Does Compagnie de Saint-Gobain (EPA:SGO) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Compagnie de Saint-Gobain (EPA:SGO). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Compagnie de Saint-Gobain

Compagnie de Saint-Gobain's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is therefore awe-striking that Compagnie de Saint-Gobain's EPS went from €0.52 to €4.11 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

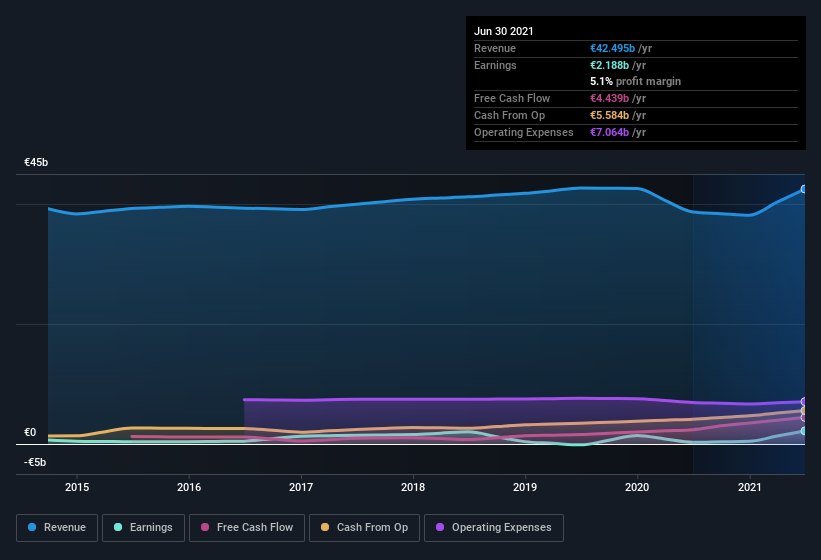

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Compagnie de Saint-Gobain shareholders can take confidence from the fact that EBIT margins are up from 6.5% to 10%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Compagnie de Saint-Gobain's forecast profits?

Are Compagnie de Saint-Gobain Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a €32b company like Compagnie de Saint-Gobain. But we are reassured by the fact they have invested in the company. To be specific, they have €16m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.05% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Compagnie de Saint-Gobain Deserve A Spot On Your Watchlist?

Compagnie de Saint-Gobain's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Compagnie de Saint-Gobain is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. What about risks? Every company has them, and we've spotted 2 warning signs for Compagnie de Saint-Gobain you should know about.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Compagnie de Saint-Gobain, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives