- France

- /

- Aerospace & Defense

- /

- ENXTPA:LAT

Latécoère S.A. (EPA:LAT) Not Doing Enough For Some Investors As Its Shares Slump 25%

The Latécoère S.A. (EPA:LAT) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 2.2% during the last year.

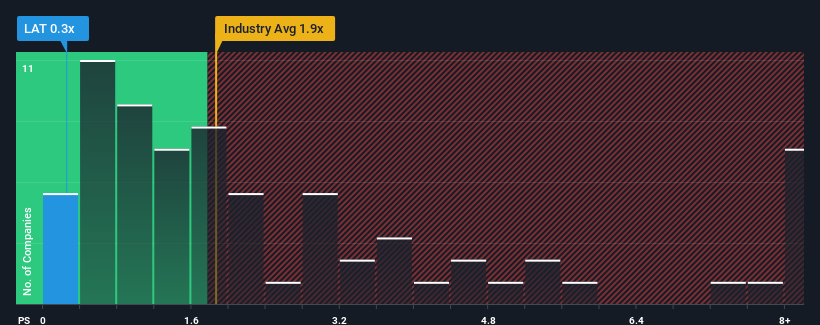

Since its price has dipped substantially, Latécoère may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Aerospace & Defense industry in France have P/S ratios greater than 1.5x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Latécoère

What Does Latécoère's P/S Mean For Shareholders?

Latécoère's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Latécoère .How Is Latécoère's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Latécoère's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Pleasingly, revenue has also lifted 112% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 1.5% during the coming year according to the one analyst following the company. Meanwhile, the broader industry is forecast to expand by 9.9%, which paints a poor picture.

With this in consideration, we find it intriguing that Latécoère's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Latécoère's P/S Mean For Investors?

Latécoère's recently weak share price has pulled its P/S back below other Aerospace & Defense companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Latécoère's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Latécoère's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Latécoère is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LAT

Latécoère

Designs, manufactures, assembles, and installs aerostructures and interconnection systems in Europe, the United States, Africa, Asia, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives