The Compensation For Compagnie de Saint-Gobain S.A.'s (EPA:SGO) CEO Looks Deserved And Here's Why

Key Insights

- Compagnie de Saint-Gobain to hold its Annual General Meeting on 6th of June

- CEO Benoit Bazin's total compensation includes salary of €1.00m

- The total compensation is similar to the average for the industry

- Over the past three years, Compagnie de Saint-Gobain's EPS grew by 84% and over the past three years, the total shareholder return was 52%

The performance at Compagnie de Saint-Gobain S.A. (EPA:SGO) has been quite strong recently and CEO Benoit Bazin has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 6th of June. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for Compagnie de Saint-Gobain

How Does Total Compensation For Benoit Bazin Compare With Other Companies In The Industry?

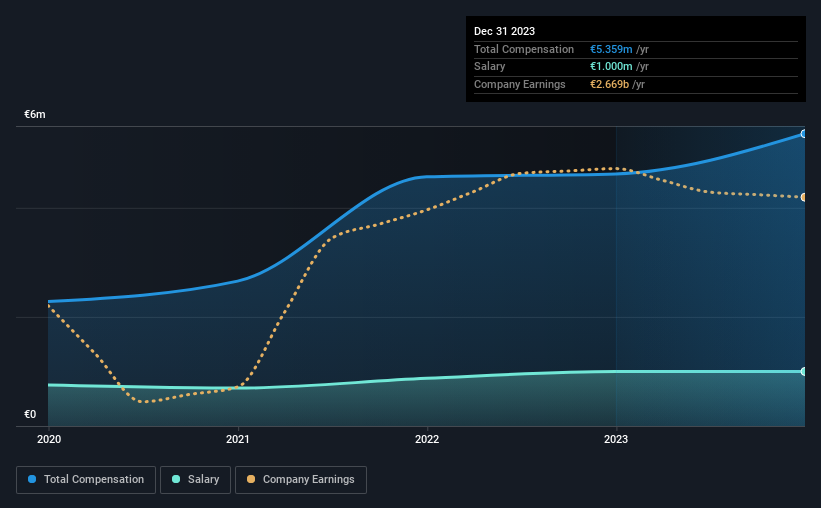

Our data indicates that Compagnie de Saint-Gobain S.A. has a market capitalization of €41b, and total annual CEO compensation was reported as €5.4m for the year to December 2023. We note that's an increase of 16% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €1.0m.

On comparing similar companies in the France Building industry with market capitalizations above €7.4b, we found that the median total CEO compensation was €4.2m. This suggests that Compagnie de Saint-Gobain remunerates its CEO largely in line with the industry average. What's more, Benoit Bazin holds €12m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.0m | €1.0m | 19% |

| Other | €4.4m | €3.6m | 81% |

| Total Compensation | €5.4m | €4.6m | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. Compagnie de Saint-Gobain pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Compagnie de Saint-Gobain S.A.'s Growth Numbers

Compagnie de Saint-Gobain S.A.'s earnings per share (EPS) grew 84% per year over the last three years. Its revenue is down 6.4% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Compagnie de Saint-Gobain S.A. Been A Good Investment?

Boasting a total shareholder return of 52% over three years, Compagnie de Saint-Gobain S.A. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Compagnie de Saint-Gobain that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Flawless balance sheet, good value and pays a dividend.