- France

- /

- Commercial Services

- /

- ENXTPA:ALCIS

Catering International & Services Société Anonyme's (EPA:ALCIS) Shares Leap 27% Yet They're Still Not Telling The Full Story

Despite an already strong run, Catering International & Services Société Anonyme (EPA:ALCIS) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 48%.

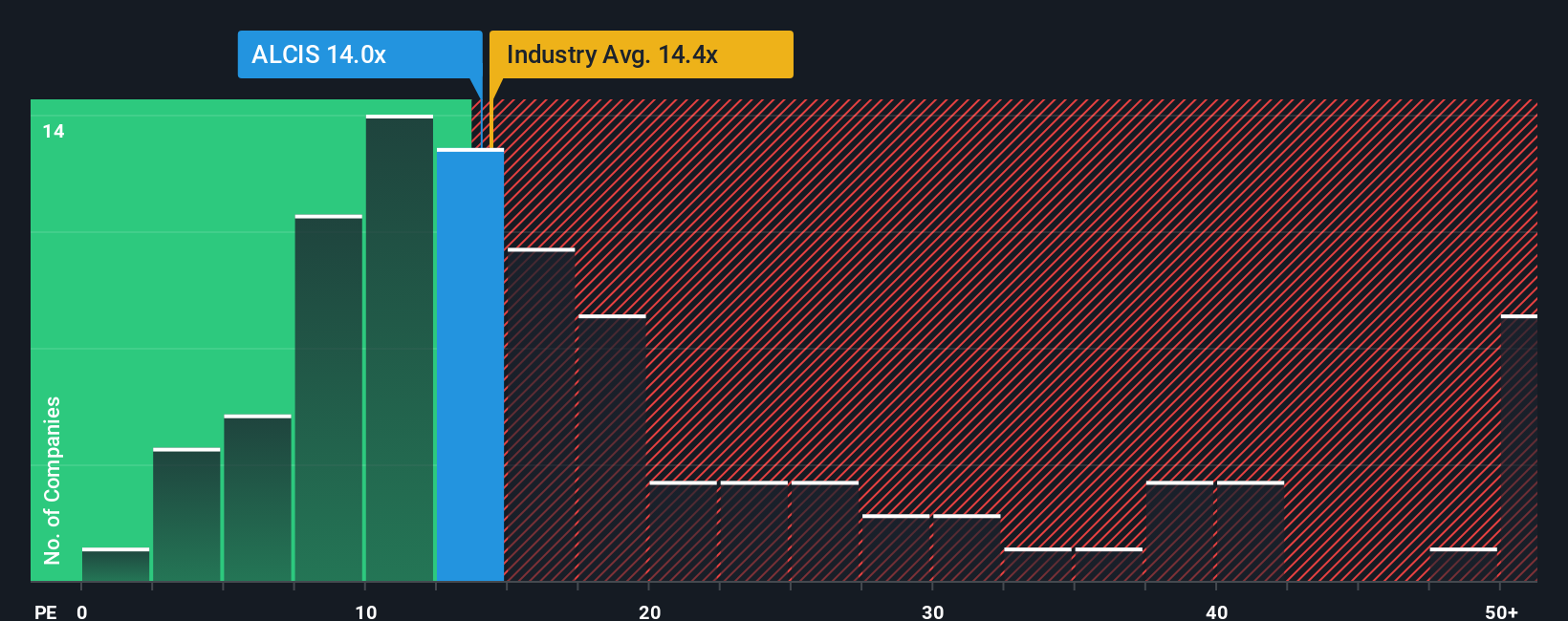

Even after such a large jump in price, Catering International & Services Société Anonyme's price-to-earnings (or "P/E") ratio of 14x might still make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 17x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Catering International & Services Société Anonyme has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Catering International & Services Société Anonyme

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Catering International & Services Société Anonyme's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 173% last year. Still, incredibly EPS has fallen 19% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 18% each year over the next three years. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Catering International & Services Société Anonyme's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Catering International & Services Société Anonyme's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Catering International & Services Société Anonyme's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Catering International & Services Société Anonyme with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCIS

Catering International & Services Société Anonyme

Provides catering, accommodation, and facilities and utility management services in Africa, Middle East, Europe, Asia, and America.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives