Is Tarkett’s Impressive 86.9% Rally Backed by Fundamentals in 2025?

Reviewed by Simply Wall St

If you have been following Tarkett stock, you might be asking yourself whether now is the right time to buy, hold, or take profits. Tarkett has been on quite a ride lately, and investors are starting to take notice. In just the past year, the stock is up an impressive 86.9%. Since the start of the year, it has gained 57.4%. Even over a five-year horizon, Tarkett has delivered a solid return of 41.7%, which may have rewarded those who held the stock through various market swings. Over the last seven days, the stock ticked up 0.6% and managed a 0.3% rise in the past month, suggesting a period of steadier consolidation after a strong rally.

Recent market developments have added to the conversation. Investors seem to be reassessing the risks and growth potential for Tarkett, with some renewed optimism about its ability to adapt to industry shifts and meet demand trends in building materials. With these shifting market dynamics, understanding whether the share price genuinely reflects the company’s value has become increasingly important.

With a valuation score of 4 out of 6, which suggests Tarkett is considered undervalued in most major metrics, there is a compelling starting point for further analysis. To better assess whether Tarkett is well positioned at today’s price, it is useful to examine how its value stands under common valuation methods. Later, I will also share a lesser-known approach to valuing stocks that may offer additional perspective for investors who want to look beyond the usual criteria.

Tarkett delivered 86.9% returns over the last year. See how this stacks up to the rest of the Building industry.Approach 1: Tarkett Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future free cash flows and discounting them back to today's value. This provides a way to evaluate whether the stock price reflects the company’s underlying earning power.

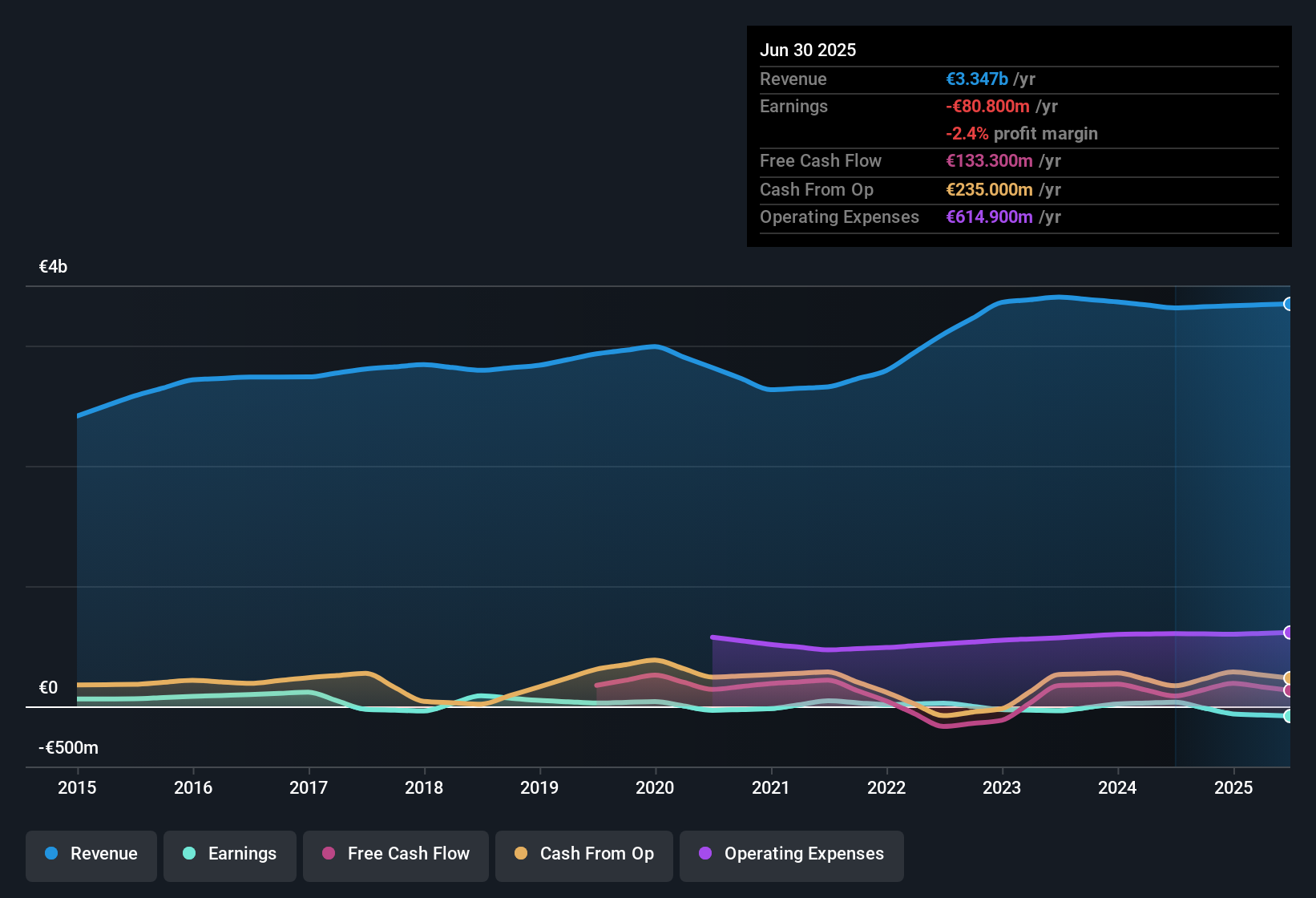

For Tarkett, the latest reported Free Cash Flow stands at €142.7 million. Analysts currently forecast FCF for up to five years, but for a complete DCF analysis, further projections are extrapolated. Over the next decade, projected cash flows gradually decrease to €128.9 million by 2035, based on an ongoing, modest annual reduction and subsequent slow recovery. These figures are all discounted back to present value to estimate Tarkett’s total business worth.

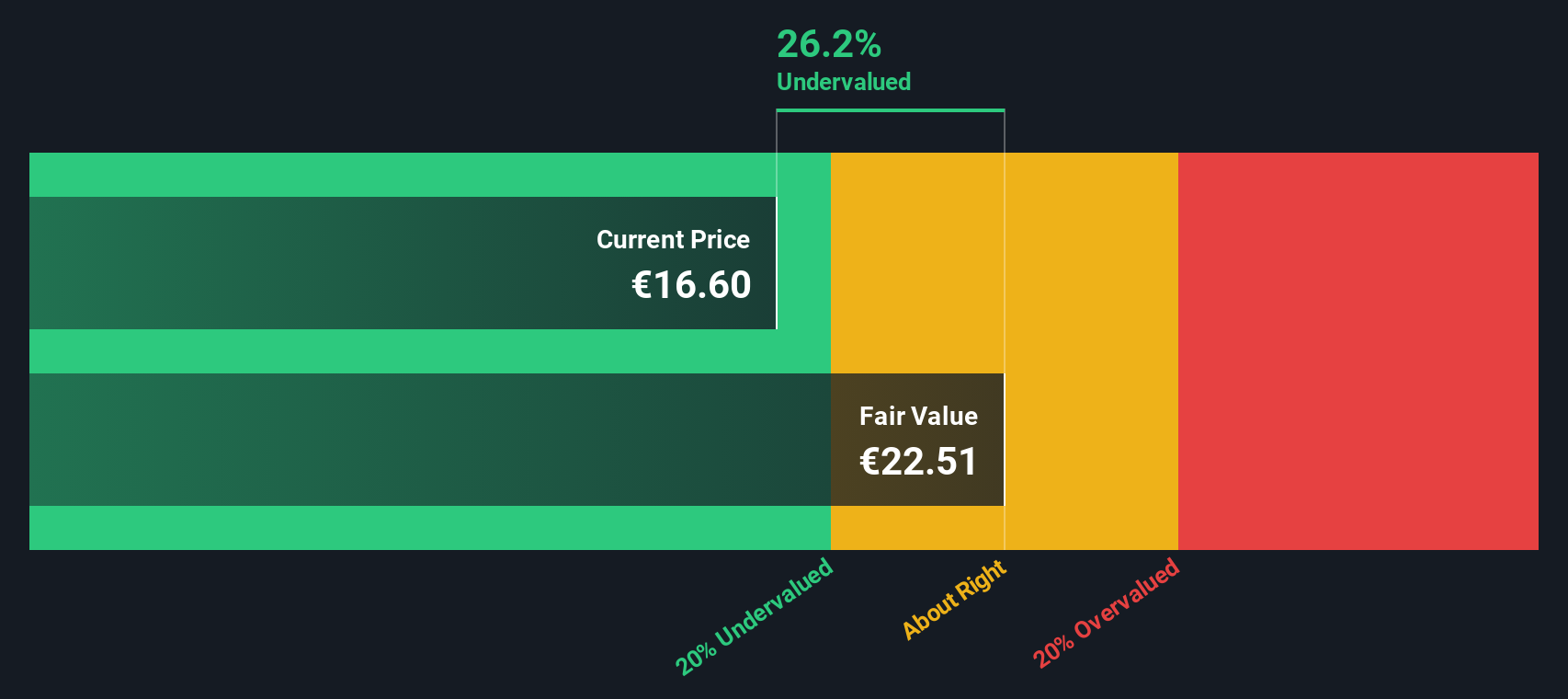

Using this approach, the model produces an intrinsic fair value of €22.55 per share. This implies the stock is trading at a 27.0% discount to its calculated valuation, indicating the current price is well below what the DCF forecast suggests is fair.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Tarkett.

Approach 2: Tarkett Price vs Sales

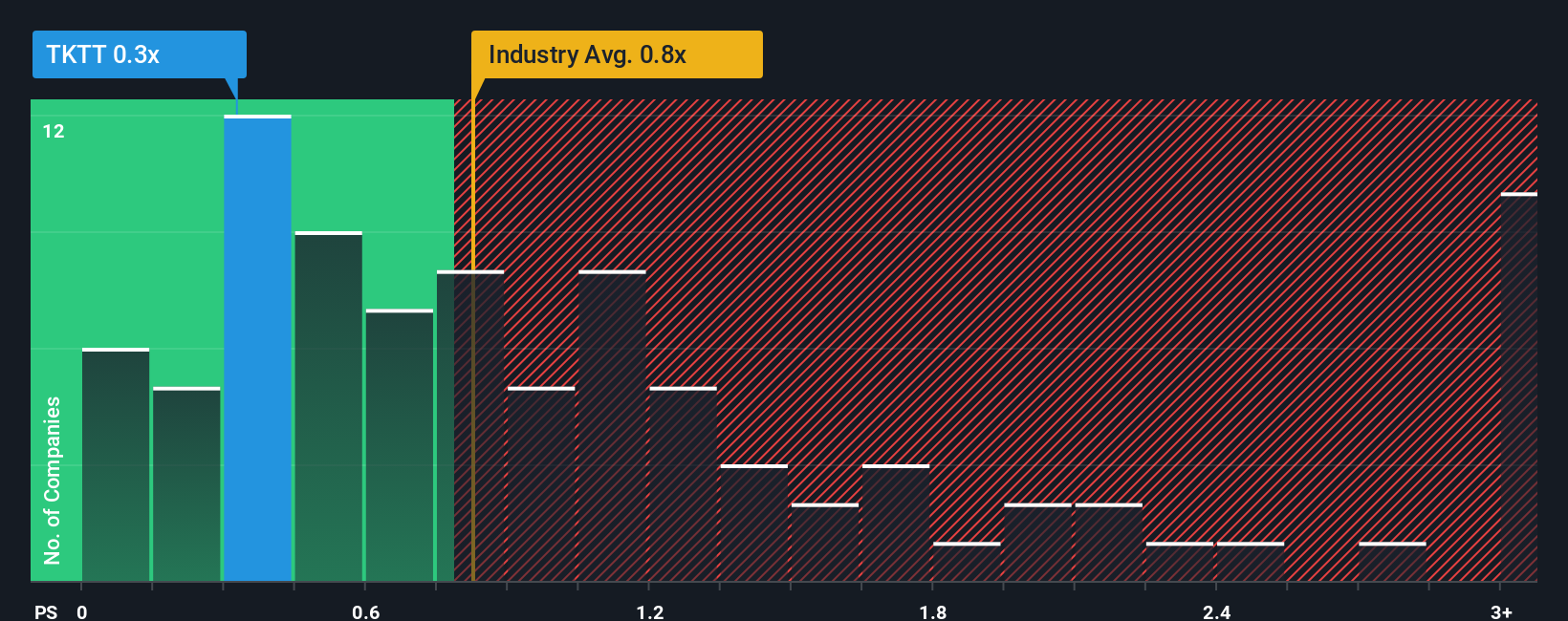

The price-to-sales (PS) ratio is particularly useful for valuing companies in industries where profitability might fluctuate, as it focuses on a company’s revenues rather than its earnings. For profitable and stable firms like Tarkett, the PS ratio gives investors a clear perspective on how the market values each euro of revenue. This makes it a widely used metric for comparison across peers and the broader industry.

Growth prospects and risk profiles have a direct influence on what should be considered a “normal” or “fair” PS multiple. Firms with stronger growth expectations and lower risk typically command higher multiples. In contrast, more mature or risk-prone companies tend to trade at lower PS values.

Tarkett currently trades at a PS ratio of 0.32x, which is below both the peer average of 0.59x and the building industry average of 1.09x. To provide a more tailored benchmark, Simply Wall St uses a proprietary “Fair Ratio” that takes into account not only industry comparisons but also key factors such as Tarkett’s own revenue growth, profit margin, company size, and risk profile. This Fair Ratio is often more insightful than peer or industry averages because it adjusts for company-specific variables that can influence what counts as fair value.

By comparing Tarkett’s actual PS ratio with this Fair Ratio, investors can make a sharper call on the stock’s valuation. In this case, the company’s current multiple is well below what might be warranted, suggesting Tarkett could be undervalued based on revenue metrics.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Tarkett Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are simple, story-driven perspectives where investors combine their view of a company’s future, including expected earnings, revenue, and margins, to build a personal fair value estimate. This approach links Tarkett’s story, such as product expansion or industry headwinds, directly to a customized financial forecast and then to a fair value, bridging the gap between numbers and real-life developments.

Available on Simply Wall St's Community page and already used by millions, Narratives are an easy and accessible tool for investors at any level. They help you make more informed decisions about buying or selling by comparing your forecasted fair value against Tarkett's live share price. One of their best features is that Narratives update automatically with new information such as earnings releases or news, so your outlook always reflects the latest events. For example, one investor’s Narrative could be optimistic, projecting strong growth and a higher fair value, while another is more cautious, estimating lower earnings and a reduced value for Tarkett. With Narratives, making smarter, story-backed investment decisions is just a few clicks away.

Do you think there's more to the story for Tarkett? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarkett might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKTT

Tarkett

Provides flooring and sports surface solutions to businesses and residential end users in Europe, the Middle East, Africa, North America, the Commonwealth of Independent States, the Asia Pacific, and Latin America.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives