- France

- /

- Electrical

- /

- ENXTPA:NEX

Nexans (ENXTPA:NEX): Evaluating Valuation in Light of Sudden CEO Transition and Investor Uncertainty

Reviewed by Kshitija Bhandaru

Nexans (ENXTPA:NEX) shares slid over 9% after the company named Julien Hueber as its new CEO, replacing Christopher Guérin with immediate effect. The sudden executive change has sparked widespread investor discussion about the company’s next steps and long-term strategy.

See our latest analysis for Nexans.

The CEO shake-up at Nexans came shortly after a notable Innovation Summit focused on grid modernization and digitalization. This event had positioned the company at the center of energy transition conversations. Despite these forward-looking developments, the 1-day share price return of -9.26% following the surprise leadership change highlights renewed investor caution. Over the past year, momentum has eased, with a one-year total shareholder return of -11.56%. However, long-term holders have still seen significant gains, as evidenced by a 183.96% total return over five years.

If you’re watching market reactions to leadership transitions, consider broadening your view and discover fast growing stocks with high insider ownership

With Nexans trading nearly 16% below analyst targets, but with annual growth slipping, investors now face a familiar dilemma. Does today’s uncertainty present a rare buying opportunity, or is the market already betting on a muted outlook?

Most Popular Narrative: 14% Undervalued

With the average target price in the most widely followed narrative sitting noticeably above Nexans' latest close, the storyline presents optimism that outpaces current market sentiment. The difference hints at confidence around operational improvements and project pipelines shaping the company’s future worth.

Heavy investments in innovation, particularly through the adoption of artificial intelligence for dynamic pricing, predictive demand planning, and operational optimization, are expected to enhance cost efficiency and further boost net margins over time through reduced cost leakage and improved resource allocation.

Want to know why analysts project Nexans can outgrow the status quo? The heart of this valuation lies in bold shifts to margin expansion and a changing business mix. Curious which underlying financial levers justify the leap in future profit expectations? Unpack the details that drive this bullish outlook by exploring the full narrative.

Result: Fair Value of €133.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and exposure to raw material price swings remain key risks that could quickly challenge this optimistic picture for Nexans.

Find out about the key risks to this Nexans narrative.

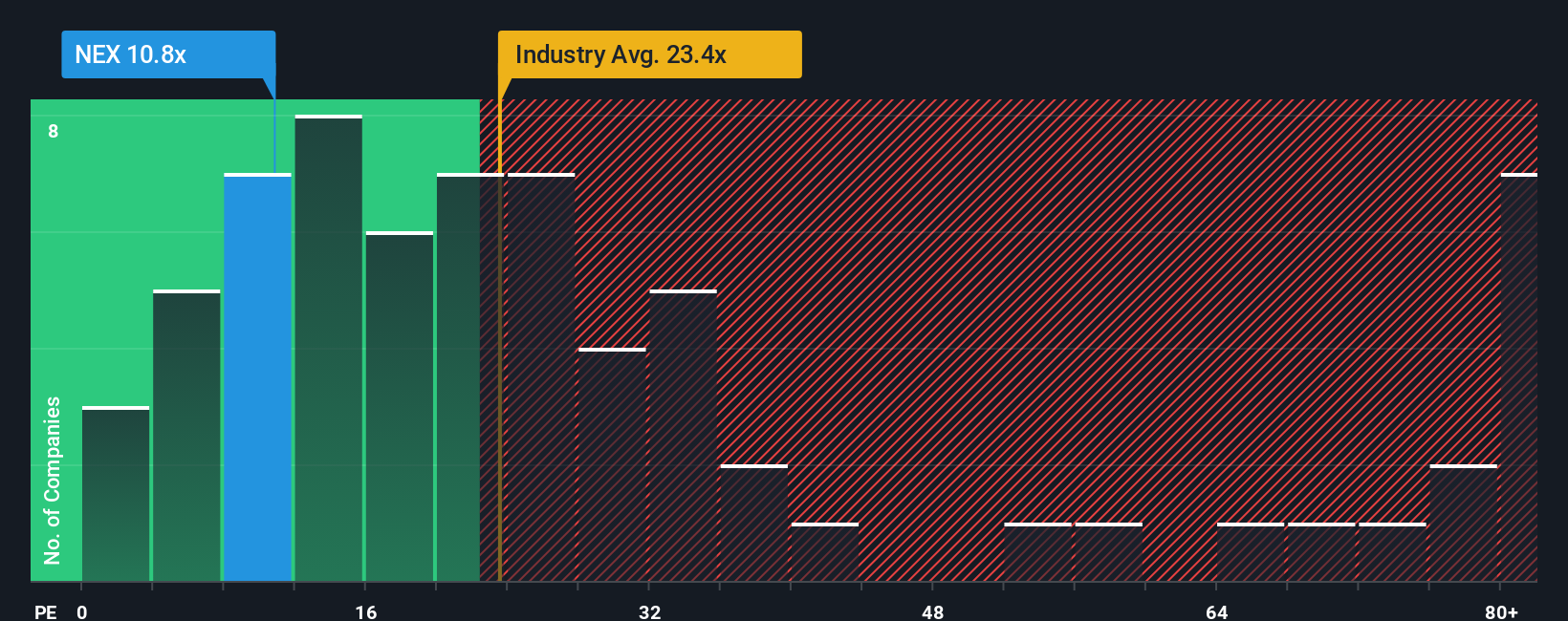

Another View: Market Multiples Signal Deeper Discount

Looking from a market multiple angle, Nexans currently trades at a price-to-earnings ratio of just 10.3x, which is well below both its fair ratio of 16.3x and the European Electrical industry average of 23.7x. This sizable gap could indicate a meaningful undervaluation, or it may reflect risks the market sees in Nexans' outlook. Are investors being too cautious, or is there more volatility ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nexans for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nexans Narrative

If you want a different perspective or enjoy digging into the numbers yourself, the tools are there to build your own story in minutes. Do it your way

A great starting point for your Nexans research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Your next big opportunity could be one smart stock screen away. Don’t leave your portfolio short on potential. Check out these powerful ways to target your strategy now:

- Uncover income potential by adding assets with consistently high payouts using these 18 dividend stocks with yields > 3% for yields over 3%.

- Spot the innovators transforming healthcare with artificial intelligence, and seize early-mover advantages via these 33 healthcare AI stocks.

- Ride the fintech revolution and harness the momentum in digital assets with these 79 cryptocurrency and blockchain stocks supporting blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NEX

Nexans

Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026