- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

Should Thales’ New IR And Dutch Leadership Lineup Reshape Its Story For Investors (ENXTPA:HO)?

Reviewed by Sasha Jovanovic

- Thales has announced leadership changes, appointing Louis Igonet as Vice President, Head of Investor Relations, and Otto de Bont as future CEO of Thales the Netherlands, with both set to take up their roles in 2026.

- These appointments bring in leaders with deep experience in investor communication and operational transformation, potentially reshaping how Thales presents its financial story and manages its Dutch operations over the coming years.

- We’ll now examine how bringing in Louis Igonet to lead investor relations could influence Thales’ broader investment narrative and outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Thales Investment Narrative Recap

To own Thales, you need to believe in sustained European defense, aerospace and cyber demand, supported by disciplined capital allocation and execution in complex projects. The latest leadership changes in investor relations and the Netherlands unit do not materially alter near term catalysts such as European defense budget acceleration, nor do they remove key risks around cyber & digital execution and exposure to large government contracts.

Among recent announcements, the memorandum of understanding with Airbus and Leonardo to combine space activities into a joint company stands out, because it directly intersects with one of Thales’ structural risks: the cyclicality and restructuring burden in its Space division. How effectively Thales executes within this future joint entity may influence whether today’s space related volatility becomes a longer term earnings contributor or remains a drag on margins.

But while higher defense spending can support orders, investors should still be aware of how dependent Thales remains on large government budgets and...

Read the full narrative on Thales (it's free!)

Thales' narrative projects €26.5 billion revenue and €2.2 billion earnings by 2028. This requires 7.5% yearly revenue growth and about a €1.2 billion earnings increase from €1.0 billion today.

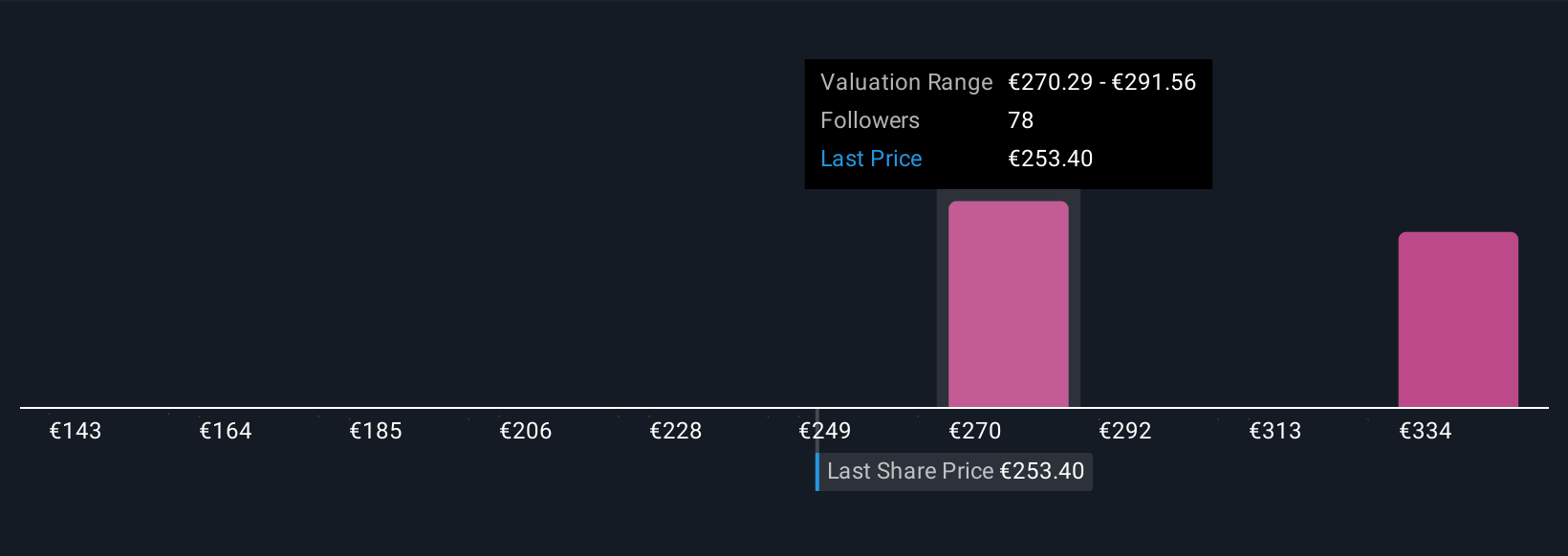

Uncover how Thales' forecasts yield a €279.69 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently value Thales between €163.37 and €351.32 per share, highlighting very different expectations. Against this, the dependence on large European defense budgets raises longer term questions about how resilient those valuations could be if political priorities shift.

Explore 8 other fair value estimates on Thales - why the stock might be worth as much as 59% more than the current price!

Build Your Own Thales Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thales research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thales research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thales' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026