- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

Assessing Safran (ENXTPA:SAF) Valuation as Shares Build on Recent Gains

Reviewed by Kshitija Bhandaru

Safran (ENXTPA:SAF) shares have risen in the past week, building on steady gains seen over the last month. Investors watching the French aerospace and defense group are interested in what this performance signals about future value.

See our latest analysis for Safran.

Momentum for Safran has picked up in recent months, with a steady share price climb suggesting renewed optimism among investors. Over the past year, the company’s total shareholder return stands at 48%, reflecting both growth expectations and a healthy appetite for risk.

If you’re curious about other aerospace and defense opportunities, explore the sector’s top contenders in See the full list for free.

But with shares near all-time highs and only a small discount to analyst price targets, the question remains: is Safran undervalued, or has the market already priced in its future growth potential?

Most Popular Narrative: 2.5% Undervalued

With Safran’s fair value narrative at €311.43 and shares last closing at €303.60, this perspective sets up a debate about its upside.

The recent acquisition of Collins' actuation and flight control assets, along with other targeted acquisitions and strategic partnerships, will broaden Safran's mission-critical offering, drive cost synergies through 2028, and further diversify revenue streams. This could result in higher EBIT margins and more stable earnings.

What’s the secret behind this bullish tilt? It’s not just headline growth. Behind the forecast is a story of market dominance, ambitious synergy targets, and financial assumptions that plenty of investors might find surprisingly bold. Want to see which future milestones shape this valuation projection? Take a closer look at the full narrative.

Result: Fair Value of €311.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as supply chain disruptions or integration hiccups from recent acquisitions could challenge these expectations and quickly shift sentiment around Safran's outlook.

Find out about the key risks to this Safran narrative.

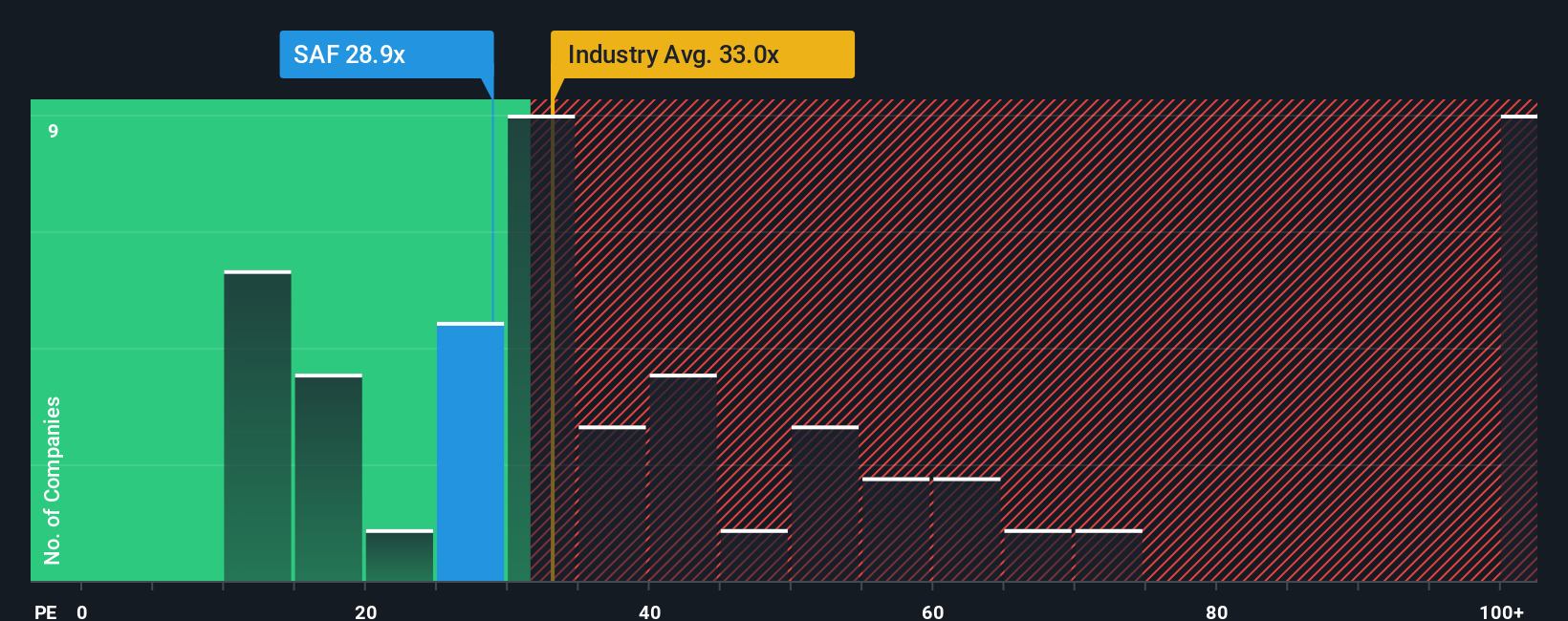

Another Perspective: Multiples Tell a Cautious Story

While the fair value estimate suggests Safran is modestly undervalued, current price-to-earnings ratios paint a more nuanced picture. Safran trades at 29.4x earnings, below the European peer average of 37.5x and the broader industry at 33.2x, but sits above its fair ratio of 27.6x. This suggests there could be less room for upside if the market shifts closer to that fair ratio benchmark. Could valuation risk be hiding just beneath the surface, or does the earnings growth story outweigh these signals?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Safran for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Safran Narrative

If you’d rather draw your own conclusions, dive into the details, and piece together your version of Safran’s story, you can easily craft a unique narrative from the data in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Safran.

Looking for more investment ideas?

Smart investors know the biggest opportunities don’t last forever. Rather than waiting on the sidelines, supercharge your watchlist with these unique stock ideas.

- Start earning consistent income when you check out these 19 dividend stocks with yields > 3% offering yields above 3% and a track record of rewarding shareholders.

- Get ahead of tomorrow’s disruptive trends by reviewing these 26 quantum computing stocks transforming industries through quantum computing breakthroughs.

- Multiply your growth potential with these 907 undervalued stocks based on cash flows that the market hasn’t fully recognized yet based on their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Safran

Engages in the aerospace and defense businesses in France, rest of Europe, the Americas, the Asia-Pacific, Africa, and the Middle East.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives