- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Even With A 31% Surge, Cautious Investors Are Not Rewarding Figeac Aero Société Anonyme's (EPA:FGA) Performance Completely

Figeac Aero Société Anonyme (EPA:FGA) shareholders have had their patience rewarded with a 31% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

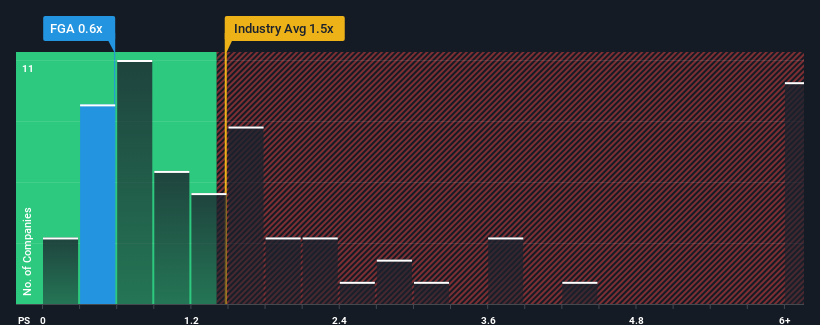

In spite of the firm bounce in price, considering around half the companies operating in France's Aerospace & Defense industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Figeac Aero Société Anonyme as an solid investment opportunity with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Figeac Aero Société Anonyme

How Has Figeac Aero Société Anonyme Performed Recently?

With revenue growth that's superior to most other companies of late, Figeac Aero Société Anonyme has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Figeac Aero Société Anonyme.Do Revenue Forecasts Match The Low P/S Ratio?

Figeac Aero Société Anonyme's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen a 18% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 9.3% as estimated by the three analysts watching the company. With the industry predicted to deliver 9.3% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Figeac Aero Société Anonyme's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Figeac Aero Société Anonyme's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Figeac Aero Société Anonyme's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Figeac Aero Société Anonyme's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Figeac Aero Société Anonyme with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential and good value.

Market Insights

Community Narratives