- France

- /

- Electrical

- /

- ENXTPA:SU

Is AI Data Center Collaboration With NVIDIA Shifting the Investment Case for Schneider Electric (ENXTPA:SU)?

Reviewed by Sasha Jovanovic

- In early October 2025, Schneider Electric announced new AI-ready data centre reference designs developed in collaboration with NVIDIA, featuring integrated power management and advanced liquid cooling systems, alongside multiple high-profile conference appearances and key executive changes.

- This deepening focus on AI infrastructure and sustainable energy technologies showcases Schneider Electric’s expanding role at the intersection of digital transformation and decarbonization for critical global sectors.

- We’ll explore how the partnership with NVIDIA on data centre solutions could reshape Schneider Electric’s growth outlook in digital infrastructure.

Find companies with promising cash flow potential yet trading below their fair value.

Schneider Electric Investment Narrative Recap

To be a shareholder in Schneider Electric, you need confidence in its ability to deliver multi-year revenue and margin growth from electrification and digital infrastructure, especially as AI-driven demand reshapes data centers. The October 2025 NVIDIA partnership announcement strengthens the most important short-term catalyst, AI infrastructure expansion, but does not materially change the biggest risk: potential margin pressures from a heavier mix of lower-margin solutions and ongoing global cost headwinds.

Among recent announcements, Schneider Electric’s co-engineered EcoStruxure Pod with Compass Datacenters is especially relevant. By helping operators rapidly deploy modular and efficient AI-ready data center spaces, this complements the NVIDIA reference designs and supports ongoing revenue drivers from robust backlogs across digital and energy management projects.

In contrast, investors should be aware that if inflation outpaces pricing and product mix shifts further to systems solutions...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's outlook forecasts €48.6 billion in revenue and €6.7 billion in earnings by 2028. This implies a 7.3% annual revenue growth rate and a €2.4 billion increase in earnings from the current level of €4.3 billion.

Uncover how Schneider Electric's forecasts yield a €257.55 fair value, a 5% upside to its current price.

Exploring Other Perspectives

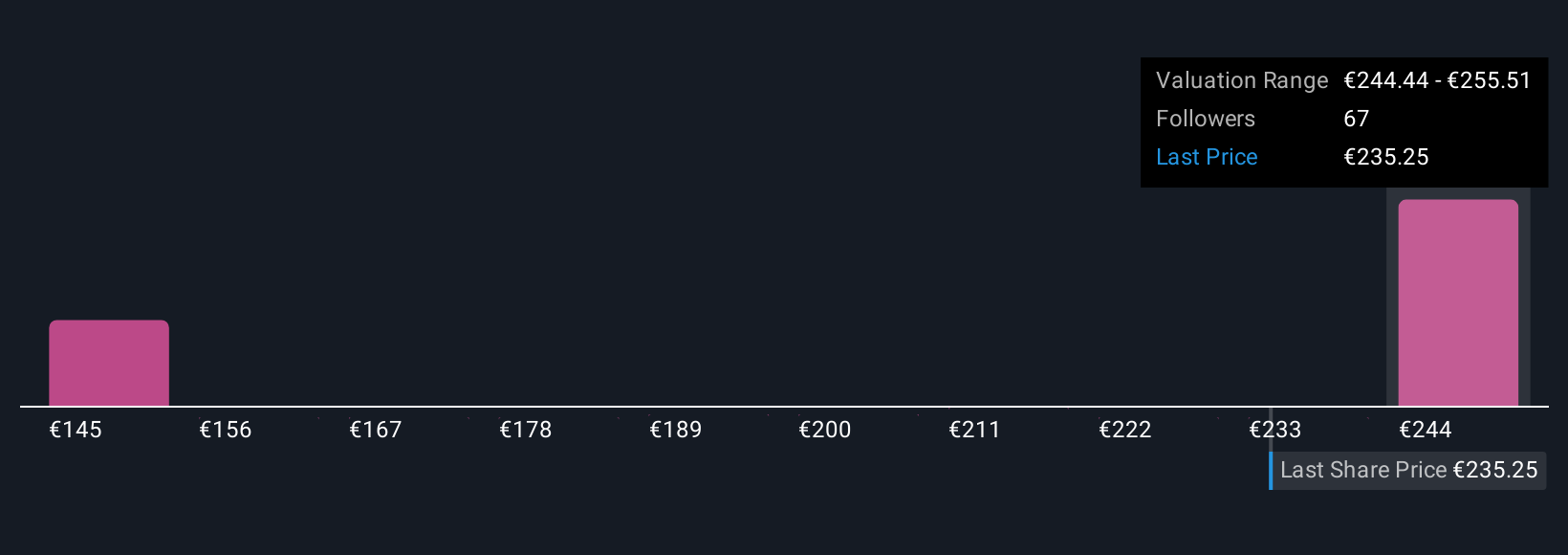

Private investors in the Simply Wall St Community contributed 9 Schneider Electric fair value estimates ranging from €141.59 to €257.55 per share. With AI infrastructure growth as a key catalyst, these differing viewpoints highlight how future earnings potential could influence returns, explore several perspectives to see the full range of expectations.

Explore 9 other fair value estimates on Schneider Electric - why the stock might be worth 42% less than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives