How Recent 18% Surge Shapes the Investment Case for Saint-Gobain in 2025

Reviewed by Bailey Pemberton

If you are thinking about what to do with your Compagnie de Saint-Gobain shares, or wondering whether now is the right time to jump in, you are not alone. With a closing price of 94.32 and steady, sometimes impressive, gains across several time frames, this French building materials giant has caught more than a few eyes lately. Over the last year, the stock is up 18.1%, and looking further back, the 3-year return hits an eye-popping 168.2%, with a 5-year move of 191.7%. Even the short-term numbers are no slouch, with a 3.7% gain over the past week and 10.0% so far this year.

Much of this momentum can be traced to broader market optimism toward companies positioned to benefit from long-term trends in infrastructure, energy efficiency, and sustainable construction. Investors have started to look past cyclical risks and are focusing instead on Saint-Gobain's ability to adapt and innovate in response to new regulations and environmental pressures. That shift in perception, from risk to opportunity, has helped power strong returns.

But before anyone calls Compagnie de Saint-Gobain either undervalued or overhyped, a closer look at its actual valuation is a must. Right now, this company passes 4 out of 6 classic undervaluation checks, which is a value score worth noting but not the full story. In the next section, we will break down these traditional valuation methods and see exactly where Saint-Gobain stands. And if you are still on the fence, do not worry, because there is an even more powerful way to cut through the noise that I will reveal at the end of the article.

Approach 1: Compagnie de Saint-Gobain Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s value. This process helps investors see what a company might truly be worth using actual cash generated by the business, rather than just profits or book value.

For Compagnie de Saint-Gobain, the latest twelve months’ Free Cash Flow stands at €3.50 billion. Analysts expect these cash flows to grow modestly, with projections reaching €3.52 billion in 2026 and €4.05 billion by 2028. Beyond that, Simply Wall St extrapolates further growth, topping €4.99 billion by 2035. All cash flows are denominated in euros.

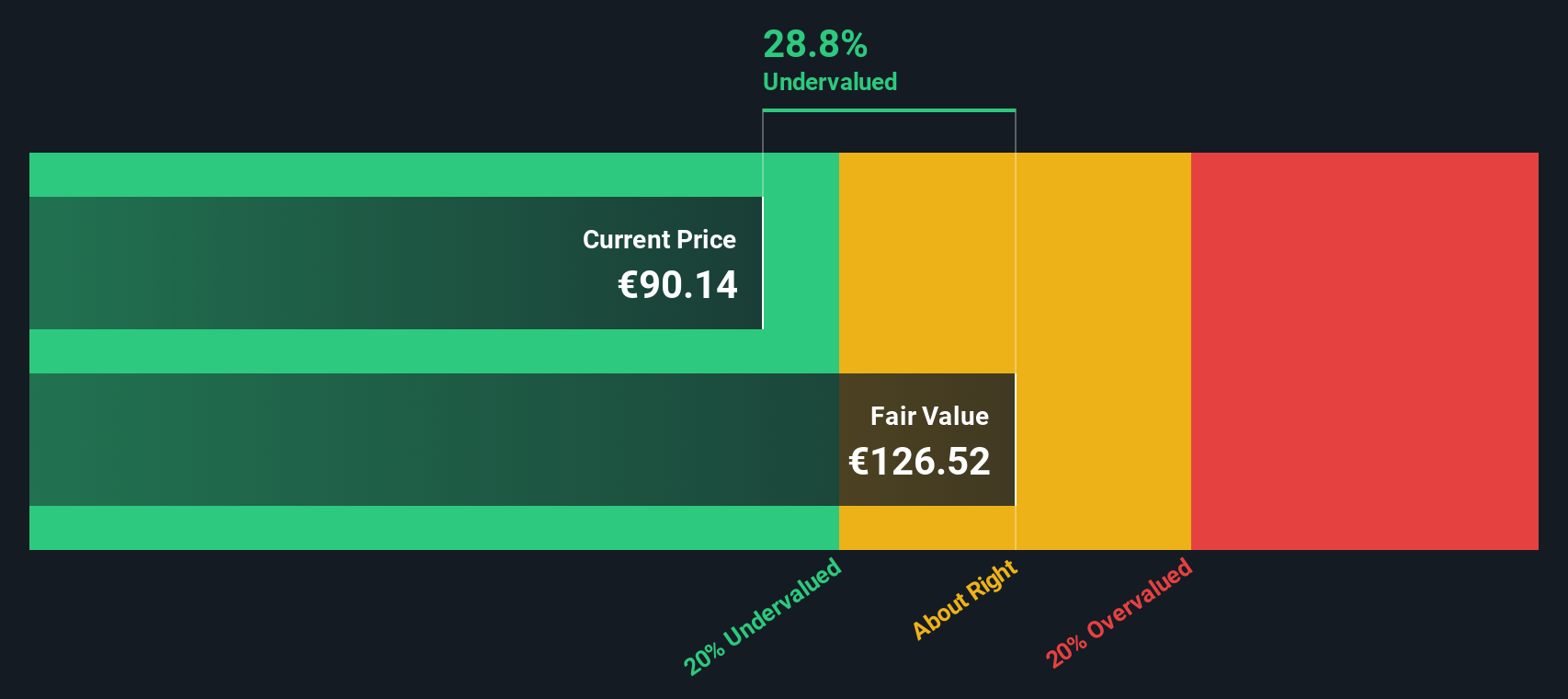

Using the two-stage Free Cash Flow to Equity methodology, the DCF model estimates Saint-Gobain’s fair value at €115.27 per share. In comparison to the recent share price of €94.32, this suggests the stock is currently trading at an 18.2% discount to its intrinsic value. According to DCF analysis, Saint-Gobain appears undervalued, which may reflect either market caution or an opportunity for patient investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Compagnie de Saint-Gobain is undervalued by 18.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Compagnie de Saint-Gobain Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Compagnie de Saint-Gobain. It offers investors a quick way to assess how much the market is willing to pay for each euro of the company's earnings. Typically, a higher PE ratio can signal market optimism about a company’s future growth, while a lower PE ratio might suggest more caution or perceived risks.

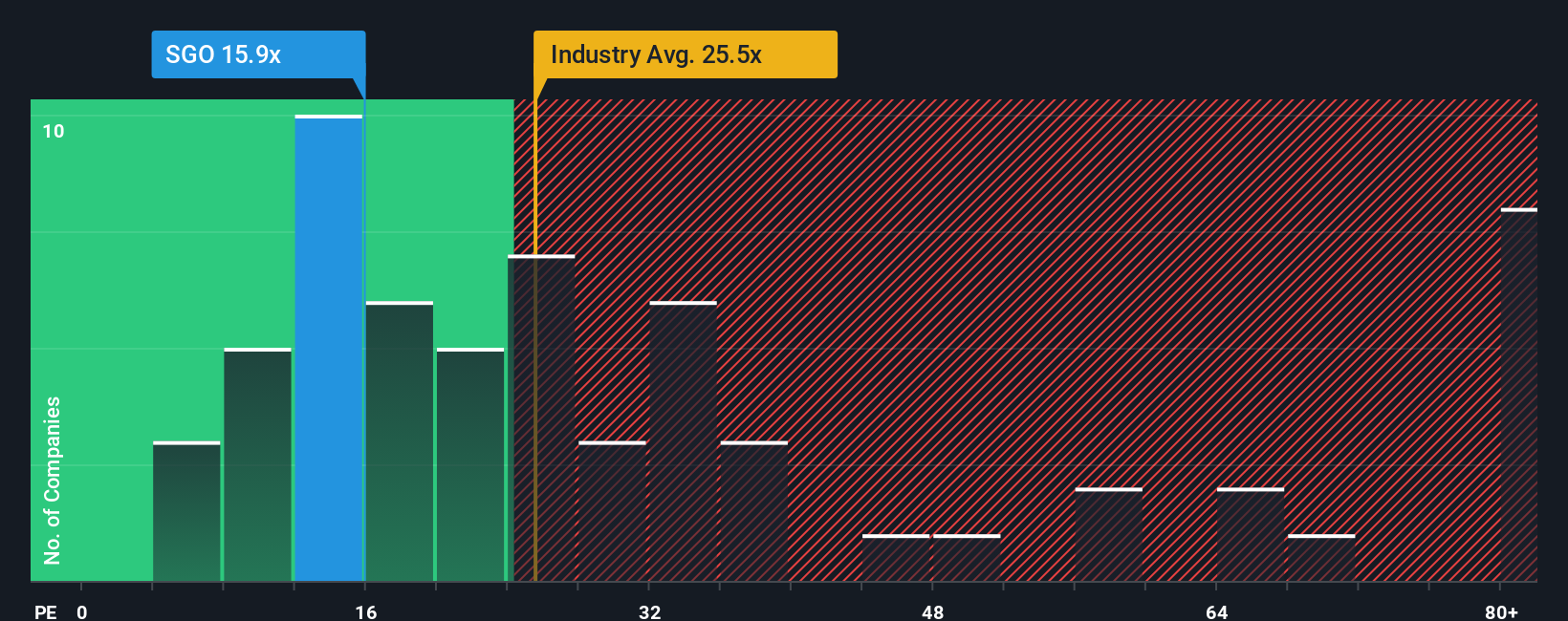

For Saint-Gobain, the current PE ratio stands at 18.3x. In comparison, the average PE ratio among building industry peers is 21.6x, while the peer group average reaches as high as 31.6x. By these measures, Saint-Gobain appears to trade at a discount relative to its industry and leading competitors.

However, a more nuanced picture emerges when considering Simply Wall St’s proprietary “Fair Ratio.” This metric goes beyond generic comparisons by incorporating factors such as Saint-Gobain’s earnings growth, profit margins, business risks, market cap, and its specific industry context. The Fair Ratio for Saint-Gobain is calculated at 27.1x. This method provides a more tailored benchmark and reduces the noise that can come from simple industry or peer averages that may not account for the company’s actual performance and prospects.

Comparing the actual PE ratio of 18.3x with the Fair Ratio of 27.1x shows that Saint-Gobain is currently valued well below what would be considered fair on a risk- and growth-adjusted basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Compagnie de Saint-Gobain Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply a story or perspective that connects a company’s journey—its unique opportunities, challenges, and future potential—to projections for revenue, earnings, and profit margins, ultimately linking all that back to what you think the company is actually worth.

Instead of relying solely on standard ratios or models, Narratives allow investors to align their assumptions and outlook with the numbers. This makes it easier to justify why you believe a stock is a buy, hold, or sell right now. On Simply Wall St, Narratives are a core feature of the Community. They enable millions of investors to quickly create or review these stories and see how each path leads to a different fair value, which can then be compared in real time to the current price.

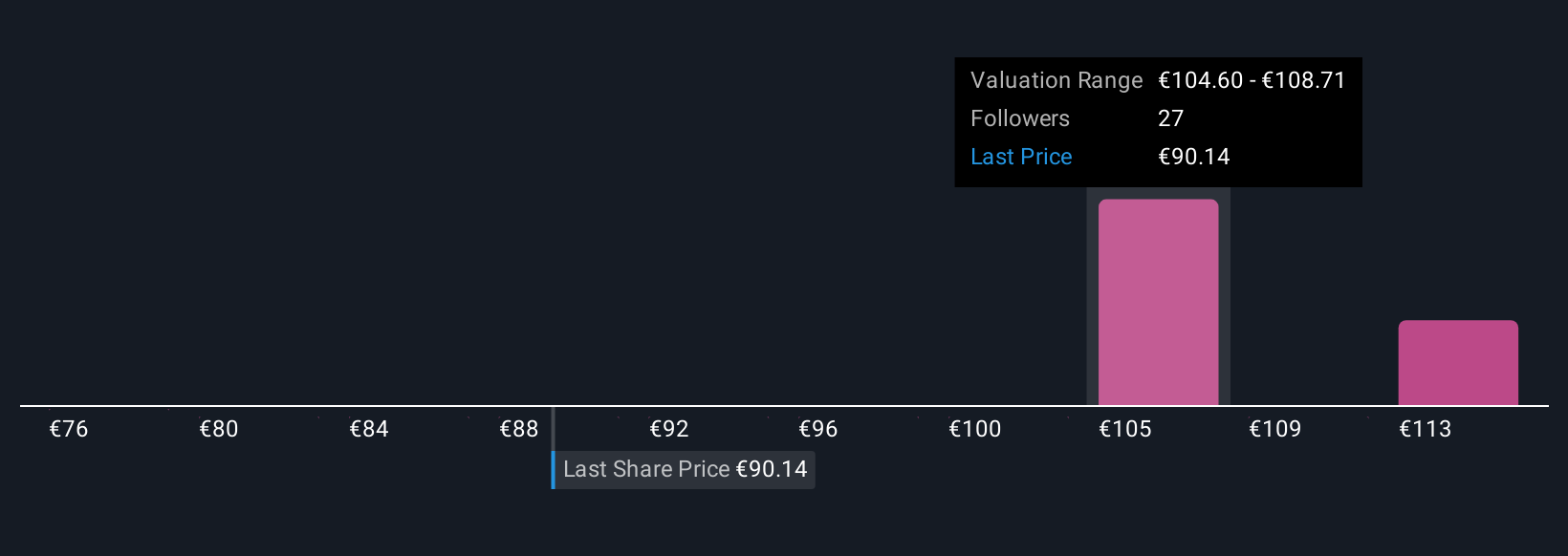

This approach is dynamic: as soon as new facts, earnings, or news hit the market, Narratives update automatically, providing you with an up-to-date, transparent rationale for your decisions. For example, when looking at Compagnie de Saint-Gobain, one investor’s bullish Narrative might project a fair value as high as €140.3, while a more pessimistic view could point to just €72.0. This reminds us that fair value is not fixed, but shaped by what you believe is probable.

Do you think there's more to the story for Compagnie de Saint-Gobain? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives