- France

- /

- Aerospace & Defense

- /

- ENXTPA:LAT

A Piece Of The Puzzle Missing From Latécoère S.A.'s (EPA:LAT) 26% Share Price Climb

Latécoère S.A. (EPA:LAT) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

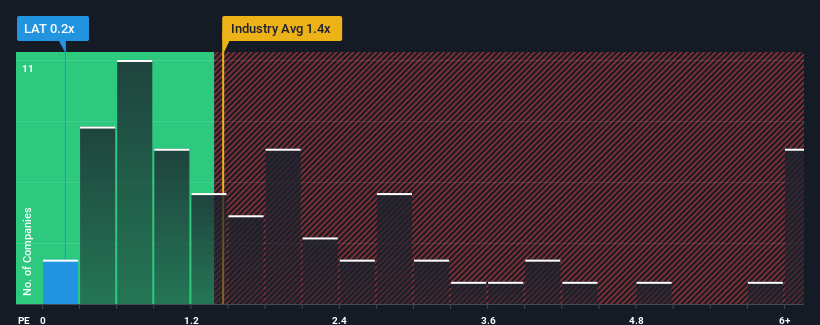

Although its price has surged higher, given about half the companies operating in France's Aerospace & Defense industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Latécoère as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Latécoère

How Has Latécoère Performed Recently?

With revenue growth that's superior to most other companies of late, Latécoère has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Latécoère's future stacks up against the industry? In that case, our free report is a great place to start.How Is Latécoère's Revenue Growth Trending?

Latécoère's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. The latest three year period has also seen an excellent 50% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the dual analysts following the company. With the industry predicted to deliver 11% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Latécoère's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Latécoère's P/S?

Despite Latécoère's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Latécoère currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Latécoère, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Latécoère, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LAT

Latécoère

Designs, manufactures, assembles, and installs aerostructures and interconnection systems in Europe, the United States, Africa, Asia, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026