- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

Euronext Paris Stocks Including Safran Believed To Be Trading Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the European markets experience a modest rise, with France's CAC 40 Index adding 0.48% amid hopes for quicker interest rate cuts by the European Central Bank, there is a renewed focus on identifying stocks that might be trading below their intrinsic value. In this context, understanding what constitutes an undervalued stock—typically those whose market price does not fully reflect their potential earnings or asset value—becomes crucial for investors looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vivendi (ENXTPA:VIV) | €10.255 | €17.93 | 42.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €28.00 | €55.58 | 49.6% |

| NSE (ENXTPA:ALNSE) | €29.80 | €57.38 | 48.1% |

| Lectra (ENXTPA:LSS) | €28.25 | €53.05 | 46.7% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.09 | 39.7% |

| EKINOPS (ENXTPA:EKI) | €3.80 | €6.64 | 42.7% |

| Solutions 30 (ENXTPA:S30) | €1.16 | €2.31 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €3.24 | €6.26 | 48.3% |

| Exail Technologies (ENXTPA:EXA) | €17.56 | €29.62 | 40.7% |

| OVH Groupe (ENXTPA:OVH) | €6.46 | €11.80 | 45.3% |

Let's review some notable picks from our screened stocks.

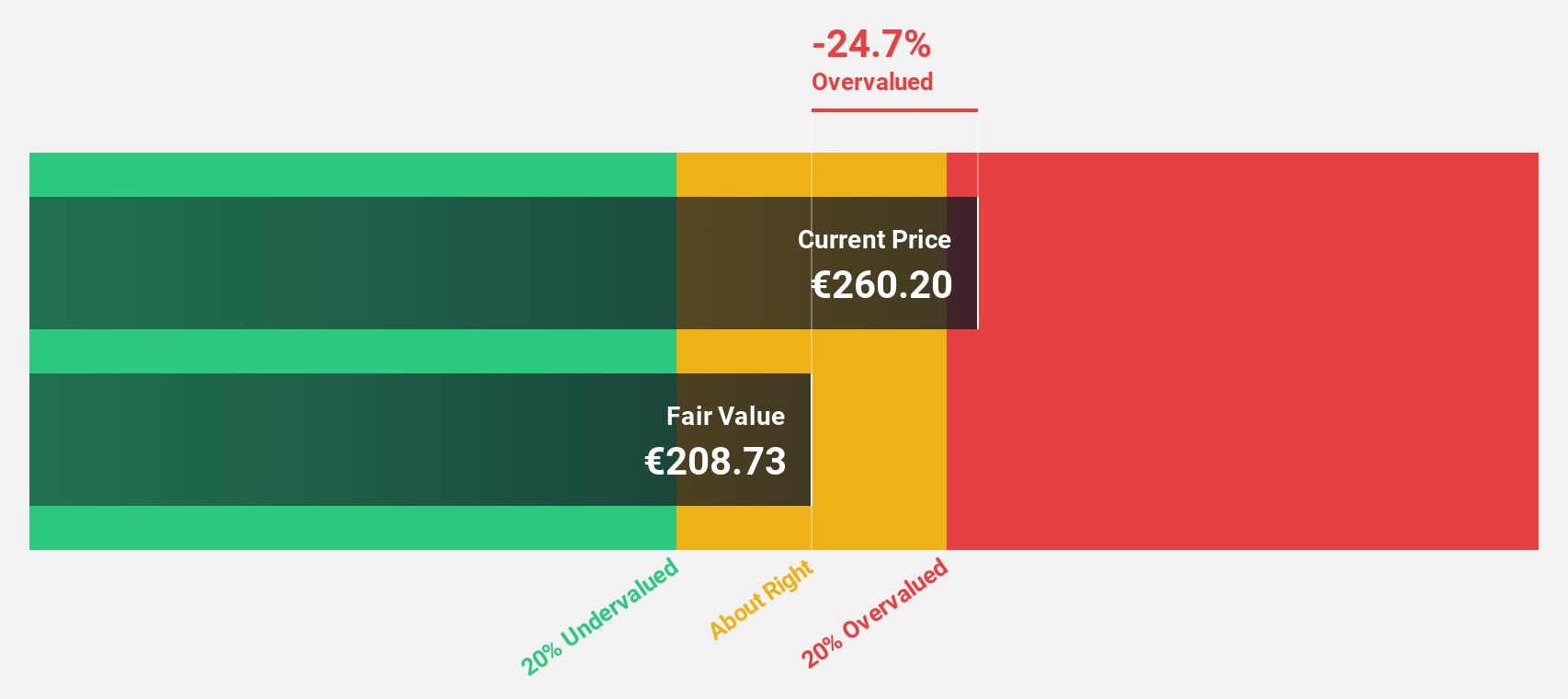

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally, with a market capitalization of €86.09 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

Estimated Discount To Fair Value: 28.8%

Safran is currently trading at €204.8, significantly below its estimated fair value of €287.67, indicating potential undervaluation based on cash flows. Despite a decline in net profit margin from 14.4% to 6.4%, revenue for the first half of 2024 increased to €13.41 billion from €11.36 billion last year, with full-year revenue expected to reach around €27.4 billion, suggesting robust growth prospects compared to the French market average.

- The analysis detailed in our Safran growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Safran stock in this financial health report.

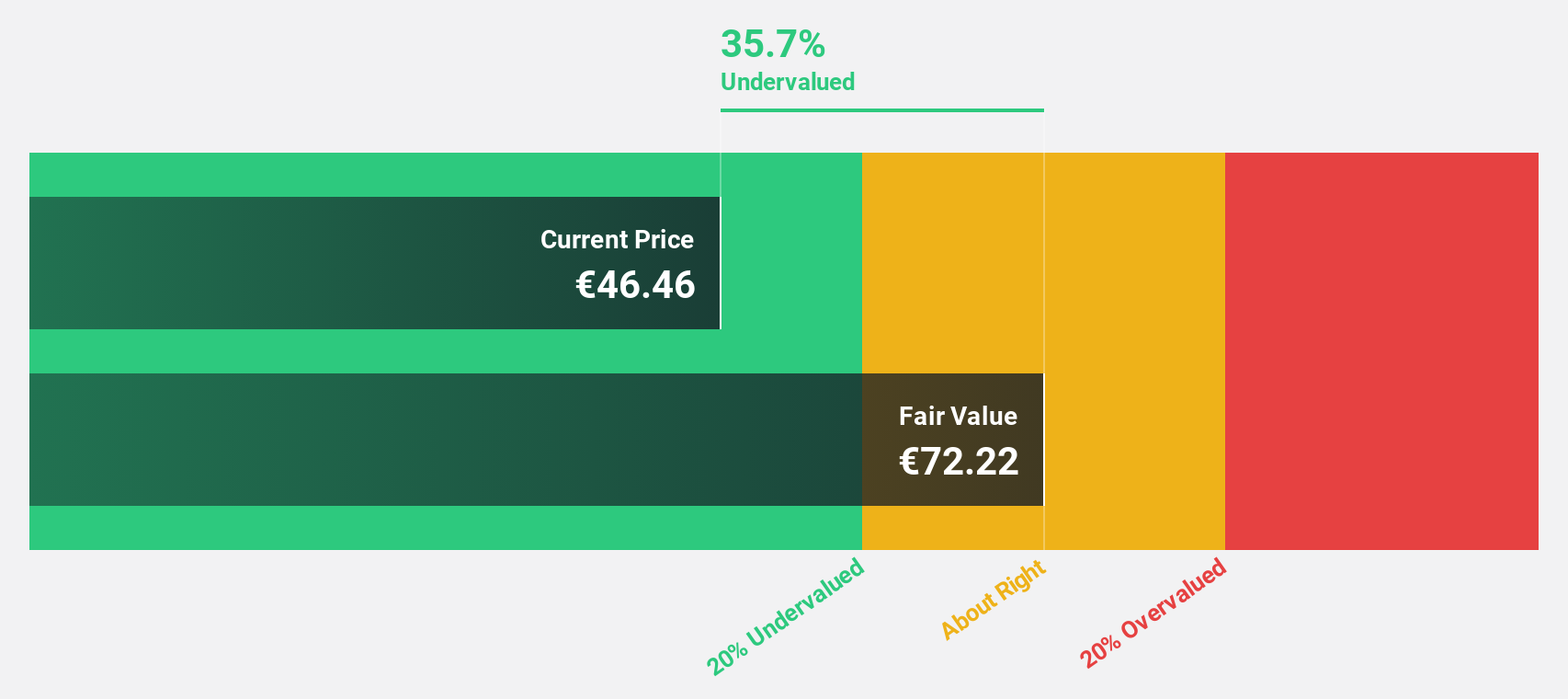

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services focused on energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of approximately €5.74 billion.

Operations: The company's revenue segments include North-Western Europe with €1.89 billion and Global Services Energy with €684.90 million.

Estimated Discount To Fair Value: 36.1%

SPIE is trading at €34.38, significantly below its estimated fair value of €53.77, highlighting potential undervaluation based on cash flows. Despite a drop in net income to €56.75 million for H1 2024 from €73.17 million the previous year, revenue grew to €4.66 billion from €4.13 billion, with future earnings expected to grow faster than the French market average despite high debt levels and an unstable dividend track record.

- Insights from our recent growth report point to a promising forecast for SPIE's business outlook.

- Delve into the full analysis health report here for a deeper understanding of SPIE.

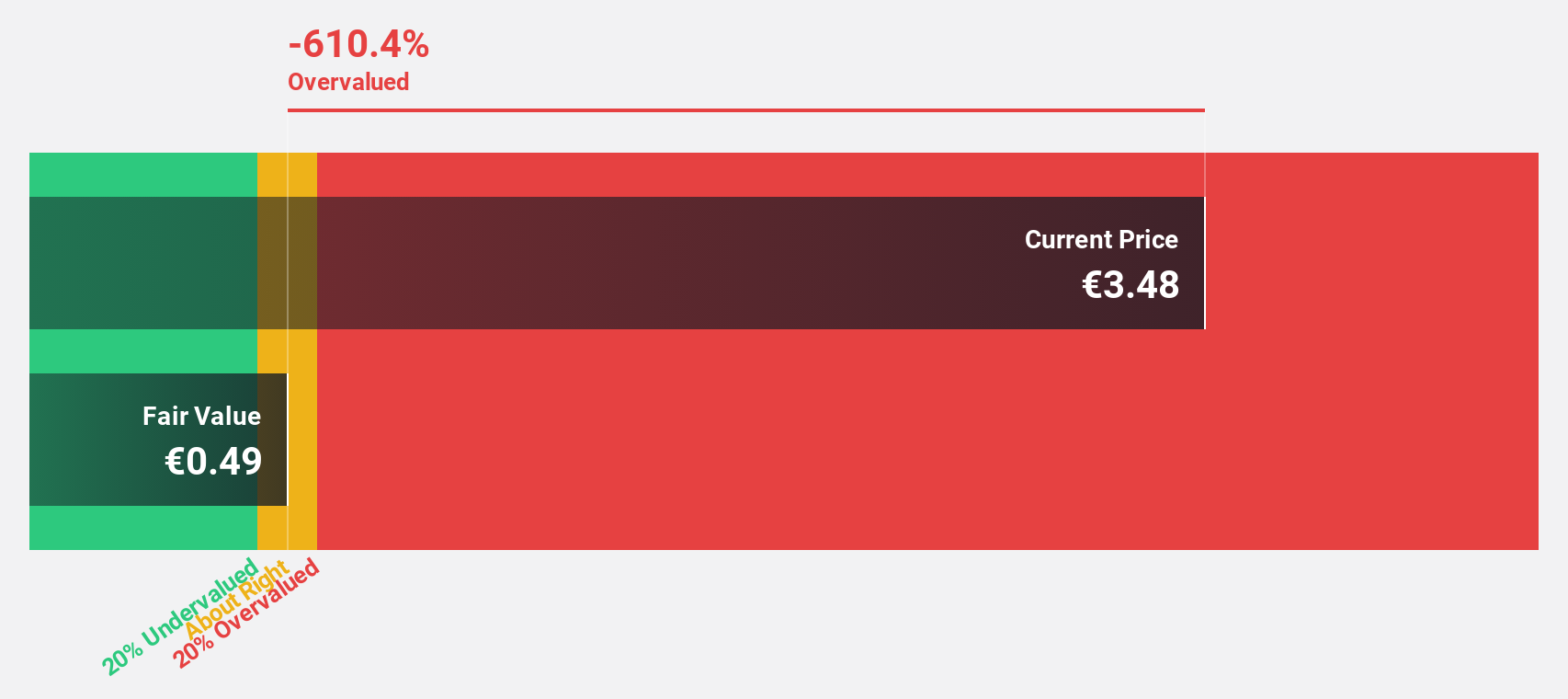

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is an entertainment, media, and communication company with operations across France, Europe, the Americas, Asia/Oceania, and Africa, and has a market cap of approximately €10.34 billion.

Operations: Revenue segments for the company include Canal + Group at €6.20 billion, Havas Group at €2.92 billion, Gameloft at €304 million, Prisma Media at €303 million, New Initiatives at €176 million, and Vivendi Village at €151 million.

Estimated Discount To Fair Value: 42.8%

Vivendi is trading at €10.26, well below its estimated fair value of €17.93, suggesting undervaluation based on cash flows. Despite a decrease in net income to €159 million for H1 2024 from €174 million the previous year, sales nearly doubled to €9.05 billion from €4.70 billion. Earnings are projected to grow significantly above market averages, though the company faces challenges with low return on equity forecasts and an unstable dividend history.

- Our expertly prepared growth report on Vivendi implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Vivendi with our detailed financial health report.

Key Takeaways

- Click here to access our complete index of 21 Undervalued Euronext Paris Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Excellent balance sheet with reasonable growth potential.