- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXENS

3 Euronext Paris Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have sparked optimism for further monetary easing, France's CAC 40 Index has seen modest gains, reflecting broader positive trends in major European stock markets. In this environment of potential economic support, identifying stocks that may be trading below their fair value can offer investors opportunities to capitalize on market inefficiencies and potential growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €10.40 | €15.93 | 34.7% |

| NSE (ENXTPA:ALNSE) | €29.10 | €57.22 | 49.1% |

| Vivendi (ENXTPA:VIV) | €10.425 | €18.02 | 42.2% |

| Exosens (ENXTPA:EXENS) | €21.80 | €42.91 | 49.2% |

| EKINOPS (ENXTPA:EKI) | €4.185 | €7.01 | 40.3% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.10 | 39.8% |

| Solutions 30 (ENXTPA:S30) | €1.162 | €2.31 | 49.6% |

| Vogo (ENXTPA:ALVGO) | €3.20 | €6.25 | 48.8% |

| Exail Technologies (ENXTPA:EXA) | €17.86 | €31.42 | 43.1% |

| OVH Groupe (ENXTPA:OVH) | €7.81 | €12.49 | 37.5% |

Let's review some notable picks from our screened stocks.

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies for amplification, detection, and imaging across various regions including France, Europe, North America, Asia, Oceania, and Africa with a market cap of €1.11 billion.

Operations: Exosens generates revenue through its electro-optical technology solutions focused on amplification, detection, and imaging across multiple global regions including France, Europe, North America, Asia, Oceania, and Africa.

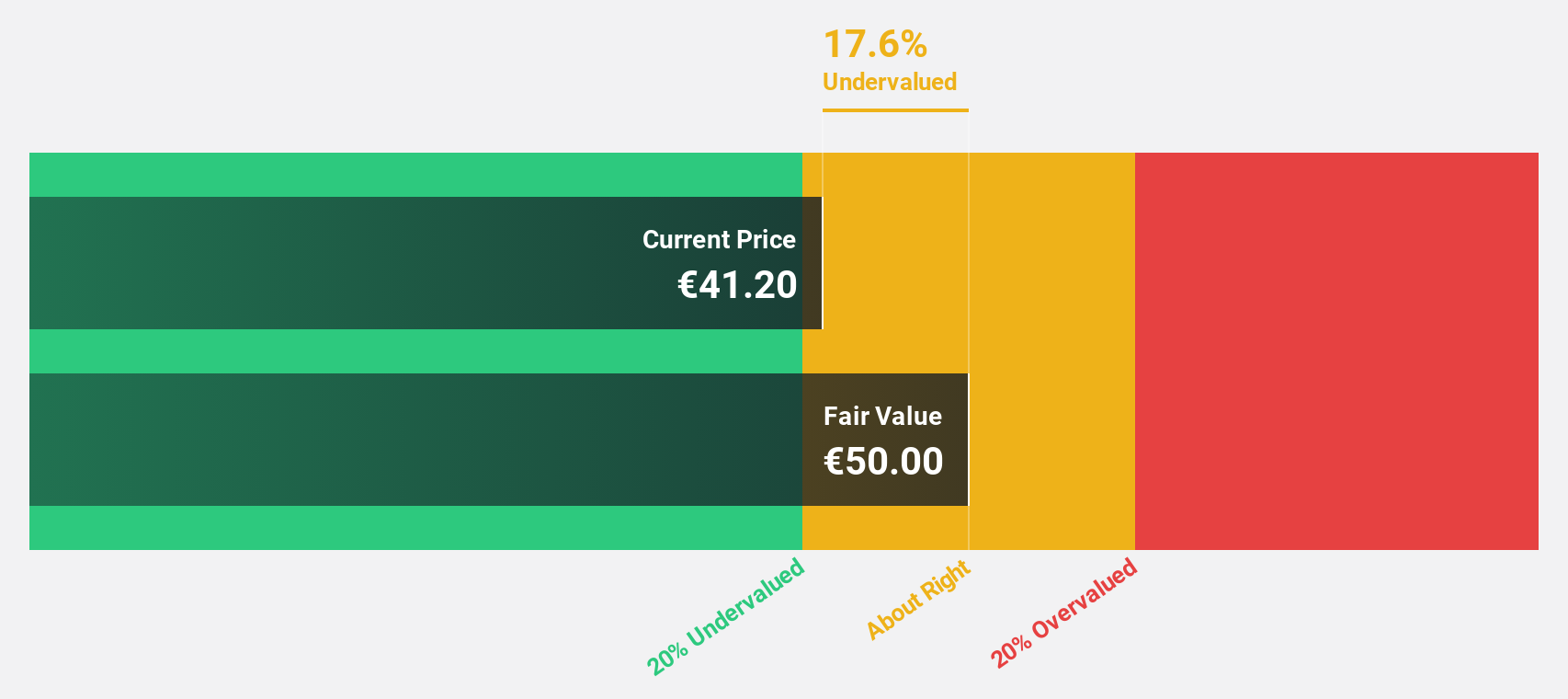

Estimated Discount To Fair Value: 49.2%

Exosens, trading at €21.8, is significantly undervalued with a fair value estimate of €42.91 and 49.2% below its estimated fair value based on cash flow analysis. Despite strong revenue growth to €186.9 million for H1 2024, net income declined to €2.9 million from €8.3 million due to lower profit margins and large one-off items affecting results. Analysts project earnings growth of 33.7% annually, outpacing the French market's expected growth rate.

- Our growth report here indicates Exosens may be poised for an improving outlook.

- Get an in-depth perspective on Exosens' balance sheet by reading our health report here.

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.48 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment at €589.61 million, followed by the Web cloud & Other segment at €185.43 million, and Public Cloud services contributing €169.01 million.

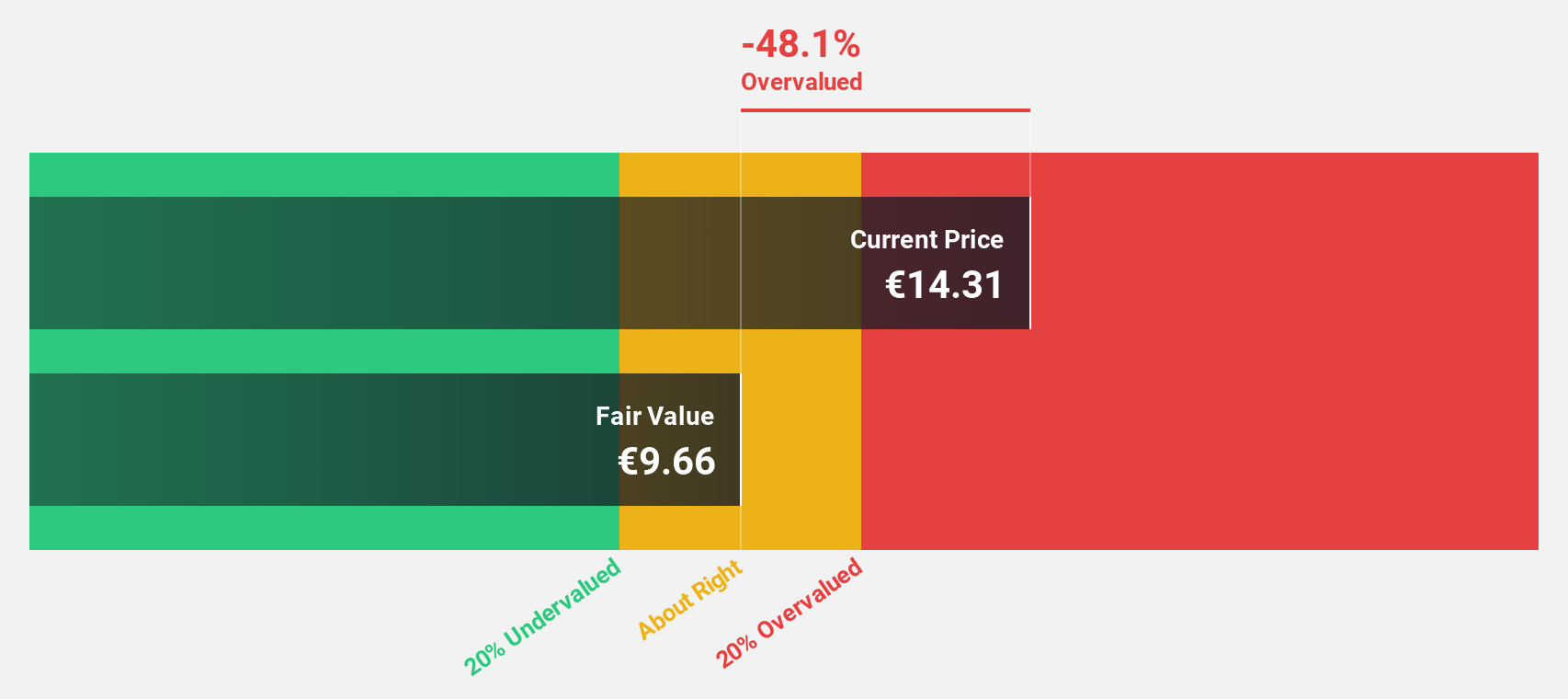

Estimated Discount To Fair Value: 37.5%

OVH Groupe is trading at €7.81, considerably below its estimated fair value of €12.49, indicating it is undervalued based on cash flow analysis. The company is projected to achieve revenue growth of 9.7% annually, surpassing the French market average of 5.5%. Despite high share price volatility recently, OVH's earnings are expected to grow significantly at 101.37% per year and become profitable within three years, outperforming market expectations for profit growth.

- Our comprehensive growth report raises the possibility that OVH Groupe is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this financial health report.

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally, with a market capitalization of €88.45 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

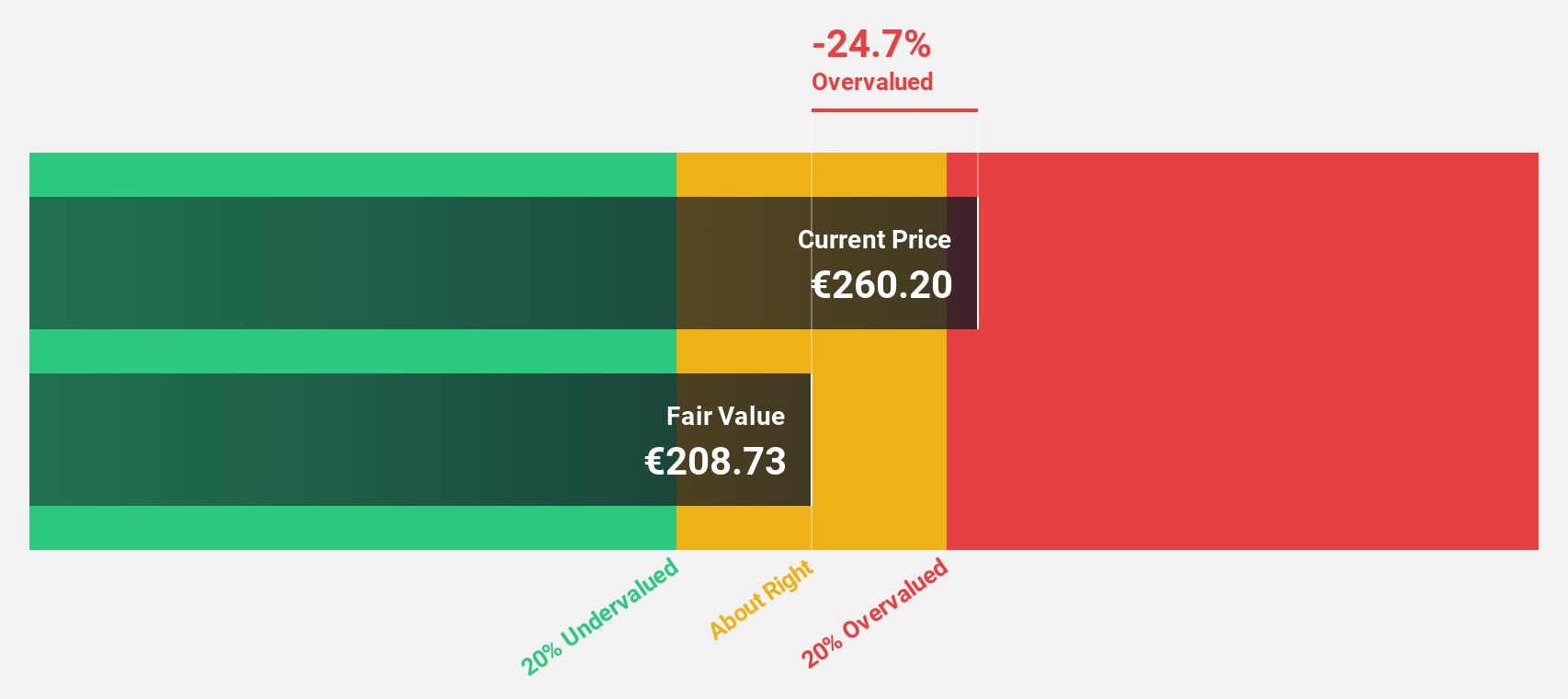

Estimated Discount To Fair Value: 25.6%

Safran is trading at €210.4, below its estimated fair value of €282.75, highlighting its undervaluation based on cash flows. While revenue is forecast to grow 10.3% annually, surpassing the French market's 5.5%, profit margins have declined significantly from last year’s 14.4% to 6.4%. Despite this, earnings are expected to grow faster than the market at 19.5% per year, supported by a strong return on equity forecast of 23.8%.

- The growth report we've compiled suggests that Safran's future prospects could be on the up.

- Dive into the specifics of Safran here with our thorough financial health report.

Taking Advantage

- Reveal the 21 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exosens might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXENS

Exosens

Engages in the development, manufacture, and sale of electro-optical technologies in the fields of amplification, and detection and imaging in France, rest of Europe, North America, Asia, Oceania, Africa, and internationally.

Good value with reasonable growth potential.