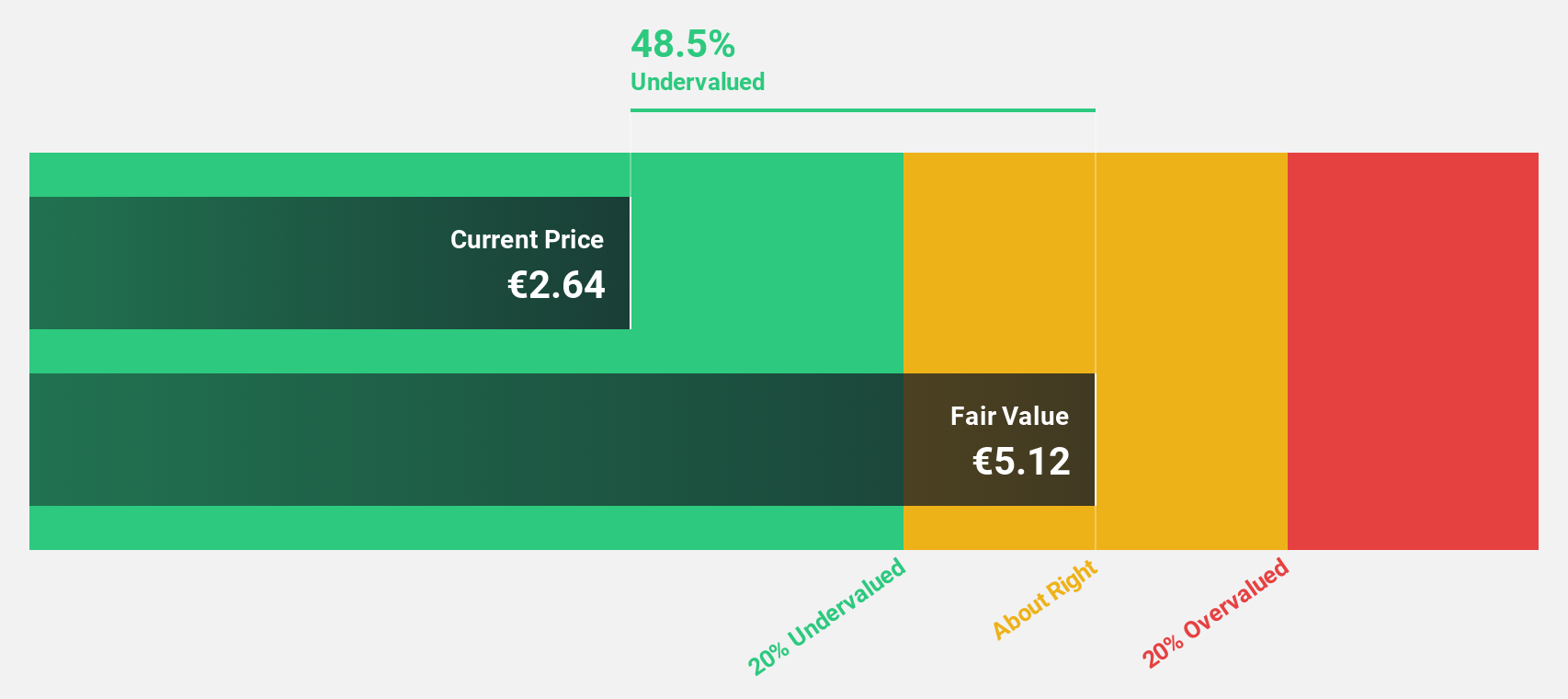

Estimated Discount To Fair Value: 48.2%

Talgo, S.A. is trading at €2.65, significantly below its estimated fair value of €5.12, suggesting potential undervaluation based on discounted cash flow analysis. Despite a recent net loss of €64.04 million for H1 2025 and revenue decline to €270.09 million, analysts expect Talgo's earnings to grow annually by over 100%, with profitability anticipated within three years. However, the company's debt coverage by operating cash flow remains a concern amid these growth forecasts.

- Our earnings growth report unveils the potential for significant increases in Talgo's future results.

- Navigate through the intricacies of Talgo with our comprehensive financial health report here.

Assystem (ENXTPA:ASY)

Overview: Assystem S.A. offers engineering and infrastructure project management services in France, the United Kingdom, and internationally, with a market cap of €642.34 million.

Operations: The company's revenue is primarily generated from its operations in France (€388.20 million) and international markets (€254.10 million).

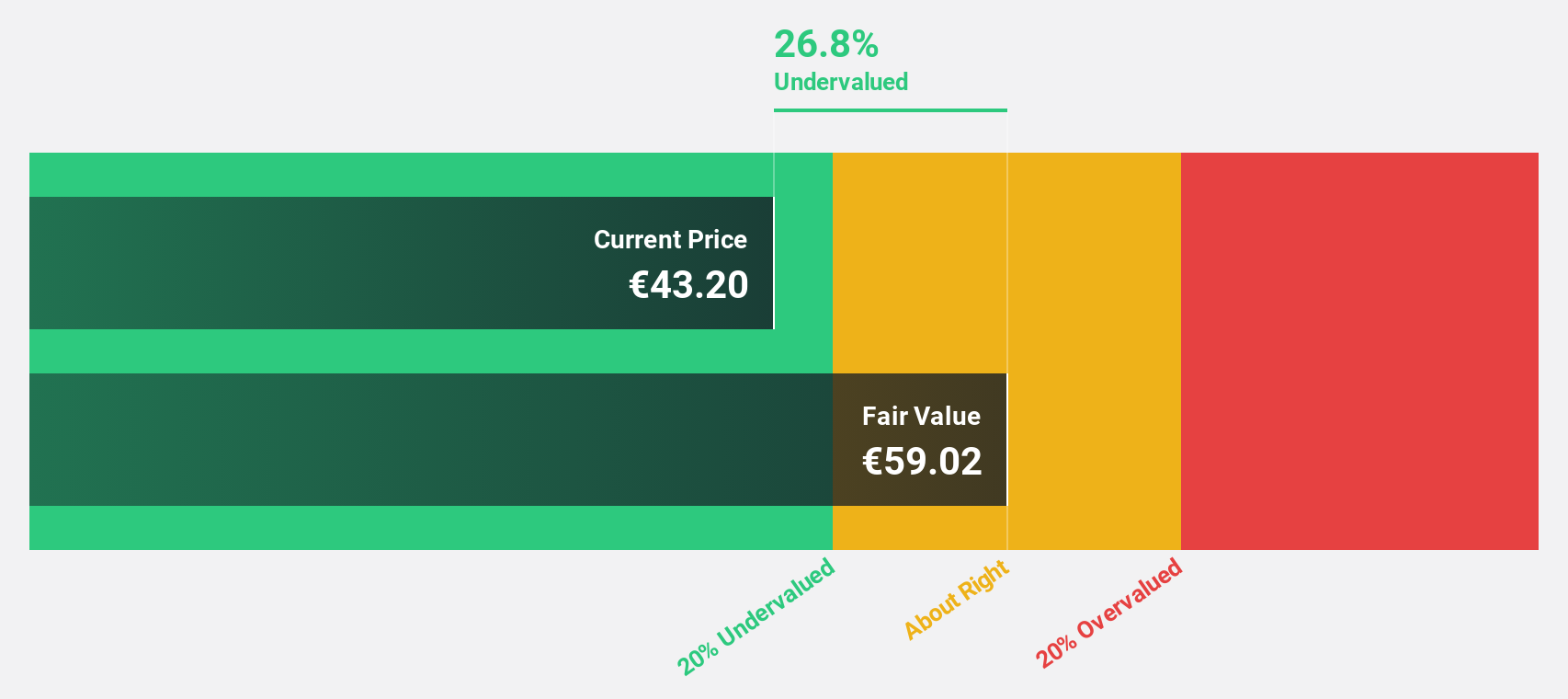

Estimated Discount To Fair Value: 29.6%

Assystem S.A. is trading at €43.25, considerably below its estimated fair value of €61.45, highlighting potential undervaluation based on discounted cash flow analysis. Despite a decline in net income for H1 2025 to €4.7 million from €5.2 million the previous year, earnings are projected to grow significantly at 55.2% annually, outpacing the French market's growth rate of 12.3%. However, profit margins have decreased from last year's figures and dividend coverage remains weak.

- Our expertly prepared growth report on Assystem implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Assystem with our detailed financial health report.

Rosenbauer International (WBAG:ROS)

Overview: Rosenbauer International AG provides systems for preventive firefighting and disaster protection technology globally, with a market cap of €482.46 million.

Operations: The company's revenue is segmented as follows: €663.40 million from Europe, €373.00 million from the Americas, €170.82 million from Asia-Pacific, €144.06 million from the Middle East & Africa, and €24.82 million from Preventive Fire Protection (PFP).

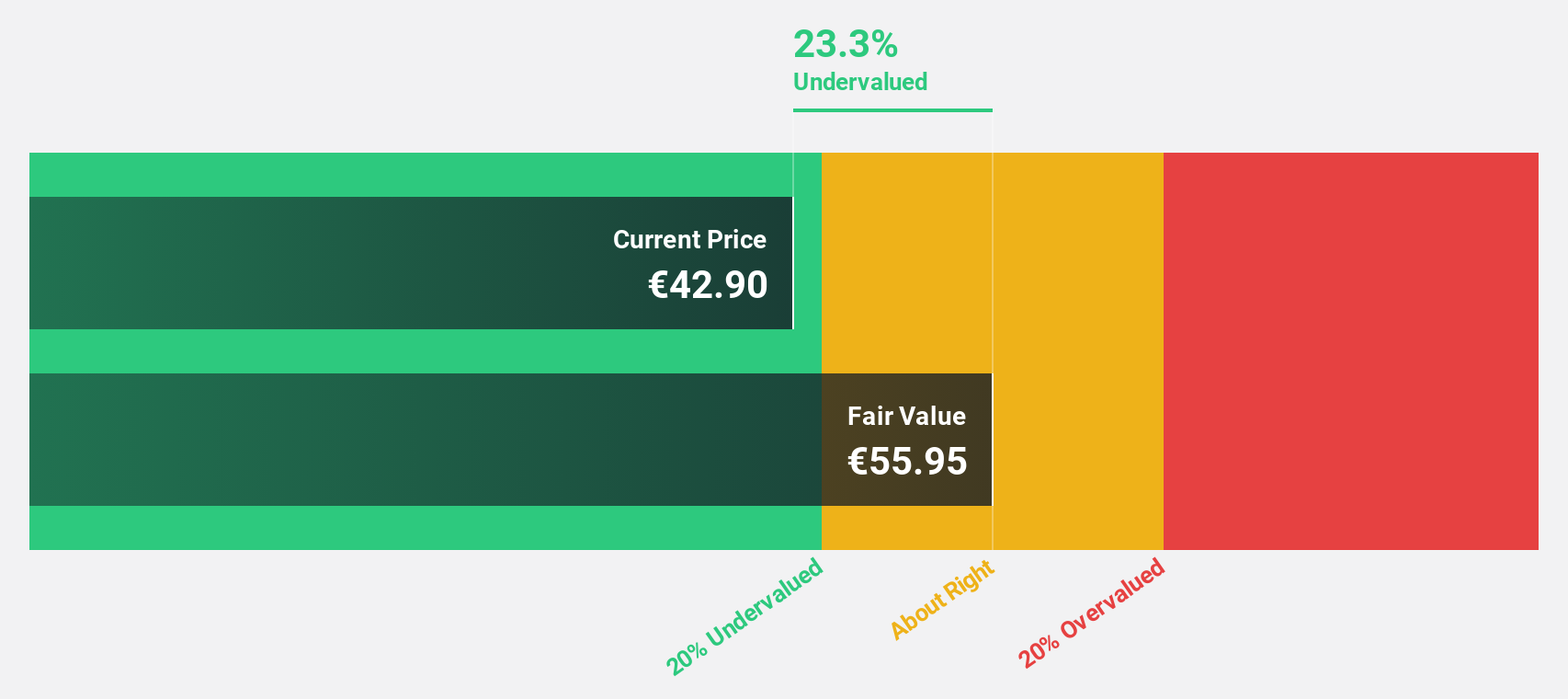

Estimated Discount To Fair Value: 13.8%

Rosenbauer International is trading at €47.3, slightly below its estimated fair value of €54.85, suggesting potential undervaluation based on cash flows. Despite a 164.4% earnings growth last year and forecasts of significant future profit increases, the company faces challenges with recent net losses and shareholder dilution. Revenue growth is expected to surpass the Austrian market average but remains modest at 6.7% annually, while interest coverage by earnings is currently inadequate.

- Our comprehensive growth report raises the possibility that Rosenbauer International is poised for substantial financial growth.

- Take a closer look at Rosenbauer International's balance sheet health here in our report.

Seize The Opportunity

- Get an in-depth perspective on all 205 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ASY

Assystem

Provides engineering and infrastructure project management services in France, the United Kingdom, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives