- France

- /

- Aerospace & Defense

- /

- ENXTPA:MLHK

How Investors Are Reacting To H&K (ENXTPA:MLHK) After the U.S. H-1B Visa Fee Challenge

Reviewed by Sasha Jovanovic

- In September 2025, the U.S. Chamber of Commerce filed a lawsuit against the Trump administration, challenging a presidential proclamation that imposes a $100,000 supplemental fee on new H-1B visa petitions submitted from abroad.

- This legal move underscores the critical influence of immigration policy on companies that depend on access to international skilled workers.

- We'll explore how the legal uncertainty around the H-1B visa fee could shape H&K's investment narrative and future hiring flexibility.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is H&K's Investment Narrative?

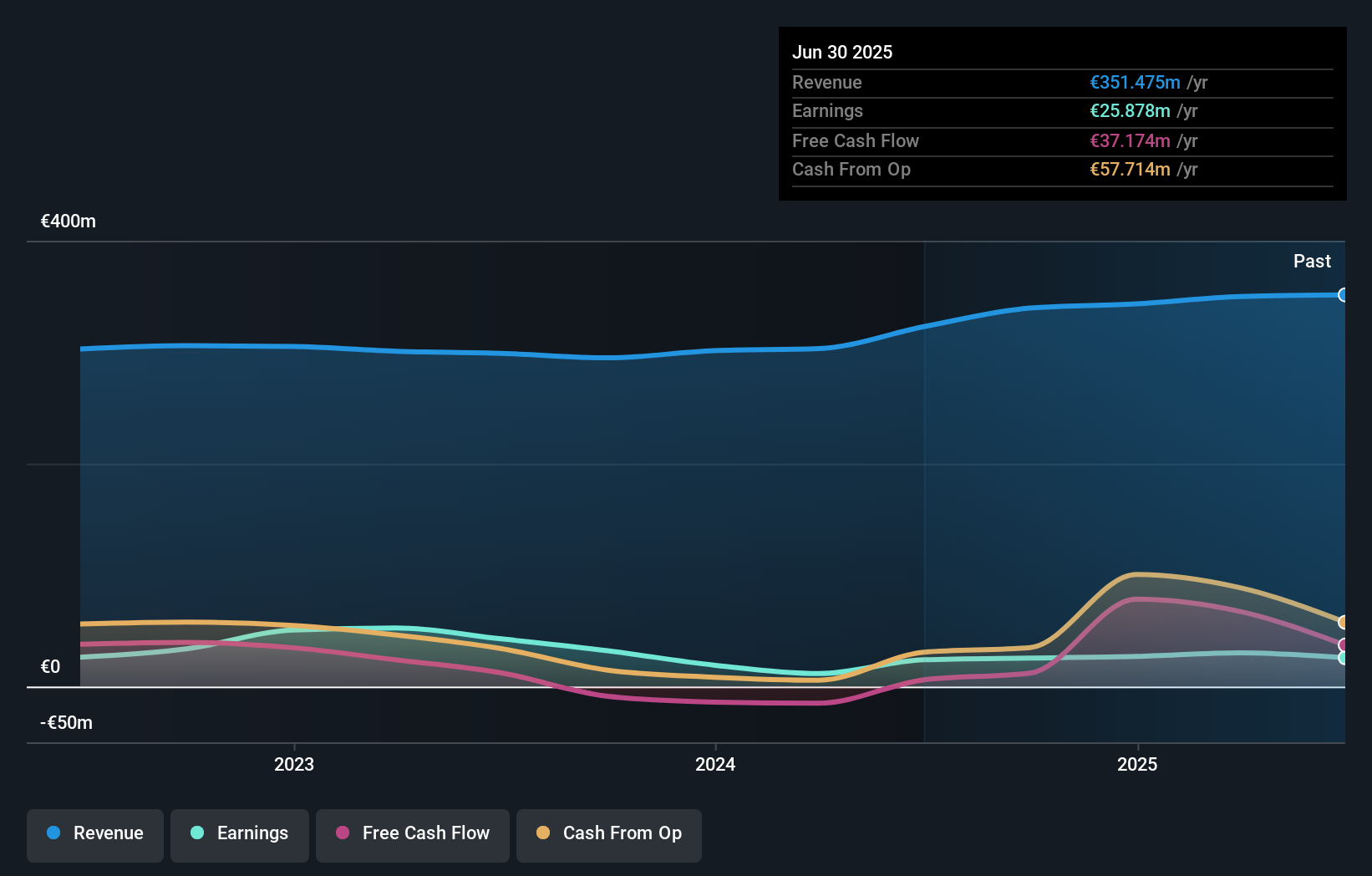

To believe in H&K as a shareholder right now, you have to place confidence in its ability to navigate both operational growth and the regulatory environment. H&K’s performance over the past year highlighted some persistent challenges: rising revenues, but volatile net income and a highly volatile share price, as well as underperformance versus peers and the broader French market. Previously, the focus was on improving operational execution, debt management, and profit margins. With the U.S. Chamber of Commerce lawsuit now challenging the recent $100,000 H-1B visa fee, there is fresh legal uncertainty added to the mix. While H&K’s financials are influenced more by its core European business, any protracted hiring restrictions or higher costs for skilled foreign workers could squeeze margins and impact future flexibility, an emerging risk that now sits alongside existing concerns about valuation and recent earnings variability. Unless the visa fee is blocked, the biggest catalysts have arguably shifted from pure operational recovery to include how H&K adapts to this evolving external threat. On the other hand, regulatory shifts can disrupt even the most resilient business models.

H&K's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on H&K - why the stock might be worth as much as 68% more than the current price!

Build Your Own H&K Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&K research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free H&K research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&K's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLHK

H&K

Together with its subsidiary, develops, manufactures, markets, and distributes infantry and small arms for military and governmental authority personnel in Germany, the European Union, and NATO countries.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives