- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

European Stocks That May Be Undervalued In November 2025

Reviewed by Simply Wall St

In recent weeks, European markets have experienced mixed performance, with the pan-European STOXX Europe 600 Index declining slightly and major indices showing varied results amid shifting expectations for interest rate cuts from the European Central Bank. As investors navigate these uncertain economic conditions and geopolitical tensions, identifying potentially undervalued stocks becomes crucial; such stocks often exhibit strong fundamentals or growth potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wirtualna Polska Holding (WSE:WPL) | PLN55.40 | PLN107.77 | 48.6% |

| Vinext (BIT:VNXT) | €3.38 | €6.63 | 49% |

| tonies (DB:TNIE) | €8.81 | €17.03 | 48.3% |

| STEICO (XTRA:ST5) | €20.40 | €40.71 | 49.9% |

| Roche Bobois (ENXTPA:RBO) | €36.20 | €70.76 | 48.8% |

| Prosegur Cash (BME:CASH) | €0.709 | €1.38 | 48.5% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.00 | NOK59.91 | 49.9% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.04 | 49.3% |

| Echo Investment (WSE:ECH) | PLN5.50 | PLN10.71 | 48.6% |

| Absolent Air Care Group (OM:ABSO) | SEK238.00 | SEK472.84 | 49.7% |

Here's a peek at a few of the choices from the screener.

Trifork Group (CPSE:TRIFOR)

Overview: Trifork Group AG offers information technology and business services across Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally with a market cap of DKK1.66 billion.

Operations: Trifork Group AG generates revenue through its provision of IT and business services across multiple international markets, including Switzerland, Denmark, the UK, the Netherlands, and the US.

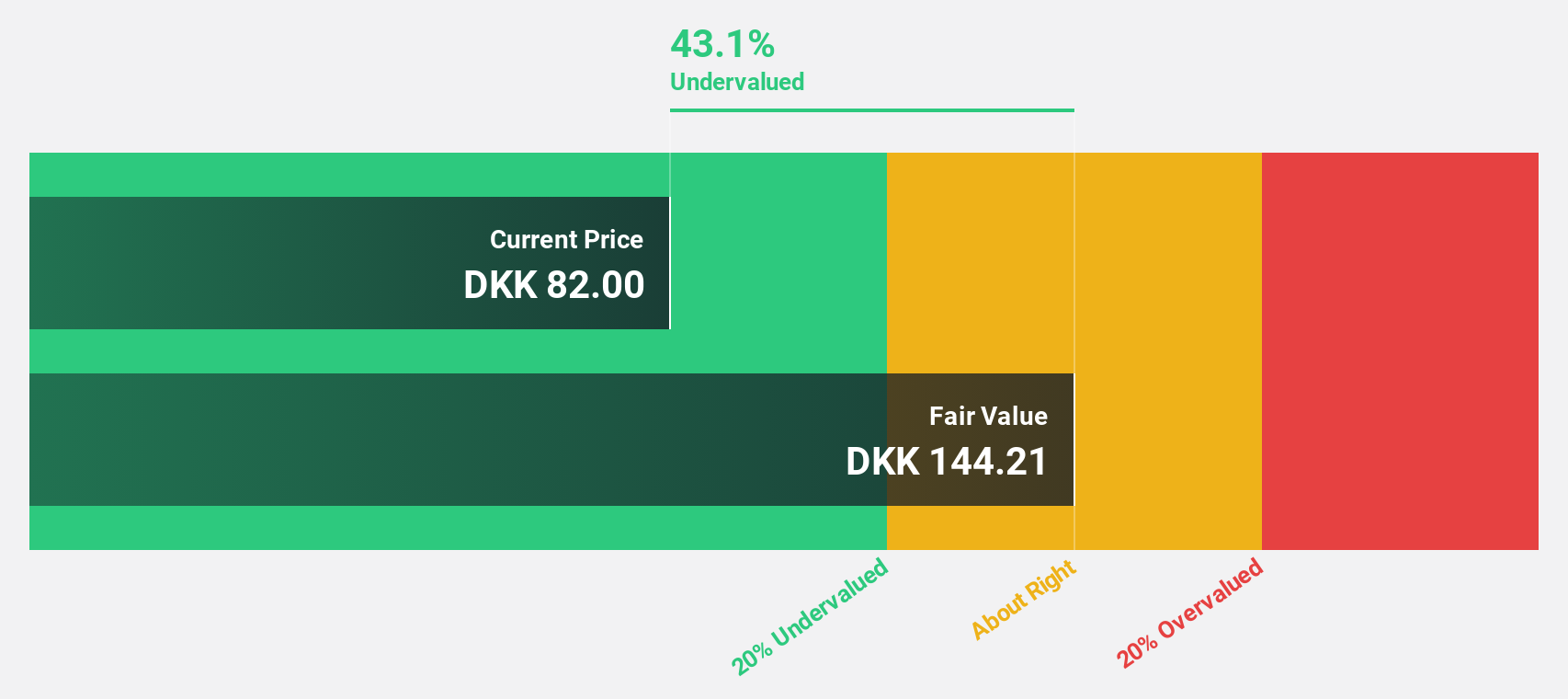

Estimated Discount To Fair Value: 37.9%

Trifork Group appears undervalued based on cash flows, trading at 37.9% below its estimated fair value of DKK137.76, with a current price of DKK85.5. Despite recent insider selling, the company has secured significant contracts like the Shared Public Treatment Platform in Denmark, enhancing its digital health solutions portfolio. Although revenue growth is modest at 6.8% annually, earnings are expected to grow significantly by 32.9% per year, surpassing market averages and indicating potential for future profitability improvements.

- According our earnings growth report, there's an indication that Trifork Group might be ready to expand.

- Dive into the specifics of Trifork Group here with our thorough financial health report.

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies operates in the robotics, maritime, navigation, aerospace, and photonics sectors both in France and internationally, with a market cap of €1.41 billion.

Operations: The company's revenue is primarily derived from its Navigation & Maritime Robotics segment at €335.41 million, followed by Advanced Technologies at €108.99 million, and Structure Exail Technologies contributing €1.14 million.

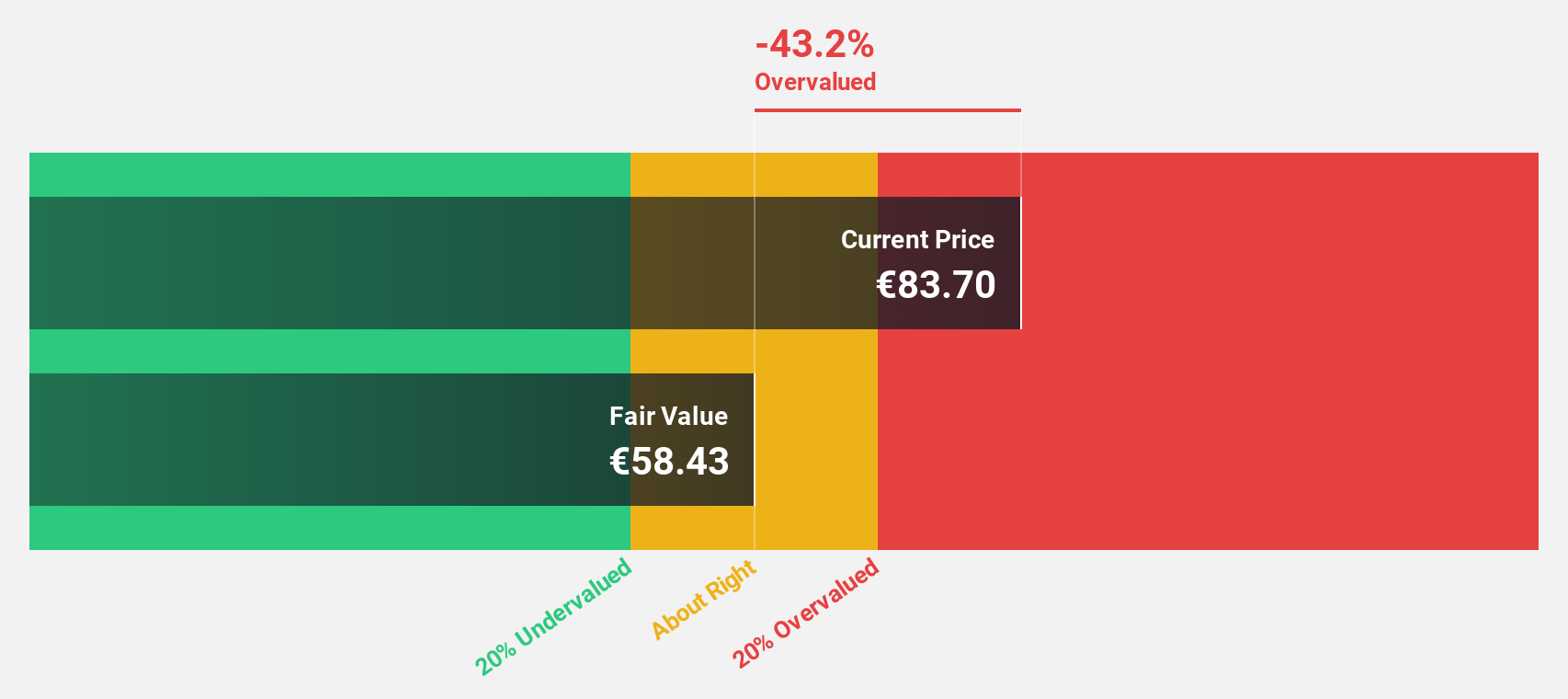

Estimated Discount To Fair Value: 47.2%

Exail Technologies is trading at €83.1, significantly undervalued compared to its estimated fair value of €157.3, indicating strong potential based on cash flows. The company has recently achieved profitability and forecasts robust earnings growth of 84.8% annually, outpacing the French market's 12.3%. Recent advancements in autonomous surface drones, including successful deployments in NATO exercises and new sales to defense clients, underscore Exail's innovative edge and expanding market presence in marine robotics.

- Insights from our recent growth report point to a promising forecast for Exail Technologies' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Exail Technologies.

Valneva (ENXTPA:VLA)

Overview: Valneva SE is a specialty vaccine company that focuses on developing, manufacturing, and commercializing prophylactic vaccines for infectious diseases with unmet needs, and it has a market cap of €694.13 million.

Operations: The company's revenue segment is primarily derived from the development and commercialization of prophylactic vaccines, amounting to €196.33 million.

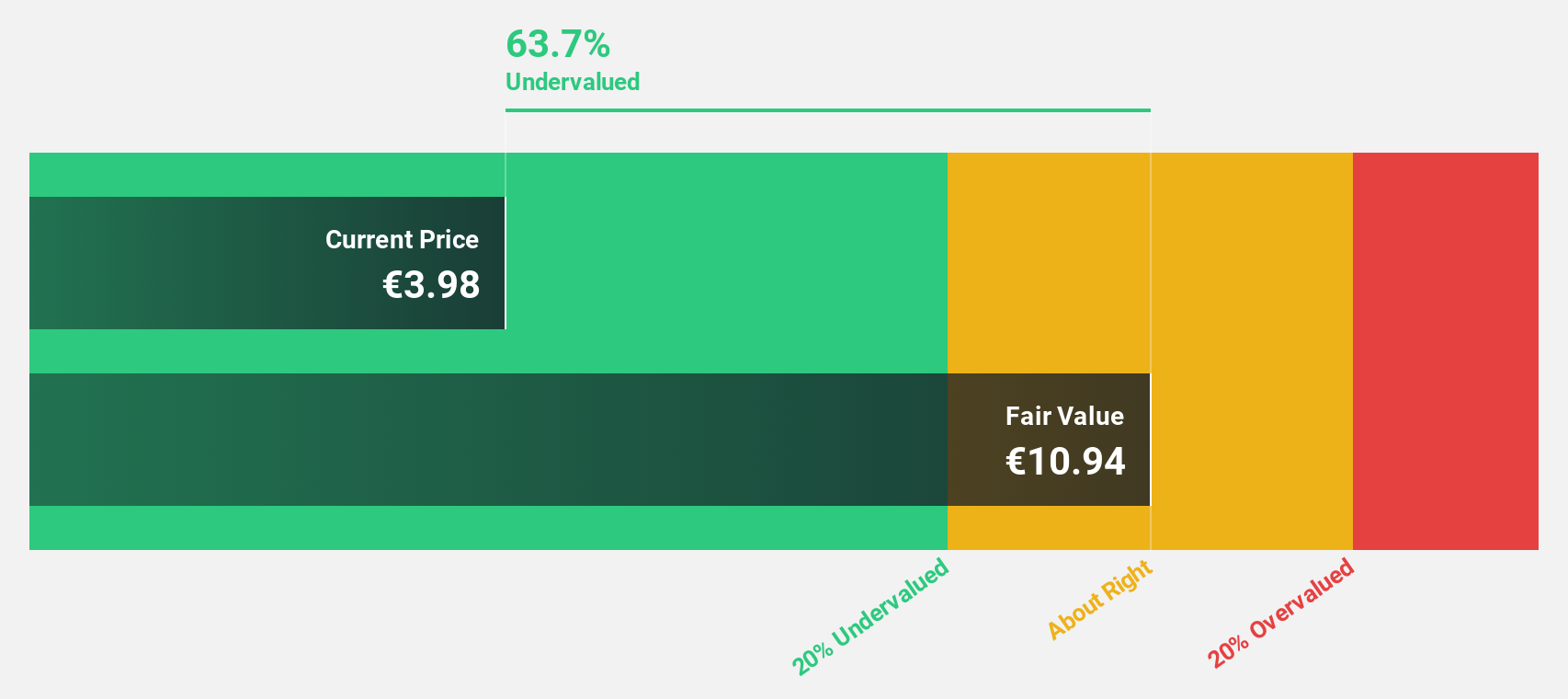

Estimated Discount To Fair Value: 31.9%

Valneva SE is trading at €4.04, below its estimated fair value of €5.94, with revenue projected to grow 22.5% annually, surpassing the French market's rate. Despite a volatile share price and revised earnings guidance for 2025, Valneva's financial flexibility has improved through a $500 million non-dilutive debt facility with favorable terms. Positive clinical data from its Lyme disease vaccine candidate and chikungunya vaccine underscore potential future revenue streams pending regulatory approvals.

- Our growth report here indicates Valneva may be poised for an improving outlook.

- Take a closer look at Valneva's balance sheet health here in our report.

Summing It All Up

- Discover the full array of 200 Undervalued European Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives